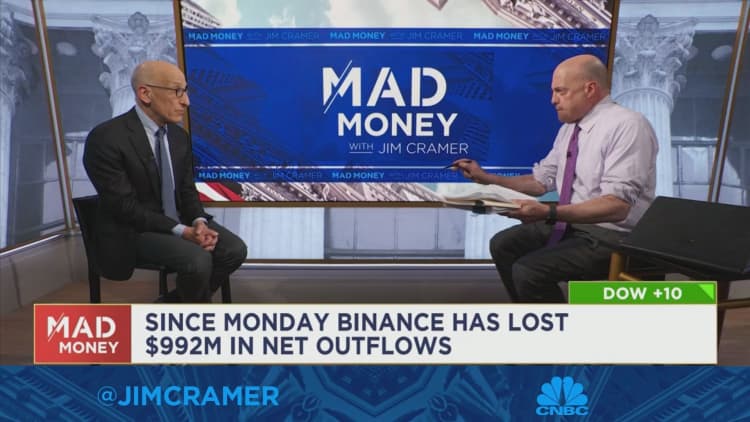

Binance’s Co- creator & & CEO Changpeng Zhao has actually offered numerous interviews going over the outlook for cryptocurrency following a rough number of weeks in the market.

NurPhoto/ Contributor/ Getty Images

The $2.2 billion of U.S. consumer possessions held by Binance is at “significant risk” of being taken by creator Changpeng Zhao unless a freezing order remains in put location, federal regulators stated in a filing Tuesday night, after the crypto regulator was charged by the Securities and Exchange Commission.

Lawyers from the SEC submitted an emergency situation movement previously, pointing out a threat of capital flight and asking a judge to repatriate and freeze U.S. consumer possessions to avoid illegal transfers by Zhao or Binance entities. The SEC took legal action against Binance and Zhao on Monday, declaring they took part in the unregistered deal and sale of securities and commingled financier funds with their own.

associated investing news

The most current filing explained Zhao as a “foreign national who has made overt his views that he is not subject to the jurisdiction of this Court.” SEC legal representatives declared that 2 Binance U.S. subsidiaries– BAM Trading and BAM Management– were managed by Zhao and had actually currently gathered “illicit gains” of a minimum of $4204 million in earnings and endeavor fundraising.

Years of interactions in between the SEC and Binance, which declares no main head office, recommend thatBinance United States could not plainly suggest who managed consumer possessions, according to the filing.

“Zhao and Binance have had free reign,” the SEC declared, over “customer assets worth billions of dollars.”

Zhao’s lawyers state the billionaire is exempt to U.S. law, in spite of his control over or advantageous ownership of U.S. business and checking account that sent out billions of dollars to Swiss and British Virgin Islands- based holding business, the SEC stated.

The SEC states federal law and precedent develop the court’s jurisdiction over Zhao and Binance.

“There is no doubt that the Court has personal jurisdiction over all Defendants,” the SEC stated.

While Binance’s U.S. arm has stated it keeps control over much of its innovation and monetary facilities, the SEC states Zhao’s supreme control puts financier possessions at danger unless action is taken instantly.

“Given the history of Zhao’s and Binance’s open desire to avoid U.S. regulation and oversight, and their surreptitious control over BAM Trading and commingling of and movements of BAM Trading assets through a web of Zhao-controlled entities outside of the United States, there can be no assurance that BAM Trading employees are not influenced by Zhao or Binance today,” the filing stated.

Federal regulators are likewise asking for the court permit them to serve Zhao by emailing his legal representatives, stating his “pattern of geographical elusiveness” makes it challenging to determine his specific home or location. Zhao is supposedly a local of the UAE.

Binance did not instantly reacted to an ask for remark.

SEE: Timothy Massad: crypto danger ‘isn’t practically the token’