Warren Buffett, chairman and president of Berkshire Hathaway Inc., in Fukushima Prefecture, Japan, on Monday,Nov 21, 2011.

Bloomberg|Bloomberg|Getty Images

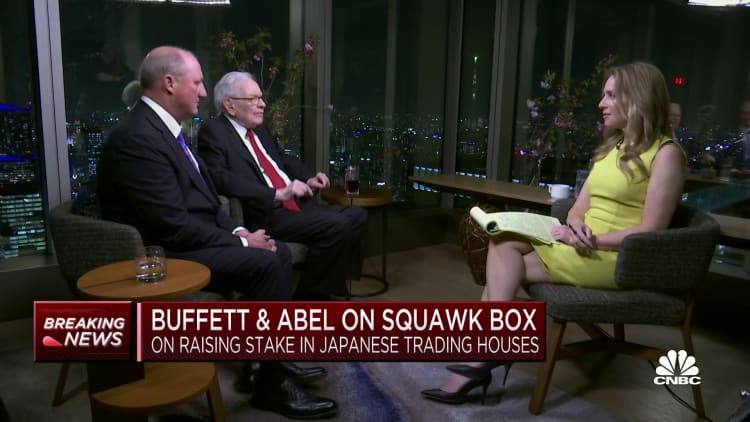

Berkshire Hathaway‘s Warren Buffett remains in Japan and just recently exposed that he raised his stakes in the nation’s leading trading homes, stating he was “confounded” by the chance to purchase them 2 years back.

The 5 business– Mitsubishi Corp., Mitsui & & Co., Itochu Corp, Marubeni Corp., SumitomoCorp saw 2 successive days of gains as Buffett validated he included approximately another portion indicate his holdings. Berkshire Hathaway’s stakes in all 5 trading homes is now 7.4%.

On Thursday, the shares continued to trade primarily greater for a 3rd day, paring earlier losses after Federal Reserve minutes revealed expectations for an economic downturn in the U.S. in the fallout of the local banking crisis. Sumitomo shares fell 0.5%.

Buffett’s journey is a “stamp of approval”– particularly for domestic financiers in Japan, according to Monex Group’s Jesper Koll.

“For Japanese institutional investors, this really is now the stamp of approval that Japan can deliver superior returns,” Koll informed CNBC’s “Street Signs Asia.”

He highlighted Buffett’s journey has the prospective to increase self-confidence amongst Japanese financiers as the country continues to face low intake.

“The real focus is confidence for Japanese investors, and that’s where Warren Buffett’s visit was very, very important,” Koll stated. “He’s got the track record globally, but now he’s got a very positive track record in investing in Japan.”

Household costs in Japan partially increased by 1.6% in February, the most recent federal government information revealed.

That likewise marked the very first development in intake that the economy has actually seen in 4th months, with costs beyond seasonal elements led by entertainment, leisure and travel.

Private intake is an essential indication for Japan, accounting for over half of the country’s gdp.

‘Unique antenna’

Monex’s Koll included that Buffett will gain from the advantage the trading homes hold.

The trading business, likewise described as sogo shosha, are corporations that import whatever from energy and metals to food and fabrics intoJapan They likewise offer services to makers. The trading homes have actually assisted grow the Japanese economy and added to the globalization of its company.

“Any new venture, any new enterprise that is being formed, the Japanese trading houses will have superior intelligence and superior access to the deal, and that’s something that Berkshire Hathaway is going to be able to leverage in a unique antenna into the future view in Japan as well as the Asia-Pacific,” Koll stated.

Earlier today, the Bank of Japan’s brand-new guv Kazuo Ueda repeated that he means to preserve the reserve bank’s accommodative financial policy, which supplies more assistance for the Japanese equity market and retail financiers.

Ueda highlighted that the reserve bank’s yield curve control and unfavorable rate of interest policies will likely be sustained up until the economy reaches its target of 2% in inflation.