Ambulances stationed outside the U.S. Capitol Building.

Adam Jeffery|CNBC

Nearly 2 years and 6 relief costs into the pandemic, the U.S. has actually invested most of its offered Covid rescue financing. But billions of dollars throughout a handful of classifications have actually not headed out the door.

Beginning under then-President Donald Trump and continuing through President Joe Biden’s administration, Congress has actually authorized some $4.5 trillion in overall help costs, according to Treasury Department information. Federal companies have actually officially dedicated to utilizing about $4 trillion of that, and have actually made $3.5 trillion in real payments to date.

It can typically take some time for the overall pot of funds to make its method to the American individuals, budget plan professionals state. That’s due to the fact that federal government companies such as the Small Business Administration and the Department of Labor go through a procedure of lawfully devoting to a part of allocated financing, which is called “obligating.” They then begin to really invest it.

The $500 billion or two in offered relief resources that have actually not been bound might not wind up being invested by companies. There are due dates for making these dedications and they might cover years. The information likewise differ by program. Funds that are not ultimately bound are returned for other federal government utilizes.

What companies can dedicate to costs might vary from the preliminary quotes presented in costs, or they might simply prepare to utilize the funds over a long-lasting duration, stated Kristen Kociolek, a director with the U.S. Government Accountability Office’s monetary management and guarantee group. A Congressional Budget Office quote of expenses from March 2021’s almost $2 trillion American Rescue Plan, for instance, programs 40% of overall costs is set to happen in between 2022 and2030

Education, healthcare, and catastrophe relief are amongst the locations where the federal government has actually underspent its obligated funds, according to a CNBC analysis of Treasury information assembled by the Pandemic Response Accountability Committee, or PRAC. The company was produced as part of the March 2020 CARES Act to support oversight of pandemic relief costs.

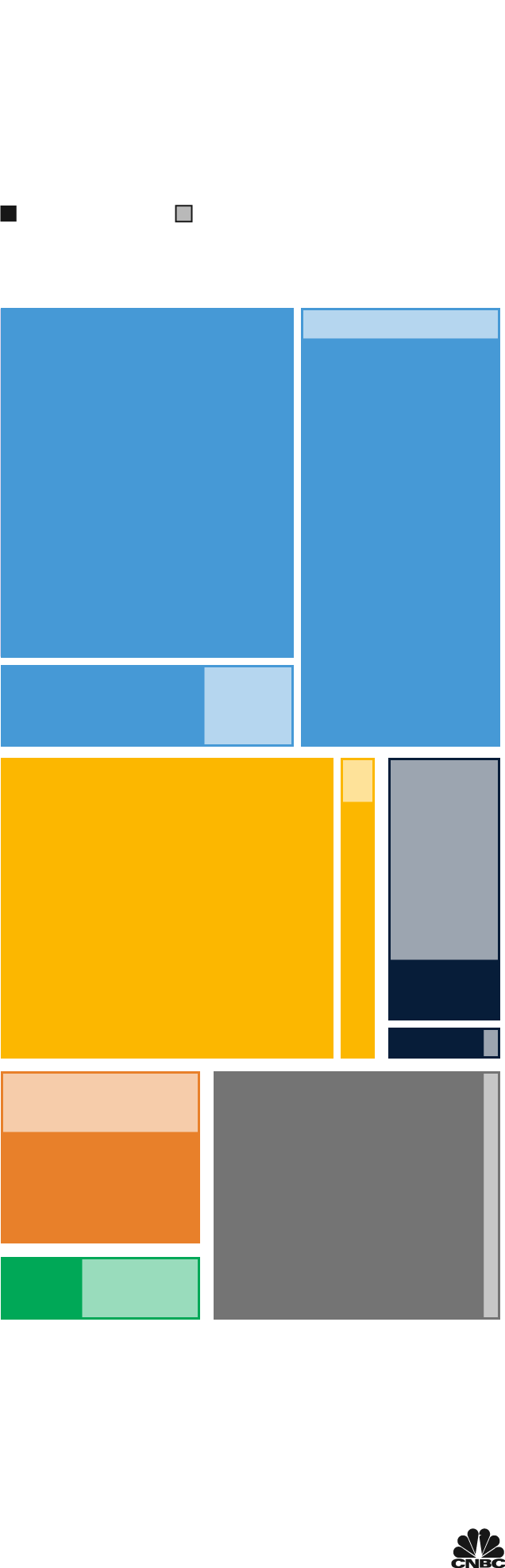

Covid relief financing, invested and staying

Roughly $3.5 of $4 trillion in bound, or dedicated, costs is out the door. Gaps

stay in education, health, and catastrophe relief.

Funds obligated however not invested

Labels reveal quantity invested// quantity staying

Stimulus checks

$844 B invested// $0 staying

Unemployment

payment

$666 B// $56 B

K-12, vocational

$60 B// $203 B

All other classifications

$563 B// $40 B

Other earnings security

$145 B// $67 B

Paycheck Protection Program

$828 B// $3B

Commerce and real estate credit

Community and local

advancement (consists of

catastrophe relief) $48 B// $75 B

Note: Includes determines connected straight to costs. As ofDec 6, 2021.

Source: CNBC analysis of Treasury information assembled by the Pandemic Response Accountability Committee

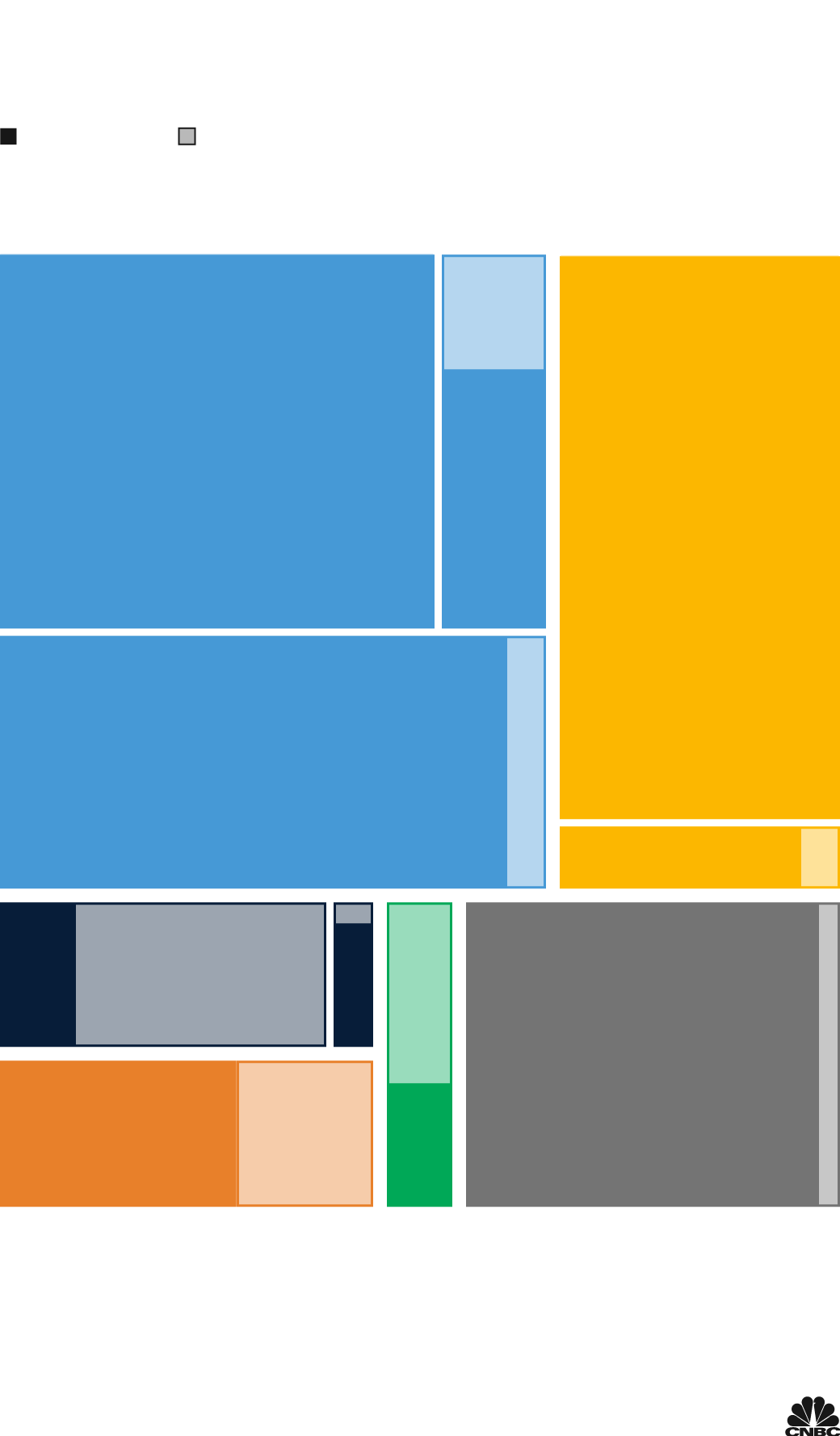

Covid relief financing, invested and

staying

Roughly $3.5 of $4 trillion in bound, or

dedicated, costs is out the door. Gaps

stay in education, health, and catastrophe relief.

Funds obligated however not invested

Labels reveal quantity invested// quantity staying

Stimulus checks

$844 B invested// $0 staying

Unemployment

payment

$666 B// $56 B

Other earnings

security

$145 B// $67 B

Commerce and real estate credit

Paycheck Protection Program

$828 B// $3B

K-12,

vocational

$60 B//

$203 B

All other classifications

$563 B// $40 B

Community and local

advancement (consists of

catastrophe relief) $48 B// $75 B

Note: Includes determines connected straight to costs.

Source: CNBC analysis of Treasury information assembled

by the Pandemic Response Accountability

Committee As ofDec 6, 2021.

Covid relief financing, invested and staying

Roughly $3.5 of $4 trillion in bound, or dedicated, costs is out the

door. Gaps stay in education, health, and catastrophe relief.

Funds obligated however not invested

Labels reveal quantity invested// quantity staying

Commerce and

real estate credit

Stimulus checks

$844 B invested// $0 staying

Paycheck Protection

Program

$828 B// $3B

Other

earnings

security

$145 B//

$67 B

Unemployment payment

$666 B// $56 B

All other classifications

$563 B// $40 B

K-12, vocational

$60 B// $203 B

Community and local

advancement (consists of

catastrophe relief) $48 B// $75 B

Note: Includes determines connected straight to costs.

Source: CNBC analysis of Treasury information assembled by the Pandemic Response

AccountabilityCommittee As ofDec 6, 2021.

The federal government prepares to utilize almost half of the staying relief cash in the future, stated Marc Goldwein, a senior vice president with the nonpartisan Committee for a Responsible Federal Budget, or CRFB. An absence of need might likewise have actually resulted in remaining cash. Goldwein kept in mind that a strong credit market may reduce the requirement for Paycheck Protection Program loans.

Some programs likewise wound up costing less than at first anticipated. Half of U.S. states cut off boosted welfare ahead of the Labor Day due date, for instance.

More cash is offered for education than any other classification. Agencies bound some $263 billion for primary, secondary and trade education, and almost $60 billion has actually been invested to date, the information reveal.

The more than $200 billion in overall education financing stays on the table in part due to the fact that schools have up until 2025 to invest it. Congress reserve the money mostly to assist reboot in-person knowing, however schools throughout the nation have actually resumed their doors while utilizing just a portion of the financing.

The GAO kept in mind in October that some states have actually utilized the cash for programs to increase trainees who fell back throughout virtual classes due to bad participation or an absence of dependable web gain access to, to name a few elements.

Policymakers likewise have a considerable share of healthcare services moneying staying, CNBC’s analysis discovered. The federal government has actually invested almost two-thirds, or $192 billion, of the approximately $303 billion bound, leaving $111 billion. The GAO kept in mind that much of the cash bound for the Department of Health and Human Services is “available for a multiyear period or are available until expended.”

Agencies might utilize these funds as required on efforts such as Covid-19 screening and treatment, according toGoldwein Among prospective usages for the cash, the federal government might purchase dosages of the coming Pfizer antiviral Covid treatment, he stated.

The federal government likewise has almost $70 billion of the $114 billion bound for catastrophe relief delegated utilize, which might be released as required. The U.S. for the very first time throughout the pandemic utilized the Federal Emergency Management Agency’s catastrophe relief fund– usually administered in reaction to significant natural catastrophes– to react to a public health crisis.

In 2 of the most carefully enjoyed pandemic help classifications, the federal government has actually gone through almost every obligated dollar. The U.S. has actually invested all of the approximately $844 billion reserved for direct payments to people, and has actually sent all however $3 billion of the more than $830 billion bound for Paycheck Protection Program bank loan.

The speed with which the infection damaged the economy and the absence of info about how to include it added to a distinctively big and quick federal government reaction.

“Compared to past recessions, what took years happened in weeks,” Goldwein stated. “So the response was similarly fast.”

The unmatched help likewise was likewise driven by the traditional knowledge that Congress invested insufficient to combat the Great Recession over a years earlier, triggering legislators to “err on the side of caution” this time around, he included.

“Just one pandemic relief program — the $800 billion Paycheck Protection Program (PPP) — is equal to the federal government’s entire response to the 2008-2009 financial crisis,” composed PRAC Chair Michael Horowitz in the group’s semiannual report to Congress released recently.

The preliminary costs were concentrated on getting cash into Americans’ pockets as quick as possible to change lost earnings as the U.S. joblessness rate increased to almost 15% in April2020 The procedure ended up being more improved gradually, with extra limitations included for PPP loans and extra welfare reduced to a quantity that would change lost earnings for the common employee instead of pay them more than they made while working.

The bulk of the permitted costs originates from the CARES Act and American Rescue Plan, costs passed in March of 2020 and 2021, respectively. Much of the cash supported people and organizations, with more than $2 trillion can be found in the kind of stimulus checks, welfare and Paycheck Protection Program loans, according to both PRAC and CRFB quotes.

Estimates from groups such as the PRAC and CRFB that try to catch a more comprehensive scope of the financing by consisting of procedures that are not straight connected to costs, such as tax credits, put the overall Covid relief price at more than $5 trillion. The PRAC’s tracker reveals an overall of $5.2 trillion in permitted financing, while the CFRB’s tally is $5.7 trillion.

U.S. Covid cases and hospitalizations are on the increase and health authorities are examining the danger of the freshly found omicron variation, which the World Health Organization on Wednesday stated has the prospective to alter the course of the pandemic. The staying relief dollars have some degree of versatility– the federal government can utilize health costs for screening or vaccination efforts, for instance– however any substantial modifications would likely need an act of Congress.

“You can’t take money that was supposed to go to testing and use it to send checks to people,” Goldwein stated.