“What’s unclear for us is how much of these banking stresses are leading to a widespread credit crunch. And then that credit crunch, just as you said, would then slow down the economy,” Minneapolis Fed President Neel Kashkari stated in an interview with CBS’ Face The Nation.

John Lamparski|Getty Images Entertainment|Getty Images

“It definitely brings us closer right now”– that was Minneapolis Fed President Neel Kashkari’s action to a concern, throughout a CBS “Face The Nation” interview, on whether the current chaos in the banking sector might bring the U.S. closer to an economic crisis.

“What’s unclear for us is how much of these banking stresses are leading to a widespread credit crunch. And then that credit crunch, just as you said, would then slow down the economy,” he stated.

associated investing news

Kashkari included that Fed authorities are keeping an eye on the effect from the fallout of the banking sector “very, very closely,” and the existing system has the “full support” of the Federal Reserve.

“The banking system has a strong capital position and a lot of liquidity and has the full support of the Federal Reserve and other regulators standing behind it,” he stated.

“The U.S. banking system is resilient, and it’s sound,” stated Kashkari, when inquired about the stability of the banking system’s capability to manage more dangers seen in California and New York.

Kashkari’s words echoed that of authorities at the Financial Stability Oversight Council, which held a closed conference recently as Fed information revealed U.S. clients withdrew almost $100 billion from banks for the week ended March 15, though this is a small portion of the overall.

Separately, sources informed CNBC that the motion of deposits from smaller sized banks to huge organizations, such JPMorgan Chase and Wells Fargo, has actually slowed to a drip in current days.

Kashkari explained the advancement as “positive” and an indication of brought back faith.

“There are some concerning signs, the positive sign is deposit outflows seem to have slowed down. Some confidence is being restored among smaller and regional banks,” he stated.

Too quickly to understand

Kashkari stated it’s prematurely to anticipate what any of this suggests for the next Federal Open Market Committee conference inMay The Fed raised rates by 25 basis points recently.

“It’s too soon to make any forecasts about the next interest rate meeting that we have, the next FOMC meeting,” he stated, including that the tension in the banking sector would be “the factors that are going to be most focused on.”

He included that banking issues might make it simpler for the reserve bank to attain its objective of managing inflation.

“On one hand, such strains could then bring down inflation, so we have to do less work with the federal funds rate to bring the economy into balance,” he stated.

“But right now, it’s unclear how much of an imprint these banking stresses are going to have on the economy. But it’s something to watch very carefully,” he included.

‘Safe sanctuary’ Asia

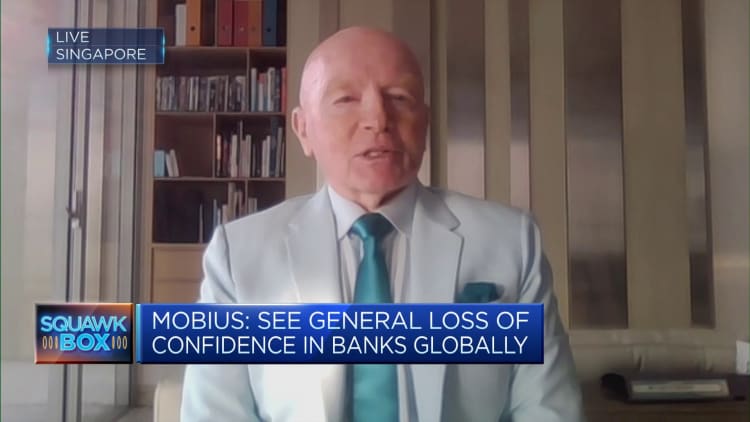

The banking worries in the United States and Europe appear much less noticable in the Asia-Pacific area, Mark Mobius, founding partner of of Mobius Capital Partners, informed CNBC.

“The banks here are much, much more cautious, much more careful, making sure that they have a strong balance sheet,” Mobius stated on CNBC’s “Squawk Box Asia” on Monday.

“I think this is in some ways, kind of a safe haven. Banks in Singapore, banks in Thailand and so forth are in pretty good shape,” he stated.

Mobius’ remarks followed shares of Deutsche Bank fell on Friday, marking a 3rd successive day of losses, after the expense of guaranteeing versus any default by the German organization surged.

Over the weekend, International Monetary Fund chief Kristalina Georgieva stressed that dangers to monetary stability have actually increased.

— CNBC’s Jeff Cox and Hugh Son added to this report