Lyft

Lyft is the very first United States ride-hailing business to be heading to the stock exchange.

Filing with the United States Securities and Exchange Commission for its going public on March 1, Lyft stated it prepares to “revolutionize transportation” and be the “defining brand of our generation.”

When the business goes public, Lyft stated it prepares to set its share cost in between $62 and $68 per share. That implies its approximated appraisal might be someplace in between $21 and $23 billion, which is considerably greater than its present personal appraisal of $15 billion. Lyft will be noted on the Nasdaq utilizing the ticker sign LYFT and the IPO might show up as quickly as completion of March.

“We believe that our brand represents freedom at your fingertips: freedom from the stresses of car ownership and freedom to do and see more,” Lyft composed in the filing. “We believe that cities should be built for people, not cars.”

The relocation puts Lyft ahead of its competitor Uber in the race to Wall Street. Uber’s CEO, Dara Khosrowshahi, has openly stated the business is concentrating on going public in the 2nd half of 2019, however it’s appearing like that timeline might be versatile. Uber sent documents to the SEC for an IPO in early December.

While Uber and Lyft use the exact same service, hailing a flight with a smart device app, it’s anticipated each business will point prospective financiers to various elements of its organization. Uber will supposedly display itself as an international business with varied functions such as food shipment and flying automobiles. Lyft, much smaller sized, with services just in the United States and Canada, is concentrating on being a steady business that hasn’t experienced the exact same sort of chaos as Uber.

“Unsurprisingly, Lyft advocates that its key success factors include founder leadership, culture and values, and a singular focus on transportation,” stated Rohit Kulkarni, senior vice president of research study for financial investment company Forge. “Arguably, Lyft is taking a jab at Uber’s miseries and general lack of exclusive focus on ride-sharing over the past couple of years.”

Lyft’s hero character is front and center in its SEC filing. We combed through the 220-page file for all the intriguing bits. Here’s the breakdown:

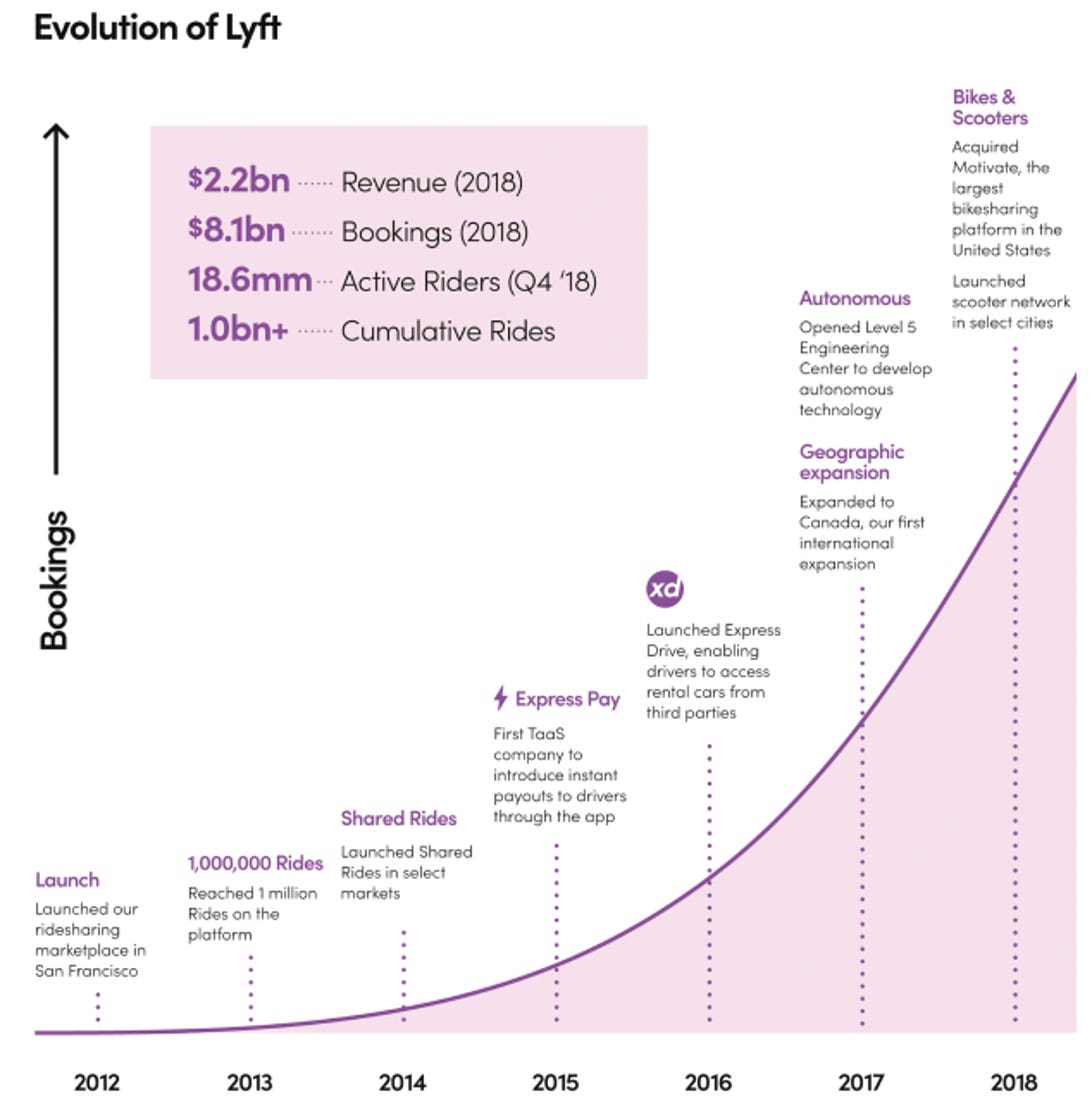

What is Lyft? First and primary, Lyft is a ride-hailing service that developed an app where travelers can press a button to hail a flight. But, according to Lyft’s filing it’s a lot more: “We are laser-focused on revolutionizing transportation.” Lyft was included in 2007 under the name Bounder Web, and after that altered its name to Zimride in 2008. It formally changed into Lyft as we understand it in 2012. Since then it’s introduced a number of efforts beyond the ride-hailing area, like carpool trips, bikes and scooters for lease, and self-driving automobiles.

The gamers. Lyft’s co-founders are Logan Green and John Zimmer. In the SEC filing, they consisted of a letter entitled “Our life’s work,” which starts with them stating, “For us, this work is personal.” The co-founders information their more youthful years of being motivated to repair traffic and enhance individuals’s lifestyle. “In those early days, we were told we were crazy to think people would ride in each other’s personal vehicles,” the co-founders composed. “One billion rides later, we’re able to look back on an industry that has been defined by the products Lyft pioneered.”

The “defining brand of our generation”? Lyft stated it intends to develop the “defining brand of our generation.” To do this it’ll promote a business culture based upon core worths, like “authenticity, empathy and support for others,” in addition to a dedication to social obligation. “We believe that our brand represents freedom at your fingertips,” Lyft composed.

Lyft

Lyft objectives. The business stated it’s pursuing the $1.2 trillion that United States customers invest in individual transport every year. “On a per household basis, the average annual spend on transportation is over $9,500, with the substantial majority spent on car ownership and operation. Yet, the average car is utilized only 5 percent of the time and remains parked and unused the other 95 percent.”

LYFT. Lyft will note on the Nasdaq utilizing the ticker sign LYFT. It’s unclear yet how Lyft’s rates will exercise, however it’s been approximated that the business will be valued someplace in between $20 billion and $25 billion. Its newest appraisal can be found in at $15 billion throughout its last financing round in 2018. Its IPO might come as quickly as early April.

The cash. As far as financials go, the business stated it gathered $2.2 billion in earnings in 2018 on $8.1 billion in reservations, revealing year-over-year development of 103 percent in sales and 76 percent in reservations.

Not so quickly. What about cash loss? Lyft lost $911.3 million in 2018, up from a bottom line of $682.8 million in 2016 and $688.3 million in 2017. The business confesses to having a “history of net losses and we may not be able to achieve or maintain profitability in the future.”

The board. Lyft’s board of directors has 10 members, 3 of whom are female. Sean Aggarwal has actually been the chairman given that January. He’s the CEO of Soar Capital, where he concentrates on financial investments in early-stage innovation business. The most popular board member is most likely Valerie Jarrett, who was a senior advisor to President Barack Obama.

The shareholders. While Lyft’s co-founders and board of directors will see a great payday when the business goes public, so will a handful of significant shareholders. Those consist of Rauten Europe, General Motors Holdings, entities connected with Fidelity, entities connected with Andreessen Horowitz and entities connected with Alphabet (Google’s moms and dad business).

Where you can capture a Lyft. Lyft is just in the United States and a couple of cities in Canada, in the meantime. That stated, the business has a far reach throughout the United States with its service supposedly in more than 300 markets, covering 95 percent of the population.

Riders. Lyft stated it dealt with more than 1 billion trips in 2018. Broken down, it stated it served 30.7 million riders in the United States and Canada in 2015. “Almost half of our riders reported that they use their cars less because of Lyft, and 22 percent reported that owning a car has become less important” to them, the business stated. It included that its active riders increased by 47 percent in the 4th quarter of 2018 compared to the exact same duration in 2017.

Lyft

Lyft

Wait, ski racks? Passengers can ask for automobiles that accommodate wheelchairs and safety seat in a number of cities where Lyft runs, however in a couple of “select” markets individuals can likewise request for a cars and truck with a ski or snowboard rack.

Drivers. Lyft’s service depends upon its agreement chauffeurs. It stated more than 1.9 billion individuals drove for the business in 2015. Since it introduced in 2012, Lyft stated it’s paid chauffeurs an overall of $10 billion in revenues.

Drivers get a piece of the pie. As a reward for chauffeurs in great standing, who have actually finished a minimum of 10,000 trips since completion of this month, Lyft stated it’d pay chauffeurs as much as $10,000. That cash might be utilized to purchase shares in the business at the IPO cost, Lyft stated.

Lawsuits. Lyft is swimming in suits. It lists 14 fits in its SEC filing and describes a number of others. Six of the cases it information are class action fits brought by its chauffeurs over category. These chauffeurs wish to be categorized as staff members — and get all the advantages that feature that — rather of independent professionals. Lyft alerts that if the present category design is altered, “there may be adverse business, financial, tax, legal and other consequences.”

The competitors. Unsurprisingly, Uber is noted as Lyft’s primary competitor. But likewise consisted of in the list are Juno and Via, which run in far less cities, and taxi business. Lyft likewise mentions Uber, Lime and Bird as rivals in the scooter world.

Let’s talk self-driving automobiles. Lyft is developing its own self-governing car system at an engineering center it calls Level 5. In the filing, the business stated its objective is to guarantee “access to affordable and reliable autonomous technology.” Since January 2018, Lyft stated it’s provided 35,000 trips in self-governing automobiles accompanied by a security motorist.

Lyft depends on… Amazon? Lyft utilizes Amazon Web Services, a cloud companies, to run its app. That implies if Amazon ever falls victim to a problem, bug or hacker, Lyft’s services might likewise be disrupted or go quiet.

So much information. Lyft has actually performed more than 1 billion trips and it’s gathered information from those trips along the method. So what’s it finishing with that information? Using it to “inform our machine learning algorithms and data science engines.”

Partnerships. To spread its reach into cities, Lyft stated it developed relationships with more than 10,000 companies, cities and towns to assist in trips for their staff members, consumers and constituents. It likewise developed unique marketing collaborations with brand names like Delta Air Lines.

Earthquakes, floods and twisters? Lyft is covering all its bases when it pertains to dangers. It notes natural catastrophes as an element that might interrupt its operations. Lyft’s head office are especially susceptible, the business composed, due to the fact that they remain in San Francisco — a location understood for seismic activity.

Then, there’s death. The word “death” is utilized 26 times in Lyft’s SEC filing. The business alerts that suits might develop from individuals passing away while riding in its automobiles, or on its bikes and scooters. Lyft’s word to financiers? This “could lead to negative publicity, harm to our reputation and brand, significant legal, regulatory or financial exposure or decreased use of our bikes and scooters.”

This story initially released on March 1 and is being upgraded continuously as more info appears.