The DXY has actually fallen more than 10% in the previous 3 months, Refinitiv information revealed– and is a couple of points far from eliminating practically all its gains that it’s seen in the previous year, prior to the Federal Reserve started its journey of rate of interest walkings to tame inflationary pressures.

Kacper Pempel|Reuters

The U.S. dollar index continued to drop on Thursday as the Federal Reserve chose a smaller sized rate of interest walking of 25 basis points.

The DXY fell 0.3% throughout Asia’s early morning session to 100.91, hovering at the most affordable levels that it’s seen considering that April 2022, according to Refinitiv information.

The index fell over night to strike a session low of 101.036 after the Fed Chair Jerome Powell acknowledged the reserve bank’s efforts to tame inflation is seeing some development– regardless of offering little indicator that it is nearing completion of its treking cycle anytime quickly.

Asian currencies saw relative reinforcing with the relocation, with the Japanese yen conditioning by 0.4% to trade at 128.43 versus the U.S. dollar.

The Korean won likewise reinforced 0.3% to stand at 1,2186 versus the greenback. The onshore Chinese yuan, also, reinforced 0.43% to trade at 6.7115 versus the dollar.

The DXY has actually fallen more than 10% in the previous 3 months, Refinitiv information revealed– and is a couple of points far from eliminating practically all its gains that it’s seen in the previous year, prior to the Federal Reserve started its journey of rate of interest walkings to tame inflationary pressures.

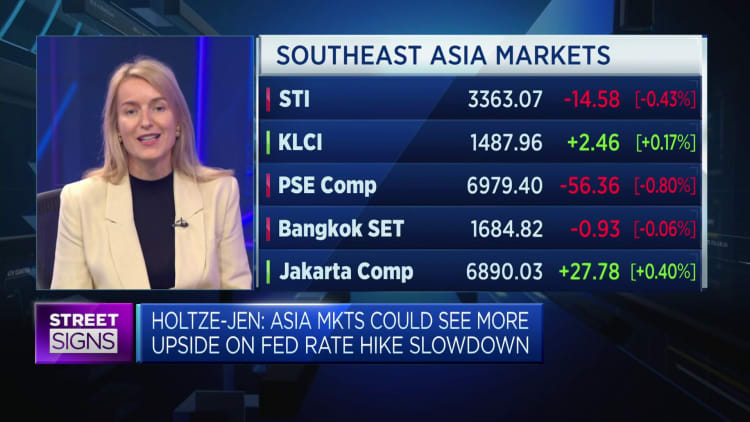

The turn-around in the dollar index will benefit currencies in the area, stated Deutsche Bank International Private Bank’s Asia-Pacific primary financial investment officer, Stephanie Holtze-Jen

“The relentless dollar strength, we will see an end to it,” Holtze-Jen informed CNBC’s “Street Signs Asia.”

“[A] strong dollar had actually cut financier beliefs entering here in regards to the marketplaces in the Asia-Pacific, due to the fact that it’s put a damage on the returns on the possession classes,” she stated, including that emerging markets are set to get from a turnaround of the index.

She included that the U.S. dollar-Chinese yuan will be an “important part to play” in currency sell light of China’s resuming and dollar weak point.

More information ahead

Standard Chartered Bank’s handling director Steven Englander stated Friday’s tasks information will remain in focus for the dollar index. He stated a reading in line with expectations will trigger it to continue its fall.

“If unemployment comes in on the low end, the dollar move will continue and the market will say yeah, we were right,” he stated.

“If the numbers continue to support the narrative, there’s still quite a bit of room for the dollar to fall,” he stated.

The U.S. Bureau of Labor Statistics is arranged to release its count of nonfarm payroll development for the month later on today. Economists surveyed by Dow Jones anticipate to see development of 187,000 because report.