Google CEO Sundar Pichai speaks on phase throughout the yearly Google I/O designers conference in Mountain View, California, May 8, 2018.

Stephen Lam|Reuters

As industry-wide layoffs struck larger tech names, some Google employees fret they’re next.

While Google has actually up until now prevented the extensive task cuts that have actually struck tech business, especially those supported by a slumping advertisement market, internal stress and anxiety is on the increase, according to files seen by CNBC and staff members who spoke on the condition of privacy.

Alphabet executives have actually worried the requirement to hone “focus,” lower expenses of jobs and make the business 20% more effective. There’s likewise been a current modification in efficiency evaluations, and some staff members indicate decreasing travel spending plans and less boodle as indications that something larger might be on the horizon.

In July, Alphabet CEO Sundar Pichai released the “Simplicity Sprint” in an effort to strengthen performance throughout an unpredictable financial environment. Just a couple of miles up the roadway, Meta informed staff members this month that it’s laying off 13% of its personnel, or more than 11,000 staff members, as the business considers decreasing advertisement profits. Snap revealed a 20% cut in August, and Twitter simply slashed about half its labor force under the management of brand-new owner ElonMusk Elsewhere in Silicon Valley, HP stated on Tuesday it prepares to lay off 4,000 to 6,000 staff members over the next 3 years.

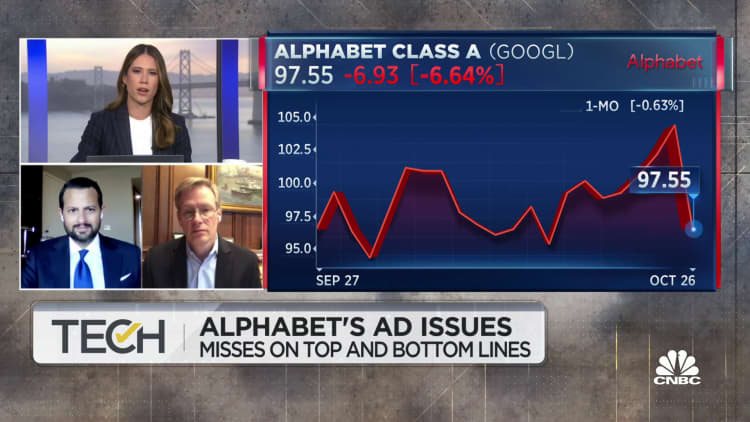

Google’s service hasn’t been struck as difficult as much of its peers, however the mix of a possible economic crisis, skyrocketing inflation and increasing rates of interest is having a clear effect. Last month, the business stated YouTube’s advertisement profits avoided a year previously as Google produced its weakest duration of development considering that 2013, besides one quarter throughout the pandemic. Google stated at the time that it would substantially decrease headcount development in the 4th quarter.

The crypto market, which put a damage in Google’s most current outcomes, has actually fallen even further with the collapse of crypto exchange FTX, causing increased issues about market contagion.

‘Don’t fire us please’

Cuts at Google have actually currently happened around the edges.

The business canceled the next generation of its Pixelbook laptop computer, slashed financing to its Area 120 internal incubator and stated it would be shuttering its digital video gaming service Stadia.

Concerns about terminations are installing, a minimum of in specific corners. And some staff members are relying on memes to reveal their stress and anxieties through humor.

One internal meme shown CNBC reveals a before-and-after animated character. On the previously side, the figure has his hands raised with the caption “inflation pay rise!” On the after side, a scared character sits together with the caption, “don’t fire us please.”

Another meme has names of tech business– “Meta, Twitter, Amazon, Microsoft”– that just recently performed layoffs beside a picture of an anxious anime character. There were likewise memes developed in referral to a declaration recently from activist financier TCI Fund Management, which got in touch with Pichai to cut wages and headcount through “aggressive action.”

Among the labor force, Pichai discovered himself on the defensive in September, as he was required to discuss the business’s altering position after years of supercharged development. Executives stated at the time that there would be little cuts, and they didn’t eliminate layoffs.

At a more current all-hands conference, a variety of concerns concerning the capacity for layoffs were extremely ranked by staffers on Google’s internal question-asking system calledDory There were likewise concerns about whether executives mishandled headcount.

“It appears that we added 36k full-time role YoY, increasing headcount by about 24%,” one top-rated question read. “Many teams feel like they are losing headcount, not gaining it. Where did this headcount go? In hindsight, and given concerns around productivity, should we have hired so rapidly?”

Employees desired information following the business’s most current profits call and remarks from CFO Ruth Porat concerning possible cuts.

One concern read: “Can we get some more clearness on how we’re approaching headcount for 2023? Do we have any sense of for how long we require to prepare for hard headwinds?”

Other questioners asked if staff members “should expect any direct consequence to our teams, direction and/or compensation to reduced profits we saw in the earnings call” and questioned, “how are we going to attain 20% more performance? Will refocus suffice or are we anticipating layoffs?”

Change to efficiency evaluations

Furthering staff member tension levels was a current modification to efficiency evaluations and upcoming assessment check-ins.

Earlier this year, Google stated it was dumping its long-held practice of giving out prolonged promo packages, which were long types staff members required to complete which consisted of evaluations from employers and colleagues. The business changed to a structured procedure it calls Googler Reviews and Development (GRADUATE).

A Google representative stated in an emailed declaration that the graduate system was released “to help employee development, coaching, learning and career progression throughout the year,” including that it “helps establish clear expectations and provide employees with regular feedback.”

Google stated a brand-new system would lead to greater pay, however employees state the overhaul has actually left more space for obscurity in rankings at a time when the business is trying to find methods to cut expenses.

The prepared overhaul has actually currently encountered issues. The business chose to end its usage of Betterworks, a program that was expected to assist with examining efficiency, staff members informed CNBC. Executives stated they prepared to rather utilize a home-grown tool, however the modification has actually come annoyingly near to anticipated year-end efficiency checks.

A guide entitled “Support Check-Ins,” which are performance reviews targeting certain employees, began appearing in internal forums. The document, viewed by CNBC, says for those who receive the review, ” the present efficiency trajectory is headed towards, or currently remains in, a lower score.”

Three actions are advised for check-ins. The very first directs employees to “breathe,” prior to taking in supervisors’ feedback. Second is, “comprehend the feedback,” and third is to ” design a strategy.” The file states check-ins might impact 10% to 20% of staffers throughout a year.

Add all of it up, and one huge concern staff members are asking is– will a lot of little cuts develop into something grander in the future?

CNBC reported last month that staff members and executives clashed on the subject of lowerings to things like boodle, travel and vacation events. Workers grumbled about an absence of openness around travel cuts and asked why the business wasn’t conserving cash by cutting executive wages.

Google engineering leaders just recently started punishing staff members’ capability to gain access to links to the internal meme generator called Memegen, a repository of user-generated memes that has actually long belonged of the business’s open culture.

Last month, a Google vice president of business engineering stated staff members require to get rid of Memegen links from their profile pages, internally referred to as “Moma.” Engineering directors said in an internal message that having a Memegen link on profiles “prevents Googlers from sharpening their focus.”

Workers naturally gathered to Memegen to tease the choice.

ENJOY: CNBC’s complete interview with RBC’s Rishi Jaluria