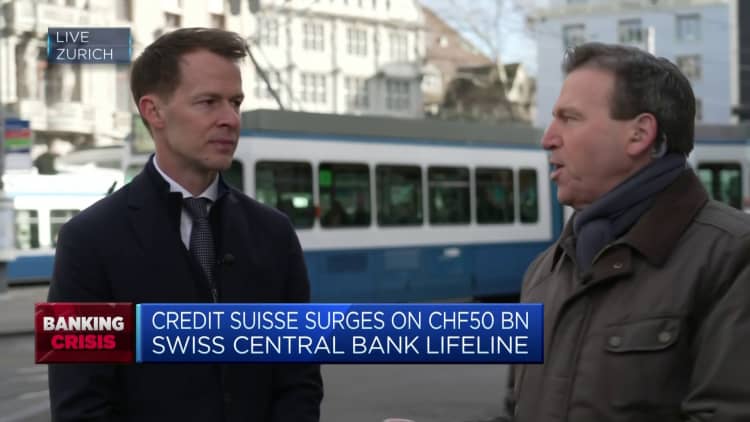

The logo design of Swiss bank Credit Suisse is seen at an office complex in Zurich, Switzerland February 21, 2022.

Arnd Wiegmann|Reuters

Credit Suisse got a liquidity lifeline from the Swiss National Bank today after its share cost plunged to an all-time low, however the embattled loan provider’s course to the verge has actually been a long and turbulent one.

The statement that Credit Suisse would obtain approximately 50 billion Swiss francs ($54 billion) from the reserve bank followed successive sessions of high drops in its share cost. It made Credit Suisse the very first significant bank to get such an intervention considering that the 2008 Global Financial Crisis.

The bank’s shares ended Wednesday at 1.697 Swiss francs– down practically 98% from the stock’s all-time high in April 2007, while credit default swaps, which guarantee shareholders versus a business defaulting, skyrocketed to brand-new record highs today.

It follows years of financial investment banking underperformance and a list of scandals and run the risk of management failures.

Scandals

Credit Suisse is presently going through a huge tactical overhaul in a quote to attend to these persistent problems. Current CEO and Credit Suisse veteran Ulrich Koerner took over from Thomas Gottstein in July, as bad financial investment bank efficiency and installing lawsuits arrangements continued to hammer revenues.

Gottstein took the control early 2020 following the resignation of predecessor Tidjane Thiam in the wake of a strange spying scandal, in which UBS-bound previous wealth management employer Iqbal Khan was trailed by personal specialists supposedly at the instructions of previous COO Pierre-OlivierBouee The legend likewise saw the suicide of a private detective and the resignations of a multitude of executives.

The previous head of Credit Suisse’s flagship domestic bank commonly viewed as a constant hand, Gottstein looked for to put to rest a period afflicted by scandal. That objective was brief.

In early 2021, he discovered himself handling the fallout from 2 substantial crises. The bank’s direct exposure to the collapses of U.S. household hedge fund Archegos Capital and British supply chain financing company Greensill Capital saddled it with huge lawsuits and compensation expenses.

These oversight failures led to a huge shakeup of Credit Suisse’s financial investment banking, danger and compliance and property management departments.

In April 2021, previous Lloyds Banking Group CEO Antonio Horta-Osorio was generated to tidy up the bank’s culture after the string of scandals, revealing a brand-new method in November.

But in January 2022, Horta-Osorio was required to resign after being discovered to have actually two times breached Covid-19 quarantine guidelines. He was changed by UBS executive Axel Lehmann.

The bank started another pricey sweeping change task as Koerner and Lehmann set out to return the embattled loan provider to long-lasting stability and success.

This consisted of the spin-off of Credit Suisse’s financial investment banking department to form U.S.-based CS First Boston, a considerable cut in direct exposure to risk-weighted properties and a $4.2 billion capital raise, which saw the Saudi National Bank take a 9.9% stake to end up being the biggest investor.

March insanity

Credit Suisse reported a full-year bottom line of 7.3 billion Swiss francs for 2022, anticipating another “substantial” loss in 2023 prior to going back to success in 2024.

Reports of liquidity issues late in the year resulted in substantial outflows of properties under management, which struck 110.5 billion Swiss francs in the 4th quarter.

After yet another sharp share cost fall on the back of its yearly lead to early February, Credit Suisse shares gotten in March 2023 trading at a paltry 2.85 Swiss francs per share, however things will become worse still.

On March 9, the business was required to postpone its 2022 yearly report after a late call from the U.S. Securities and Exchange Commission associating with a “technical assessment of previously disclosed revisions to the consolidated cash flow statements” in 2019 and 2020.

The report was ultimately released the following Tuesday, and Credit Suisse kept in mind that “material weaknesses” were discovered in its monetary reporting procedures for 2021 and 2022, though it validated that its formerly revealed monetary declarations were still precise.

Having currently suffered the worldwide risk-off shock arising from the collapse of U.S.-based Silicon Valley Bank, the mix of these remarks and verification that outflows had actually not reversed intensified Credit Suisse’s share cost losses.

And on Wednesday, it entered into freefall, as leading financier the Saudi National Bank stated it was unable to offer anymore money to Credit Suisse due to regulative limitations. Despite the SNB clarifying that it still thought in the change task, shares dived 24% to an all-time low.

On Wednesday night, Credit Suisse revealed that it would exercise its alternative to obtain approximately 50 billion Swiss francs from the Swiss National Bank under a covered loan center and a short-term liquidity center.

The Swiss National Bank and the Swiss Financial Market Supervisory Authority stated in a declaration Wednesday that Credit Suisse “meets the capital and liquidity requirements imposed on systemically important banks.”

The assistance from the reserve bank and peace of mind on Credit Suisse’s monetary position resulted in a 20% appear the share cost on Thursday, and might have assured depositors in the meantime.

However, experts recommend concerns will stay regarding where the marketplace will put the stock’s real worth for investors in the lack of this buffer from the Swiss authorities.