Oil costs have actually been up to approximately $80 from over $120 in early June in the middle of growing worries about the possibility of a worldwide financial recession.

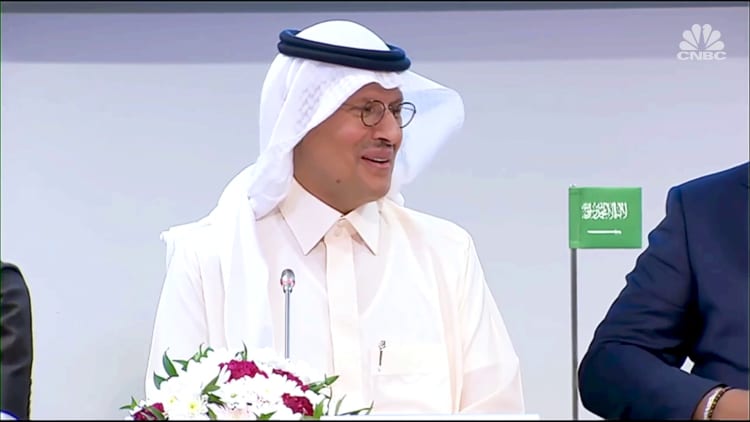

Bloomberg|Getty Images

A group of a few of the world’s most effective oil manufacturers on Wednesday consented to enforce deep output cuts, looking for to stimulate a healing in unrefined costs in spite of calls from the U.S. to pump more to assist the worldwide economy.

OPEC and non-OPEC allies, a group frequently described as OPEC+, chose at their very first in person event in Vienna given that 2020 to decrease production by 2 million barrels each day from November.

Energy market individuals had actually anticipated OPEC+, that includes Saudi Arabia and Russia, to enforce output cuts of someplace in between 500,000 barrels and 2 million barrels.

The relocation represents a significant turnaround in production policy for the alliance, which slashed output by a record 10 million barrels each day in early 2020 when need dropped due to the Covid-19 pandemic. The oil cartel has given that slowly unwound those record cuts, albeit with numerous OPEC+ nations having a hard time to meet their quotas.

Oil costs have actually been up to approximately $80 a barrel from more than $120 in early June in the middle of growing worries about the possibility of a worldwide financial recession.

The production cut for November is an effort to reverse this slide, in spite of repetitive pressure from U.S. President Joe Biden’s administration for the group to pump more to decrease fuel costs ahead of midterm elections next month.

International criteria Brent unrefined futures traded at $9282 a barrel throughout Wednesday afternoon handle London, up around 1.1%. U.S. West Texas Intermediate futures, on the other hand, stood at $8737, practically 1% greater.

OPEC+ will hold its next conference onDec 4.

White House ‘dissatisfied’

The White House stated in a declaration that Biden was “disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of Putin’s invasion of Ukraine.”

It stated that Biden had actually directed the Department of Energy to launch another 10 million barrels from the Strategic Petroleum Reserve next month.

“In light of today’s action, the Biden Administration will also consult with Congress on additional tools and authorities to reduce OPEC’s control over energy prices,” the White House stated.

The declaration included that the OPEC+ statement functioned as “a reminder of why it is so critical that the United States reduce its reliance on foreign sources of fossil fuels.”

To make sure, the burning of nonrenewable fuel sources, such as coal, oil and gas, is the primary chauffeur of the environment emergency situation.

Speaking at a press conference, OPEC Secretary-General Haitham Al Ghais safeguarded the group’s choice to enforce a deep output cut, stating OPEC+ was looking for to offer “security [and] stability to the energy markets.”

Asked by CNBC’s Hadley Gamble whether the alliance was doing so at a cost, Al Ghais responded: “Everything has a price. Energy security has a price as well.”

‘Selfishly inspired’

Energy experts stated the real effect of the group’s supply cuts for November was most likely to be restricted, with unilateral decreases by Saudi Arabia, the United Arab Emirates, Iraq and Kuwait most likely to do the primary task.

What’s more, experts stated it is presently hard for OPEC+ to form a view more than a month or 2 into the future as the energy market deals with the unpredictability of more European sanctions on non-OPEC manufacturer Russia– consisting of on shipping insurance coverage, rate caps and minimized petroleum imports.

“In its own words, OPEC’s mission is to ensure an adequate pricing environment for both consumers and producers. Yet the decision to reduce output in the current environment runs counter to this objective,” Stephen Brennock, a senior expert at PVM Oil Associates in London, stated in a research study note.

“Further squeezing already-tight supplies will be a slap in the face for consumers. The selfishly motivated move is aimed purely at benefiting producers,” he included. “In short, OPEC+ is prioritising price above stability at a time of great uncertainty in the oil market.”

Rohan Reddy, director of research study at Global X ETFs, informed CNBC that the group’s choice to enforce production cuts might see oil costs rally back to $100 a barrel– presuming no significant bouts of Covid worldwide and the U.S. Federal Reserve not ending up being suddenly hawkish.

“Due to the decision, volatility will likely return to the market, and despite concerns about the resilience of the global economy, the oil market is tight, all of which should serve as a tailwind for prices in the fourth quarter,” Reddy stated.

He included that while a go back to $100 oil is possible, “a more likely scenario in the short term is that oil prices hover in the $90 to $100 range as the market digests economic data releases.”

— CNBC’s Emma Graham added to this post.