The BlockFi logo design on a mobile phone organized in the Brooklyn district of New York, on Thursday,Nov 17, 2022.

Gabby Jones|Bloomberg|Getty Images

There was apparently one male who might conserve crypto– Sam Bankman-Fried The previous FTX CEO bailed out and took control of crypto companies as cryptocurrency markets withered with Terra’s spring crash. In October, FTX won the bidding war for insolvent crypto company Voyager Digital in an extremely useful offer.

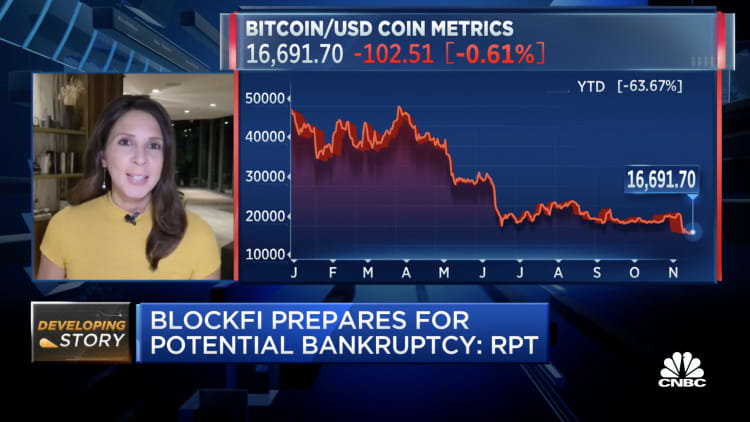

With the collapse of FTX, the companies which Bankman-Fried conserved now discover themselves in an unpredictable state. Voyager put itself back up for auction recently. On Monday, BlockFi applied for personal bankruptcy in New Jersey, after weeks of speculation that the FTX collapse had actually fatally maimed it.

associated investing news

The FTX “death spiral,” as BlockFi consultant Mark Renzi put it, has actually now infected another crypto entity. BlockFi’s personal bankruptcy had actually been expected for a long time, however in an in-depth 41- page filing, Renzi strolls lenders, financiers and the court through his point of view at the helm of BlockFi.

According to Renzi, direct exposure to 2 succeeding hedge fund failures, the FTX rescue and wider market unpredictability all conspired to require BlockFi into personal bankruptcy.

Renzi is eager to highlight that from his viewpoint, BlockFi does not “face the myriad issues apparently facing FTX.” Renzi indicated a $30 million settlement with the SEC and the business’s business governance and danger management procedures, composing that BlockFi is “well-positioned to progress regardless of the reality that 2022 has actually been a distinctively awful year for the cryptocurrency market.”

The “issues” that Renzi describe might consist of FTX’s well-publicized absence of monetary, danger, anti-money laundering, or audit systems. In a court filing, recently selected FTX CEO John Ray III stated he ‘d never ever seen “such a complete failure of corporate controls” as at FTX.

Indeed, Renzi is eager to highlight BlockFi’s distinctions from FTX, and competes that FTX’s intervention in summer season 2022 eventually aggravated results for BlockFi. Renzi is a handling director at Berkeley Research Group, which BlockFi has actually gotten as a monetary consultant for its Chapter 11 procedures.

Both BRG and Kirkland & & Ellis, BlockFi’s legal consultant, have experience in crypto insolvencies. Kirkland and BRG both represented Voyager throughout its unsuccessful auction to FTX. Both companies have actually currently gathered millions in costs from BlockFi in preparation work for the personal bankruptcy, according to court filings.

Similarly to filings in Voyager’s and Celsius Network’s insolvencies, Renzi indicate wider turbulence in the cryptocurrency markets, sped up by the collapse of crypto hedge fund Three Arrows Capital, as the driving force behind BlockFi’s liquidity crisis.

BlockFi, like Celsius and Voyager, provided extremely high rate of interest on client crypto accounts. All 3 companies had the ability to do so thanks to cryptolending– lending client cryptocurrencies to trading companies in exchange for high interest and security. Three Arrows, or 3AC was “one of BlockFi’s largest borrower clients,” Renzi stated in a court filing, and the hedge fund’s personal bankruptcy required BlockFi to look for outdoors funding.

A brand-new round stopped working for BlockFi. Traditional third-party financiers were frightened by “unfavorable” market conditions, Renzi stated in a filing, requiring them to rely on FTX simply to make great on client withdrawals. Unlike Voyager or Celsius, BlockFi had actually not stopped client withdrawals at that point.

FTX put together and provided a plan of loans approximately $400 million. In return, FTX scheduled the right to obtain BlockFi as quickly as July 2023, the court filing stated.

While FTX’s rescue bundle did at first buoy BlockFi, negotiations with FTX’s Alameda Research additional undercut BlockFi’s stability. As Alameda unwound and FTX moved better to personal bankruptcy, BlockFi tried to carry out margin calls and loan remembers on its Alameda direct exposure.

Ultimately, however, Alameda defaulted on “approximately $680 million” of collateralized loans from BlockFi, “the recovery on which is unknown,” the court filing stated.

BlockFi was required to do what it had actually withstood doing throughout the Voyager and Celsius crises. OnNov 11, the day FTX applied for personal bankruptcy, BlockFi stopped briefly client withdrawals. Investors, like at FTX, Voyager and Celsius, are now left in limbo, without any access to their funds.

Correction: FTX applied for Chapter 11 personal bankruptcy defense onNov 11. An earlier variation misstated the date.