Michael Godek|Moment|Getty Images

Three years after the Secure Act of 2019 introduced the very first significant modifications to the U.S. retirement system in more than a years, more adjustments are now on their method.

Dozens of retirement-related arrangements jointly referred to as “Secure 2.0” are consisted of in a $1.7 trillion omnibus appropriations expense that got approval from the House on Friday– following the Senate’s nod on Thursday– and will head to President Joe Biden for his signature.

associated investing news

Secure 2.0 “addresses gaps that have left some people on the sidelines of retirement savings, unable to access the workplace retirement plans that do so much good in establishing the capability and habit of savings,” stated Susan Neely, president and CEO of the American Council of Life Insurers.

More from Personal Finance:

Here are 10 methods to prevent the early withdrawal charge for Individual retirement accounts

Wells Fargo settlement consists of $2 billion for mistreated consumers

These are the 10 finest city locations for novice property buyers

“Part-time workers, military spouses, small-business employees, and student loan borrowers are just a few who will benefit and have a better chance of positioning themselves for a more financially secure retirement as a result of Congress’s action today,” Neely stated.

The Secure 2.0 arrangements are planned to construct on enhancements to the retirement system that were executed under the 2019 SecureAct Those modifications consisted of offering part-time employees much better access to retirement advantages and increasing the age when needed minimum circulations, or RMDs, from particular pension need to begin– to age 72 from 70 1/2.

This time around, a few of the numerous arrangements that remain in the huge appropriations expense consist of:

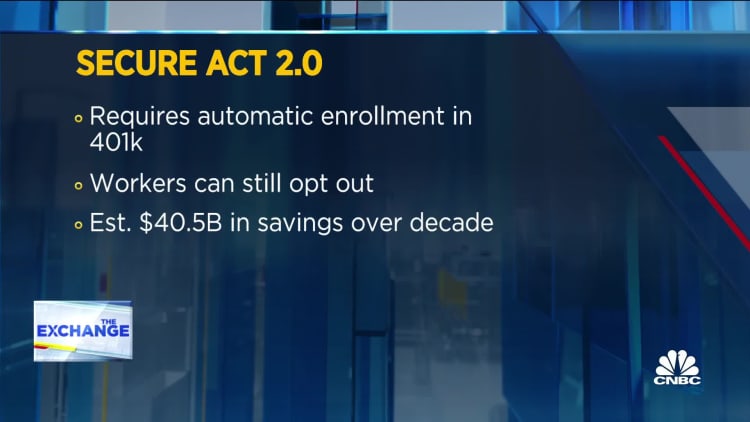

- Requiring automated 401( k) registration: Employers would be needed to instantly register workers in their 401( k) strategy at a rate of least 3% however not more than 10%. Businesses with 10 or less employees and brand-new business in organization for less than 3 years are amongst those that would be left out from the required.

- Increasing the age when RMDs would require to begin: The existing expense would increase it from age 72 to age 73 in 2023 and after that to age 75 in2033 Additionally, the charge for stopping working to take RMDs would be minimized to 25%, and in many cases, 10%, from the existing 50%.

- Creating larger “catch-up” contributions for older retirement savers: Under existing law, you can put an additional $6,500 each year in your 401( k) as soon as you reach age50 Secure 2.0 would increase the limitation to $10,000 (or 50% more than the routine catch-up quantity) beginning in 2025 for savers ages 60 to63 Catch- up quantities likewise would be indexed for inflation. Additionally, all catch-up contributions will go through Roth treatment (i.e., not pretax) other than for employees who make $145,000 or less.

- Broadening company 401( k) match choices: A proposition would make it simpler for companies to make contributions to 401( k) prepares on behalf of workers paying trainee loans rather of conserving for retirement.

- Improving employee access to emergency situation cost savings: One arrangement would let workers withdraw as much as $1,000 from their pension for emergency situation expenditures without needing to pay the common 10% tax charge for early withdrawal if they are under age 59 1/2. Companies likewise might let employees established an emergency situation cost savings account through automated payroll reductions, with a cap of $2,500

- Increasing part-time employees’ access to pension: The initial Secure Act made it so part-time employees who schedule in between 500 and 999 hours for 3 successive years might be qualified for their business’s 401( k). Secure 2.0 lowers that to 2 years. Companies currently have actually been needed to give eligibility to workers who operate at least 1,000 hours in a year.

- Helping employees who are paying back trainee loans conserve for retirement: Secure 2.0 makes it simpler for companies to make contributions to 401( k) strategies (and comparable office strategies) on behalf of workers who are making trainee loan payments rather of adding to their retirement strategy.

- Boosting just how much can be put in a certified durability annuity agreement: Currently, the optimum that can enter into a QLAC is either $135,000 or 25% of the worth of your pension, whichever is less. Secure 2.0 removes the 25% cap and increases the optimum quantity allowed a QLAC to $200,000

- Changing the needed minimum circulation guidelines for Roth 401( k) s: Currently, while Roth Individual retirement accounts include no RMDs throughout the initial account owner’s life, that’s not the case for Roth 401( k) s. Starting in 2024, the pre-death circulation requirement would be gotten rid of.

- Broadening utilizes for unused college cost savings cash: An arrangement would enable tax- and penalty-free rollovers to Roth Individual Retirement Accounts from 529 college cost savings accounts that are at least 15 years of ages, within limitations.

- Helping military partners get access to retirement strategies: Secure 2.0 produces tax credits for small companies that let military partners register immediately in their strategy and get approved for instant vesting of any company matches.

The expense likewise consists of rewards for small companies to establish retirement cost savings prepares for their employees, motivates people to reserve long-lasting cost savings and makes it simpler for annuities to be an earnings alternative for senior citizens.