Binance’s Co- creator & & CEO Changpeng Zhao has actually provided a number of interviews talking about the outlook for cryptocurrency following an unstable number of weeks in the market.

NurPhoto/ Contributor/ Getty Images

Over a month after the collapse of FTX, financier issue over crypto exchange Binance isn’t fading.

Binance’s native token, BNB, has actually fallen 15% in the previous week, consisting of a drop of over 6% in the past 24 hours. BNB, very first minted in 2017, is the world’s 5th most important cryptocurrency, with a market cap of about $39 billion, according to Coin MarketCap. It’s behind just bitcoin, ethereum, tether and USD Coin.

The newest problem towering above Binance is FTX’s personal bankruptcy procedures. Binance was the very first outdoors financier in FTX. In leaving its equity position in the business in 2015, Binance got payment equivalent to approximately $2.1 billion.

In an interview with CNBC’s “Squawk Box” on Thursday, Binance CEO Changpeng Zhao dismissed issues that his business might have that cash clawed back as FTX winds its method through personal bankruptcy court and trustees aim to recover any deceitful conveyances made by FTX to outdoors services or financiers.

“We are financially OK,” Zhao stated, after he was asked by CNBC’s Becky Quick if the business might deal with a $2.1 billion need.

Crypto financiers have actually ended up being doubtful of remarks from magnates about the monetary health of their business. FTX creator and ex-CEO Sam Bankman-Fried stated on Twitter that his business’s possessions were great, even as executives understood it remained in the middle of a liquidity crunch that ultimately required the exchange into personal bankruptcy. Bankman-Fried was apprehended today in the Bahamas and charged by U.S. district attorneys with scams and cash laundering.

Withdrawal needs are another location of issue. Zhao stated that around $1.14 billion of net withdrawals occurred on Tuesday, however tweeted that this was “not the greatest withdrawals we processed, not even leading [five].” On Wednesday, he stated the scenario had “stabilized.” Blockchain analytics company Nansen stated the withdrawal number on Tuesday reached as high as $3 billion.

A Binance representative informed CNBC in a declaration that, “we passed this extreme stress test because we run a very simple business model – hold assets in custody and generate revenue from transaction fees.” The representative did not supply an instant action to a concern about the drop in BNB.

Binance and FTX were thoroughly linked. Zhao revealed openly last month that his business was liquidating its position in FTT, FTX’s native coin, in the middle of issues surrounding the solvency of both FTX and its sis trading company, Alameda Research.

FTX then dealt with an instant rise in withdrawal needs, and Binance actioned in with a non-binding contract to obtain the business as part of a rescue strategy. A day later on, Binance revoked the offer, mentioning that FTX’s “issues are beyond our control or ability to help.”

Like all of the significant crypto tasks and business, Binance established its own currency. On its site, the business states individuals can “use BNB to pay for goods and services, settle transaction fees on Binance Smart Chain, participate in exclusive token sales and more.” Areas where BNB can be utilized, the website states, consist of payment, travel and home entertainment.

There’s a distributing supply of about 160 million BNB out of an overall optimum supply of 200 million, according to Coin MarketCap. Bloomberg reported in June that the SEC was examining whether the 2017 token sale totaled up to a security provided that ought to have been signed up with regulators.

— CNBC’s MacKenzie Sigalos added to this report.

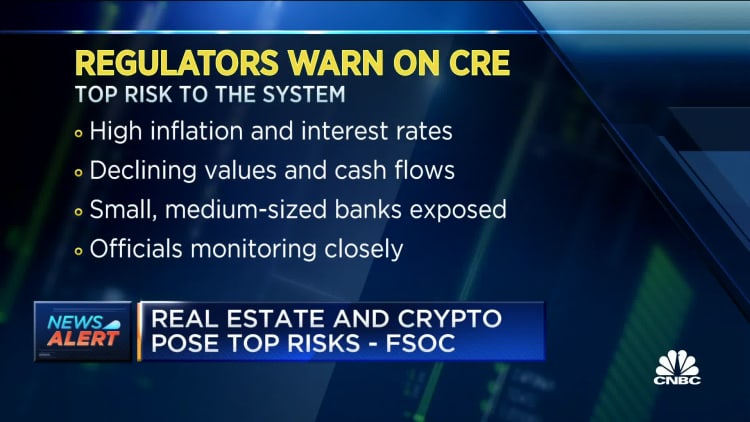

SEE: Regulators emphasize leading dangers: industrial property, credit losses, crypto