In thisFeb 21, 2020 picture, Dilip Kumar, vice president of physical retail and innovation for Amazon, presents for an image inside an Amazon Go Grocery shop set to open quickly in Seattle’s Capitol Hill community.

Ted S. Warren|AP

Amazon has actually invested practically 3 years improving the art of bringing whatever you can possibly imagine to your doorstep in the fastest quantity of time, at the most affordable possible rate. By practically any step, it’s been among the best business successes in history.

But regardless of Amazon’s undisputed supremacy in e-commerce, one huge market has actually shown especially vexing: groceries.

Amazon has actually presented an excessive selection of services– Prime Now, Fresh, Go and others– in its effort to end up being a giant in the $750 billion U.S. grocery market. In 2017, it invested $137 billion to obtain Whole Foods, a cost more than 10 times greater than Amazon had actually paid in any previous offer.

Still, it’s simply a specific niche gamer in the market. As of mid-December,Amazon com and Whole Foods represented a combined 2.4% of the grocery market over the past 12 months, while Walmart regulated 18%, according to research study companyNumerator Amazon’s shipment services have actually struggled to stick out in a congested field, while the Go automated corner store have actually been deprioritized, according to individuals knowledgeable about the business’s method.

On creator Jeff Bezos’ watch, investors revealed little issue about this corner of the Amazon empire. The business’s stock rate skyrocketed practically 400% in his last 5 years at the helm, improved by e-commerce development and a flourishing cloud organization.

The story has actually altered considering that July, when Bezos was been successful as CEO by long time cloud chief AndyJassy The stock has actually come by about 13% because time and was the worst entertainer in the Big Tech group in 2015. Amazon simply reported its slowest development rate for any quarter considering that 2001.

That might offer financiers a factor to begin searching for things they do not like. One location of examination might be Amazon’s physical shops system, that includes Whole Foods and Fresh shops. It saw lower sales in 2021 than in 2018, even as its footprint of leases broadened by 17% over that stretch.

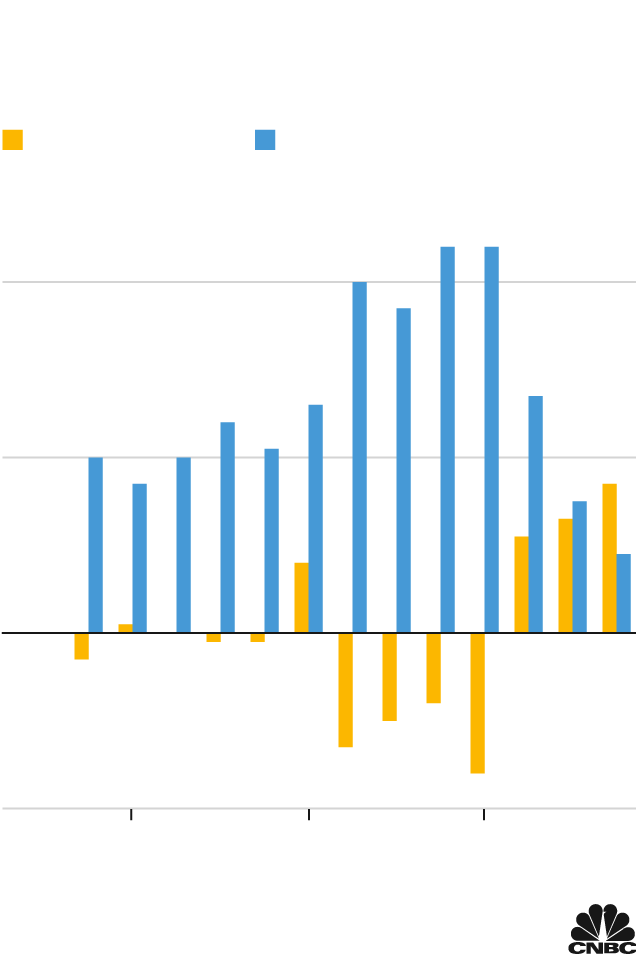

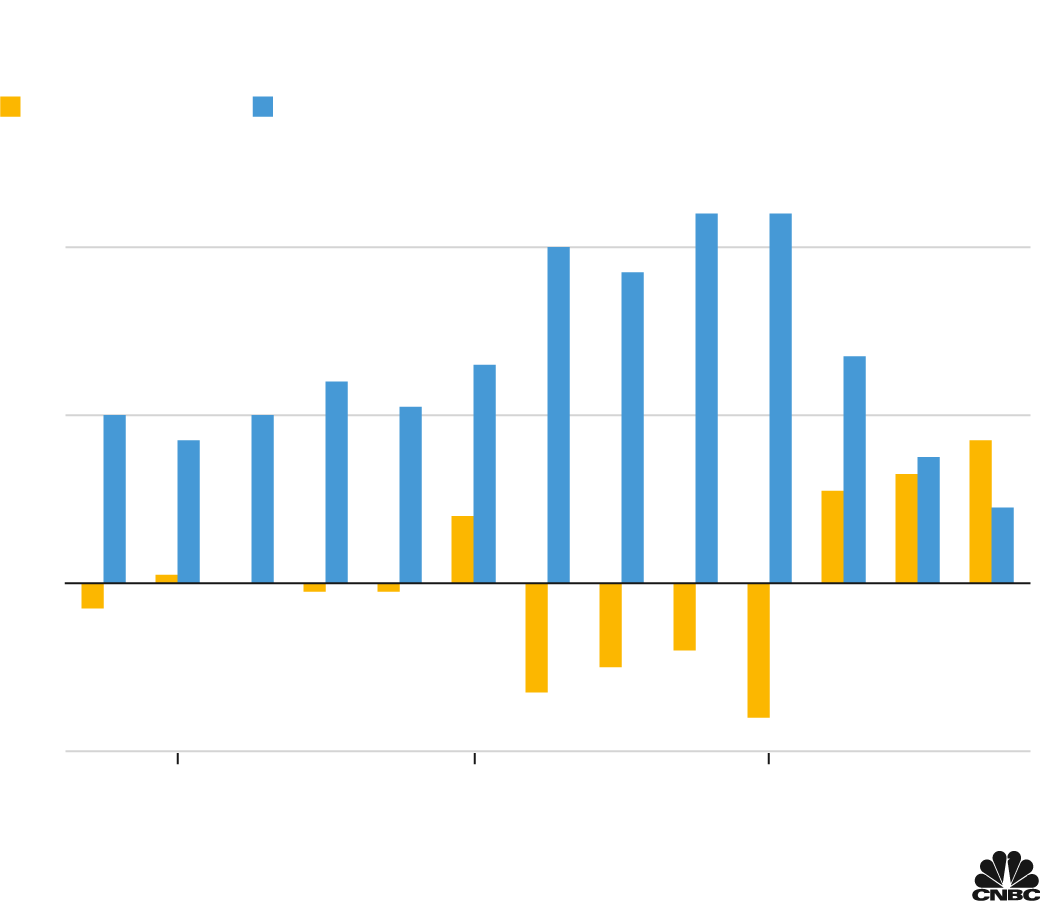

Amazon quarterly sales, modification from previous year

Source: Company filings. As of Q4 2021.

Amazon quarterly sales, modification

from previous year

Source: Company filings. As of Q4 2021.

Amazon quarterly sales, modification from previous year

Source: Company filings. As of Q4 2021.

“Amazon’s all about the cloud, e-commerce and entertainment,” stated Jake Dollarhide, CEO of Longbow Asset Management, which has actually counted Amazon has a “core holding” considering that2011 “It’s almost like the grocery business is an expensive hobby.”

Competition is all over. Entrenched gamers such as Walmart, Target, Kroger and Albertsons are getting savvier with digital offerings, thanks to the pandemic shock. Meanwhile, Instacart, Uber, DoorDash and Gopuff are tossing cash at fast shipment, Amazon’s sweet area.

With Jassy now outlining the roadway ahead for Amazon and its disjointed portfolio of high-cost grocery possessions, CNBC talked with experts and previous workers about how the business got to this point and where it goes from here.

Most of individuals who accepted be spoken with did so on condition that they not be called since they weren’t licensed to discuss their experiences or they feared retribution from the business.

They depicted an environment of extreme internal competitors for resources and stated culture clashes taken place when groups came together. Part of that is deliberate, as Bezos promoted an office of completing concepts. It’s likewise wreaked havoc and an absence of clear instructions.

Amazon decreased to supply commentary on the record for this story or make any executives offered for interviews.

Fresh vs. Prime Now

The year 2017 marked an inflection point for Amazon’s grocery method.

Late that year, 2 increasing stars at Amazon were called into a conference to reconsider how the business provides groceries.

Amazon was putting cash into the Prime Now quick shipment program and the Amazon Fresh grocery shipment service.

Bezos wasn’t delighted. He saw Fresh and Prime Now as too comparable to validate the significant financial investment that each needed. That issue was magnified by the Whole Foods acquisition, that made Amazon’s grand aspirations clear to the competitors and led financiers to discard shares of other grocery chains.

Amazon Fresh grocery delivery van from the Amazon Prime service parked on a rural street in San Ramon, California, July 5, 2018.

Smith Collection/Gado|Archive Photos|Getty Images

Amazon management summoned Stephenie Landry, who ran Prime Now, and Ben Hartman, head of Amazon Fresh, to the business’s Seattle head office. They were informed to get ready for a “bake-off” that would figure out the course forward for the business’s online grocery organization, according to individuals knowledgeable about the matter.

It was a turning point forAmazon The Fresh shipment service had actually been around considering that 2007, when long time executive Doug Herrington, a previous vice president at dot-com grocery flameout Webvan, introduced an effort to drive fresh fruits, veggies, meat and milk in temperature-controlled lug bags to some homeowners in the Seattle suburban area of MercerIsland

Andrea Leigh keeps in mind the early days of the grind, attempting to make it in the low-margin organization. Having operated in Amazon’s media, grocery and premium and infant classifications, Leigh was on maternity leave in 2010 when she was reminded assist Fresh generate income so it might grow beyond Seattle.

“We had been working on Fresh for three years at that point and we hadn’t gotten the model profitable,” Leigh stated. “There was a real interest and desire to expand.”

One concept was to guide grocery consumers towards higher-priced products in other classifications. It might be a set of earphones or a last-minute birthday present.

Leigh constructed an algorithm that recognized top-selling products in Seattle, believing it might enhance Fresh’s basic product selection. The software application didn’t constantly work as planned.

One time Amazon wound up buying a lot of life-sized horsehead masks, after the algorithm flagged them as the city’s leading toy. The algorithm didn’t adapt to acknowledge that Halloween was approaching.

By the time Fresh introduced outdoors Seattle, opening a Los Angeles operation in 2013, Prime Now was on the horizon and would quickly posture an obstacle from the within.

Fresh had actually been around for 6 years, however Prime Now had an unique benefit. It was being run by Landry, who had actually worked as a shadow consultant to Jeff Wilke, Bezos’ right-hand guy. She was handpicked for Prime Now by Dave Clark, the leading retail manager, after she developed a subscription program tailored towards expectant moms that impressed management.

Prime Now was likewise unprofitable, however the group showed it might make shipments with increasing performance, and Amazon executives were positive it might scale, 2 previous Prime Now workers stated.

By 2016, Prime Now was offered in lots of cities throughout the nation, and was getting in Fresh’s grass, including fresh food to its shipment choices and surpassing Target- like items such as hair shampoo and paper towels, a previous Prime Now worker stated.

Two previous workers explained it as a business competition, and conversations started about whether the groups must continue along their different methods.

With Prime Now and Fresh both in requirement of continuing capital and Whole Foods unexpectedly contributed to the mix, the bake-off taken place in between Landry andHartman

Landry’s side won. Prime Now, which was simply 3 years of ages at the time, took control of control ofFresh Hartman, who began at Amazon as an item supervisor in 2002, left groceries for a function in the European customer organization.

Stephenie Landry, VP of grocery at Amazon, presents in a stacking island filled with orders from consumers making last minute vacation purchases, WednesdayDec 21, 2016, at a circulation center in New York.

Bebeto Matthews|AP

Landry, who maintained the title vice president of grocery, kept the Fresh branding since it appeared to resonate much better with customers than Prime Now, according to individuals with understanding of the matter. Fresh was plainly related to groceries, while Prime Now might be quickly puzzled with Amazon’s Prime membership service.

Amazon terminated the Prime Now app and site in 2015, bringing all online grocery orders under Fresh or Whole Foods.

The competition stayed as the combined groups had a hard time to collaborate. One previous Prime Now worker stated the Fresh group was demoralized and dissatisfied about being brought under Landry’s management.

Meshing Amazon’s online and in-person method is showing to be an even larger difficulty.

The high end grocery gamble

Prior to 2017, Amazon had actually currently moved into brick-and-mortar retail with book shops and pop-up shopping center kiosks, however Whole Foods was its very first genuine venture into devoted supermarket.

Whole Foods likewise represented a chance for Amazon to display its items and innovation, producing the very best mix of e-commerce and in-person shopping. It sounded fantastic in theory. In practice, Amazon dealt with significant cultural and combination difficulties.

Founded in 1980 in Austin, Texas, Whole Foods matured a universe far from the tech centers of Seattle and SiliconValley The business delighted in the regional experience. Regional supervisors had a level of autonomy over their shops, down to the artists they worked with to highlight blackboard indications, according to a previous Whole Foods senior supervisor.

Amazon had its own concepts. Immediately after the offer closed, it concentrated on including Prime Now’s fast shipments to the Whole Foods menu to reach a brand-new set of consumers.

Prime Now ultimately made it into Whole Foods shops across the country. But along the method, Amazon found the shop designs made it tough to effectively choose and process orders, a previous Prime Now worker stated.

Employees prepare orders for shipping atAmazon com Inc.’s Amazon Prime Now satisfaction center in Singapore, on Thursday, July 27, 2017.

Ore Huiying|Bloomberg|Getty Images

So instead of counting on Whole Foods, Amazon checked out producing a brand-new grocery chain that integrated lessons from Whole Foods with Amazon’s logistics competence, property footprint and Prime Now storage facilities, which put restricted stock near consumers.

Steve Kessel, a longtime Amazon executive who had actually constructed the initial Kindle prior to taking control of physical shops, envisaged a grocery store where grocery shipment and pickup didn’t hinder in-store shopping. Consumers might check out the shop and still be happy, while areas of the center would be devoted to shipments and curbside pickup.

Kessel selected Jeff Helbling, a previous Kindle vice president, to lead what would end up being Amazon Fresh shops.

In 2020, the very first Amazon Fresh opened in the upscale Los Angeles community of WoodlandHills It included a mix of grocery store staples and ready foods, along with meats and seafood. In a different location, customers might return Amazon orders or purchase Fire tablets.

Amazon Fresh grocery stores now number more than 20 throughout 6 states and Washington, D.C. Many remain in structures previously inhabited by local grocery stores, such as Fairway Market and Giant Food.

In less than 2 years, the shops have actually currently shown they can be far more effective than their competitors in business.

An approximately 35,000- square-foot grocery store generally can meet approximately 120 to 150 online orders a day. Jordan Berke, CEO of Tomorrow Retail Consulting, stated Amazon Fresh shops can dealing with order volume that’s 3 to 5 times greater at the time of launch. He stated those figures are based upon conversations with business workers.

In addition to the helpful shop style, Berke stated that Fresh shops likewise see more online need since of the Prime customer base.

They seem a struck with customers. Traffic at 8 Fresh shops stayed constant in between March, around the time they opened, and September, according to a report released in October by retail analytics companyPlacer ai.

“The relative steadiness in visits shows that a core group of customers have added a trip to Amazon Fresh to their regular grocery routine, indicating that Amazon Fresh has successfully integrated into the grocery mix for the neighborhoods it entered,” the company composed.

But management has actually remained in flux. Kessel revealed his departure in late 2019, a relocation that was deemed a significant shakeup, individuals knowledgeable about the matter stated. Cameron Janes, who had actually been vice president of physical retail, left in November.

Amazon didn’t formally change Kessel up until this month, when Tony Hoggett, a veteran of British grocery store chain Tesco, was induced to lead physical shops. Hoggett’s hiring was viewed as a recommendation by some workers that the business required more brick-and-mortar experience.

Landry reports to Hoggett, an indication of Amazon’s concentrate on the growth of physical shops.

Go shops not a blockbuster

Grocery shops and shipments are all part of what Amazon calls F3, or Fresh FoodFast

There’s one piece of its grocery portfolio that’s orphaned from that group: Amazon Go.

In 2012, Kessel tapped 2 Amazon retail veterans, Gianna Puerini and Dilip Kumar, to spearhead a top-secret task that would develop into an effort to automate the corner store, getting rid of the trouble of waiting in lines.

Puerini and Kumar’s group established a cashier-free shop, loaded with cams and sensing units that utilize expert system to determine and track sandwiches, yogurt and chips selected off the racks.

The initially Amazon Go opened to the general public in 2018 at the business’s Seattle head office.

After more than a year in beta, Amazon opened their cashier-less supermarket to the general public

Stephen Brashear|Getty Images

Four years later on there are 24 shops, a portion of the 3,000 the business was seeking to open by 2021, according to a Bloomberg report after the preliminary launch.

They’re greatly focused in thick, metropolitan locations, which are perfect places for hectic workplace employees throughout the lunch break rush. But when workplaces closed their doors throughout the coronavirus pandemic and cities entered into lockdown, traffic vanished and Amazon tempered its growth efforts.

Last month, the business revealed strategies to open its very first Go shop in the residential areas, in the town of Mill Creek, Washington, about 30 minutes north of Seattle.

Former Amazon workers stated the total grocery method has actually moved even more in the instructions of larger shops and far from Go marts.

The Go department has actually ended up being more of a tech incubator. Its Just Walk Out innovation is being evaluated at some Fresh places, Whole Foods shops and full-size Go Grocery shops, which have actually considering that been rebranded under the Fresh label.

Last month, Business Insider reported that Amazon has actually thought about offering gas at Go corner store, in addition to lottery game tickets and pharmaceuticals. The business has actually apparently acknowledged that offering fuel might bring dangers, consisting of a possible dispute with its different environment efforts.

The future of Go is cloudy. Removed from the grocery department, Go falls under the physical shops system, handled by Kumar, a previous Go worker stated. Kumar reports to Hoggett, while Puerini has actually considering that retired from the business.

The Go system consists of other kinds of Amazon merchants such as the 4-star shops and book shops, however likewise supervises advancement of the Just Walk Out innovation and other items such as the Amazon One contactless payment system.

“It’s just a bunch of shots on goal trying to figure it out,” stated Scott Jacobson, a handling director at Madrona Venture Group in Seattle and a previous Amazon worker who assisted introduce theKindle “It’s not clear what the future is yet.”

Just a novelty?

Go at first was kept different from the grocery department since the focus was more on the innovation it was developing, the previous Go worker stated.

But as Go’s operations broaden, they begin to trespass on Amazon’s other grocery possessions, possibly producing the type of internal competitors that the 2017 bake-off was expected to fix.

What’s clear to individuals inside the grocery organization is that the financial investment and skill focus is onFresh However, the method stays complicated. Whole Foods has more than 500 shops across the country. Amazon Fresh has actually opened 38 shops in the U.S. and U.K. in less than 2 years. And there are 2 lots Go corner store.

Jacobson stated that, unlike its e-commerce and cloud, Amazon’s grocery organization is a novelty that hasn’t developed any genuine distinction in grocery to separate it from the lots of rivals.

“The problem with a novelty is if it’s not fundamentally more valuable, then that’s all it is — a novelty,” Jacobson stated.

Investors have not loudly questioned the procedure yet, however the macro environment is altering. Money supervisors have actually been turning out of tech on inflation and rate of interest issues, sending out Amazon’s stock in January to its worst regular monthly drop considering that2018 According to a Wall Street Journal report today, billionaire activist financier Dan Loeb, who’s been contributing to his Amazon holdings, informed financiers on a personal call that he sees about $1 trillion in untapped worth at the business.

Like Bezos prior to him, Jassy prevents the quarterly incomes calls, so it was left as much as fund chief Brian Olsavsky to upgrade financiers after fourth-quarter outcomes previously this month.

Groceries weren’t a huge subject, however an expert did ask Olsavsky about same-day shipment and how the business’s financial investments are settling.

“We feel good about where we are,” Olsavsky stated. With regard to attempting to provide groceries in one to 2 hours and Prime plans in one to 2 days, he stated, “We’re continuing to build capacity that enables us to hit those cutoffs.”

— CNBC’s Nate Rattner added to this story.

SEE: Cloud computing and marketing balance out downturn in e-commerce