With Libra, Facebook is entering the cryptocurrency company.

Getty Images

Facebook altered the method we interact. Now the social networks giant wishes to alter how its approximately 2.4 billion users consider utilizing a cryptocurrency to make daily purchases.

Earlier today, the social media network and its partners revealed an international digital coin called Libra, verifying information of a job that had actually been dripping out in dribs and drabs for months. Libra, which will be handled by a governing body and backed by steady monetary possessions, is anticipated to debut in the very first half of 2020.

Facebook and the Libra Association, the body that will govern the coin, intend to produce a steady digital cash that will provide users self-confidence in its worth and will not go through the wild revolutions of more acknowledged cryptocurrencies, such as bitcoin. The group is likewise attempting to minimize issues that Libra might be utilized for cash laundering or black market deals, stating it would deal with authorities around the globe to guarantee Libra complies with policies in numerous nations and jurisdictions.

The efforts to charm political leaders and regulators, nevertheless, appeared to fail. Almost instantly after the statement, United States and European political leaders revealed issue about Libra, stating Facebook’s history of personal privacy issues raised concerns about whether it was an in shape steward of individuals’s monetary information.

Rep. Maxine Waters, who chairs the House Financial Services Committee, stated Facebook “has repeatedly shown a disregard for the protection and careful use of this data.” The social networks business deals with a record-setting fine of as much as $5 billion from the Federal Trade Commission, which has actually been examining Facebook for apparently stopping working to secure user personal privacy. A Senate committee has actually arranged a hearing on July 17 to go over Libra.

In Europe, the response was comparable. Bruno Le Maire, France’s financing minister, informed Europe 1 radio that Libra was great if its usage was restricted to deals, according to AFP. But the social media network should not be permitted to produce a “sovereign currency” that might be utilized to release financial obligation or serve other functions connected with government-issued cash. Bank of England Gov. Mark Carney referenced Libra at a conference of Portugal, stating, “Anything that works in this world will become instantly systemic and will have to be subject to the highest standards of regulation,” according to Bloomberg.

Facebook’s cryptocurrency aspirations are the most recent example of the social media network’s efforts to seal itself in the every day lives of its users. If Facebook and its partners can encourage individuals to utilize Libra, the social media network might draw in brand-new users, keep them online longer and produce more profits beyond marketing, that made up 99% of its $15 billion in sales in the very first 3 months of 2019.

The Libra job highlights Facebook’s efforts to motivate its users to invest more time on the website or with its services by permitting them to send out cash, purchase items and offer their utilized ownerships on its platform. If they do so, Facebook might produce profits streams beyond its dominant marketing company, that made up 99% of its $15 billion in sales in the very first 3 months of 2019.

“Payments is foundational to doing commerce,” stated Lisa Ellis, an expert at MoffettNathanson Research. “This would be a significant step toward enabling that.”

The relocation in cryptocurrency comes as Facebook doubles down on its personal areas. The business prepares to make it possible for users to send out messages without changing in between it’s Messenger, WhatsApp and Instagram services. Calibra, the digital wallet Facebook produced to shop Libra, will be developed into Messenger and WhatsApp, though not Instagram initially.

How rapidly Facebook can rope in Libra users is an open concern. Using existing cryptocurrencies to spend for daily purchases is far from typical, in spite of efforts to make those deals mainstream. Many cryptocurrencies, most significantly bitcoin, swing extremely in worth and exist in a complicated regulative environment. They’ve been utilized for speculation or in criminal activities.

Facebook and the Libra Association state they’re working to attend to these issues. Libra will be backed by a reserve of possessions including “bank deposits and government securities in currencies from stable and reputable central banks.” That recommends significant worldwide currencies, like the dollar and the euro, which do not vary strongly everyday.

Facebook isn’t the very first tech business to incorporate payments into a service. Line, a Japanese messaging app, introduced a digital token called Link in 2015. Chinese messaging app WeChat lets users connect charge card to pay and cash transfers, however prohibited cryptocurrency deals.

Facebook’s size and international reach, however, give it an advantage, according to analysts. Roughly 2.7 billion people use Facebook or Messenger, WhatsApp or Instagram. By contrast, Line has less than a quarter of the number of users and WeChat has about 1 billion users.

Dave Jevans, CEO of CipherTrace, a cryptocurrency security company, says Libra could convince other social media platforms to enter financial services.

“This starts to begin the conversation around social media platforms, which have been big political platforms over the last three or four years, becoming financial platforms to enable a global society,” Jevans said.

Creating a digital wallet

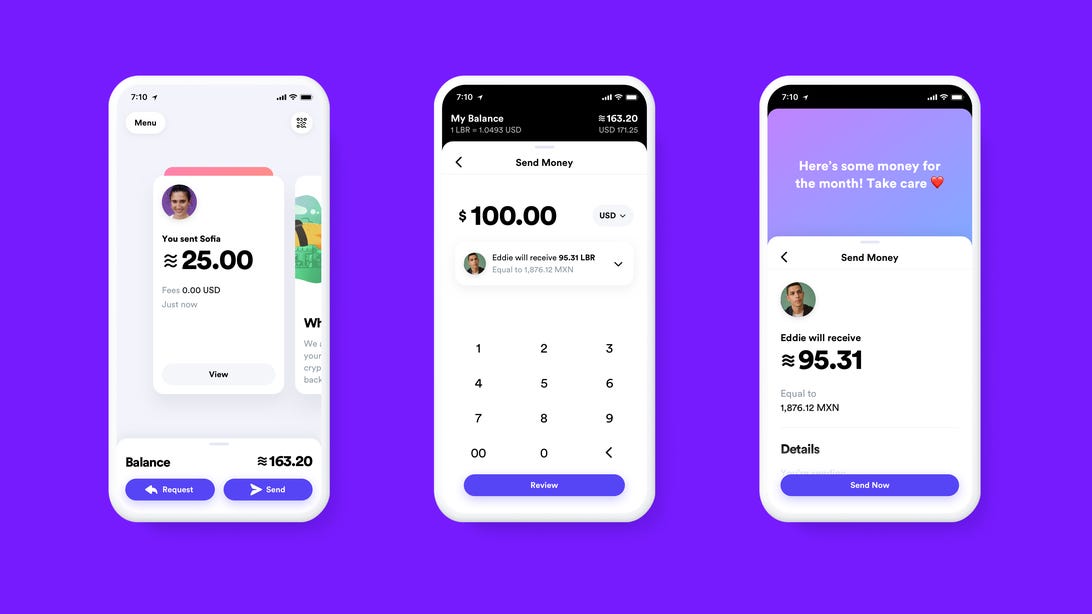

Facebook’s digital wallet, Calibra, is expected to launch in 2020.

Users will download the Calibra app onto their iPhone or Android devices, or add the wallet into Messenger or WhatsApp.

To prevent fraud, Facebook will also ask users to verify their identity by uploading an ID such as a driver’s license. The company will encrypt this information and may retain it, depending on local regulations. Users can then link their bank accounts to the app to exchange, for example, US dollars for Libra. The wallet will automatically convert the dollar figure into the Libra amount.

Over time, people could use Libra coins to purchase an item on Marketplace, make a donation or buy a product from retailers, said Kevin Weil, vice president of product for blockchain at Facebook. The wallet, which is still being built, may also be integrated into Instagram direct message at some point, he said.

“There’s a lot of overlap between the way you use a wallet and the way you would use a messaging app that makes them great first steps for us,” Weil said.

Facebook plans to offer incentives to get consumers and businesses to use Libra. A business could get cash back in Libra coins if it processes a transaction using the virtual currency. Early users may get some Libra coins when they set up an account and for referring friends to the app.

Sending money across borders could be cheaper using Libra than conventional banks, Weil says, adding that the fees for transfers will be less than a penny. By comparison, the average cost of sending $200 was 7% in 2018, according to the World Bank. It’s unclear whether there will be a limit to the amount of money that people will be able to send using Calibra.

The Calibra wallet will also work with other wallets that accept Libra, similar to the way email can be sent across services, such as between Google and Yahoo.

“It’s that same kind of interoperability that you have between wallets in the Libra ecosystem,” Weil said.

Managing a new cryptocurrency

Facebook won’t have direct control over Libra. Instead, it will be part of a nonprofit headquartered in Switzerland called the Libra Association that will oversee the cryptocurrency. The association has 28 founding members, including PayPal, Visa, Uber, Coinbase, Andreessen Horowitz and Mercy Corps, but aims to have 100 by 2020.

The founding partners of the Libra Association include Mastercard and Visa.

Businesses and venture capital firms that are part of the association will invest at least $10 million, which will be used to fund the group’s operations and Libra incentives.

Each member will maintain a node, the servers that process transfers and power the Libra blockchain. All members will be represented on the Libra Association Council and have one vote, limiting Facebook’s influence over the cryptocurrency.

Facebook and its partners won’t get a cut of cryptocurrency transactions or use the financial data from users for ad targeting. But making it easier for people to spend or send money could attract users or increase engagement, which would be attractive to advertisers. Businesses that use Libra might also have more money to spend on Facebook ads. In the future, the Libra Association could offer a range of financial services.

David Marcus, who leads Facebook’s cryptocurrency efforts, said Libra might be more popular among people who don’t have access to financial services in the early days. About 1.7 billion adults worldwide still don’t have access to a bank account, according to data from the World Bank.

“The effect of having a more competitive, vibrant financial system with, you know, more players, more services and the diversity of offerings I think will bring in many more people,” he said. “But it will take time.”

Facebook’s video calling smart display connects you with friends and family

See all photos

Originally published June 18.

Update, June 20: Adds reaction from politicians and regulators.