Greg Becker, President and CEO of Silicon Valley Bank (SVB), speaks throughout the Milken Institute Global Conference on May 3, 2022 in Beverly Hills, California.

Patrick T. Fallon|AFP|Getty Images

Before Silicon Valley Bank’s failure, its previous CEO Greg Becker backed 2 tech market lobbying groups that attempted to affect the Dodd-Frank monetary reform law and pressed to cut business taxes, according to records examined by CNBC.

In the accumulation to the bank’s collapse, Becker chaired a group called Tech Web and was a board member of the Silicon Valley Leadership Group, 2 trade companies that have actually lobbied federal government authorities on a variety of concerns connected to the company. Becker stepped down as chairman of Tech Web at the start of the year however stayed on the group’s executive council up until Monday, when he resigned.

associated investing news

Both trade companies consisted of Silicon Valley Bank as a member prior to its failure, according to archived variations of their sites. Current members of both companies consist of tech giants Google, Amazon, Meta and Apple.

SVB collapsed under pressure after consumers withdrew a shocking $42 billion recently. Days after the bank was required to close on Friday, regulators backstopped SVB client deposits as part of several relocate to include the damage from its failure. Regulators later on selected Tim Mayopoulos to run SVB.

The lobbying by trade groups connected to Becker and SVB contributes to a string of efforts to affect policy that has actually drawn legislators’ attention considering that the bank stopped working. Some members of Congress have actually looked for more details on the practices that left the bank susceptible and its push to chip away at guidelines, in addition to Becker’s sale of more than $3 million in stock in late February.

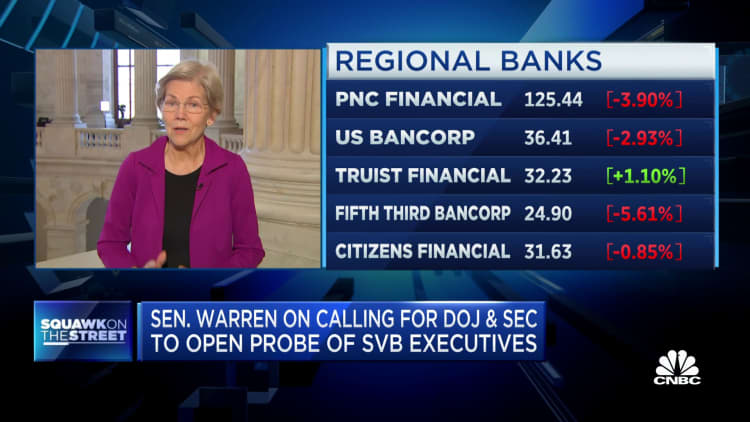

Senate Banking Committee memberSen Elizabeth Warren, D-Mass, sent out a letter to the banking executive asking him to “describe the full scope of your efforts to roll back Dodd-Frank regulations in Congress.” Warren and other legislators are now indicating the bank’s failure as reason to tighten up safeguards around the monetary market, consisting of by rolling back a 2018 law that loosened up Dodd-Frank guidelines.

When Becker led Tech Web, the group stacked money into forming federal policy– consisting of pieces of Dodd-Frank The company has actually invested more than $2 million considering that the start of 2020 on lobbying Congress, according to its lobbying disclosure reports.

Tech Net invested $1.84 million in 2015 on 20 internal and external lobbyists, the most it bought lobbying considering that 2005, according to information from the nonpartisan guard dog OpenSecrets. The trade group had large coffers to draw from: it generated more than $4.2 million in subscription fees in 2020, according to its newest monetary disclosure type submitted with the internal revenue service.

Tech Net focused its lobbying, in part, on “Section 1033 of the Dodd-Frank Consumer Protection Act,” according to its disclosure reports. The group engaged with House and Senate legislators, in addition to Consumer Financial Protection Bureau authorities, on the arrangement associated to customer disclosures, records reveal.

Steve Kidera, a representative for Tech Web, informed CNBC that the group’s “disclosed lobbying on Section 1033 was a consumer data privacy issue related to the announced notice of proposed rulemaking at the CFPB on data privacy, one of our industry’s top policy issues.”

Section 1033 was developed under the sweeping monetary reform legislation, which previous President Barack Obama signed into law after the 2008 monetary crisis.

The CFPB states it is “in the process of writing regulations to implement” area 1033 which would need banks such as Silicon Valley Bank to “make available to consumers, upon request, transaction data and other information concerning a consumer financial product or service that the consumer obtains from the covered entity.”

Though the lobbying disclosures do not discuss whether Tech Web supports or opposes area 1033 as composed, the company plainly wishes to have a say in how the guideline is carried out.

The group’s 2023 policy concepts state it wishes to develop a “robust consumer data right through a Section 1033 rulemaking that promotes the free flow of consumer authorized data across the financial ecosystem.” Tech Web included that it supports “a flexible, consent-based framework for notifying consumers of how their information will be shared, transmitted, stored, and utilized.”

The other trade company for which Becker held a board seat has actually reached into its own deep pockets to affect policy. The Silicon Valley Leadership Group in 2020 raised $1.3 million in contributions and generated an extra $2.9 million through subscription fees, according to the records submitted with the internal revenue service.

Its 2021 records, which were offered to CNBC by the company after a questions, reveals they generated practically the very same quantity in subscription fees that year. The group raised more than $940,000 through contributions in 2021, according to the records.

The company boasts on its site that it “supported comprehensive corporate tax reform, including lowering the corporate income tax rate and moving toward a hybrid/territorial international tax system.”

The business tax rate most just recently dropped in2017 Former President Donald Trump signed GOP tax cuts into law, reducing the rate to 21% from 35%.

Laura Wilkinson, a spokesperson for the Silicon Valley Leadership Group, informed CNBC that Silicon Valley Bank executives became part of the group’s union of lots of member business that consulted with House and Senate legislators in 2017 on Capitol Hill to promote for cutting the business tax rate.

“We’re focused on strengthening competitiveness by fighting for a fair business tax system at the local, state, and federal levels,” Wilkinson stated. “In 2017, this included joining the broad coalition of main street businesses and innovation leaders that advocated for a simpler and fairer tax system as part of comprehensive tax reform to support economic growth and American jobs.”

Federal records reveal that the Silicon Valley Leadership Group has actually not submitted lobbying disclosure reports considering that 2009.

Becker was chairman of the Silicon Valley Leadership Group from 2014 through 2017, according to an archived variation of his SVB bio page. Becker might not be grabbed remark.

SVB and Becker back Democrats

Even as it pursued policy objectives that often encountered Democrats’ concerns, SVB and Becker typically provided cash to the celebration’s prospects for workplace.

One of Becker’s huge contributions in the 2022 election cycle went to Senate Majority Leader Chuck Schumer, D-N.Y., according to Federal Election Commission filings. Schumer is providing the contributions his project got from both Becker and the bank’s PAC to charities.

Since 2011, the year Becker ended up being CEO and president of SVB, its political action committee has actually provided most of its contributions in each election cycle to Democrats, according to OpenSecrets. The exception was available in 2012, when Republicans kept control of the House even as Obama won reelection.

Senate Banking Committee memberSen Mark Warner, D-Va, likewise got contributions fromBecker Warner got $11,400 from the ex-bank CEO throughout the 2020 and 2022 election cycles, according to Federal Election Commission records.Sen Jon Tester, D-Mont, got $3,000 from the bank’s PAC in 2017, according to FEC records.

Becker likewise hosted Warner for a charity event in 2016 at his California house, according to a welcome to the event. Representatives for both Warner and Tester will not state whether they prepare to contribute any of the funds they got from Becker or the bank’s PAC.

The veteran legislators elected the 2018 law that rolled back pieces of Dodd-Frank

The costs they backed reclassified the “too big to fail” requirement under Dodd-Frank, which included improved regulative examination. By raising the regulative limit for banks from $50 billion in properties to $250 billion, medium-size banks were excused from those guidelines. Becker, in statement he sent to a Senate panel in 2015, made a comparable require his and other medium-sized banks to be exempt from the Dodd-Frank guidelines.

The Federal Deposit Insurance Corp., which assisted form the defenses for SVB depositors, stated prior to the bank closed that the business had around $209 billion in overall properties– which would have made it based on those guidelines prior to 2018.