We anticipate to breakeven by 2025, states Xpeng’s president

Chinese electrical vehicle business Xpeng’s shipment exceeded 40,000 units in the 3rd quarter of2023 Subsequently, the car manufacturer forecasts that car shipments will rise to in between 59,500 and 63,500 in the 4th quarter.

“The earnings we announced actually has shown very encouraging signs of renewed growth for the company … with further growth expected for the current fourth quarter,” Brian Gu, vice chairman and president of Xpeng informed CNBC’s “Street Signs Asia.”

He included that Xpeng has actually seen “meaningful profit margin improvement starting the fourth quarter,” hence expecting a favorable margin and more powerful capital moving forward.

Gu likewise anticipates Xpeng to enhance its success and breakeven by 2025.

— Quek Jie Ann

Oil costs little bit altered on Friday, set for 4th week of falls

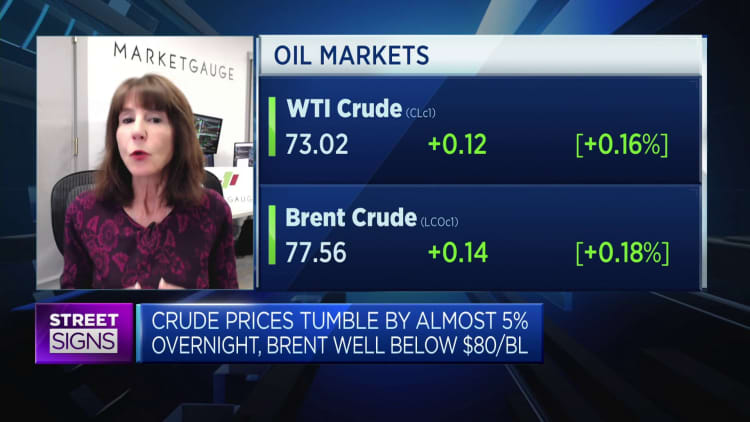

Oil costs were little bit altered on Friday however were set for the 4th straight week of decreases after striking 4 month-lows in the previous session.

The cost of U.S. petroleum fell 5% on Thursday as stocks increased while slowing commercial activity raised issues about subsiding need.

The West Texas Intermediate inched 0.14% greater at $73 a barrel in Asia trading hours, while the Brent acquired 0.11%, to $7754 a barrel.

U.S. crude and the worldwide criteria both traded at their most affordable level because early July on Thursday.

“The shift lower was likely driven initially by oversupply concerns,” Commonwealth Bank of Australia experts composed in a note. “Demand concerns added to oversupply narrative, particularly with U.S. continuing jobless claims rising to the highest level in almost two years.”

— Shreyashi Sanyal

Philippine peso enhances to 3-month high after reserve bank leaves rate the same

The Philippine peso edged 0.14% greater versus the U.S. dollar in early afternoon trading on Friday.

The peso traded at 55.620 per dollar, reinforcing to its greatest level because early August a day after the Bangko Sentral ng Pilipinas held rates of interest at 6.5%, as anticipated.

The reserve bank likewise signified that the nation’s inflation outlook is steadying, however alerted that it might raise rates of interest if costs increase.

“BSP maintained a hawkish stance and remains prepared to resume tightening if necessary,” Tommy Wu, senior financial expert at Commerzbank, composed in a customer note.

“All in all, with the balance of risks to the inflation outlook tilted to the upside, BSP would have to maintain its hawkish stance to keep inflation expectations anchored.”

— Shreyashi Sanyal

Alibaba shares plunge 9% to a 12- month low after ditching cloud spinoff strategies

Signage at the Alibaba Group HoldingLtd workplaces in Beijing, China, on Wednesday, March 29,2023 Alibaba’s overhaul might work as a design template for a restructuring of China Tech itself: a shake-up that attains Beijings goal of sculpting up the nations tech titans while opening possibly billions of dollars in suppressed investor worth.

Bloomberg|Bloomberg|Getty Images

Shares of Alibaba plunged 9% in early Hong Kong trading on Friday after the Chinese e-commerce giant stated it would not continue with the complete spinoff of its cloud group due to U.S. chip export constraints.

Alibaba shares was up to their most affordable level because late November in 2015, last trading at about 73 Hong Kong dollars. Hong Kong- noted shares of the business have actually tipped over 13% because the start of the year, underperforming the primary Hang Seng index’s 11.2% YTD decrease.

The business reported quarterly incomes on Thursday, with earnings of 27.7 billion yuan ($ 3.8 billion) for the September quarter, listed below the 29.7 billion yuan anticipated by experts.

Revenue satisfied expectations at 224.79 billion yuan, up 9% year over year.

Alibaba likewise revealed it will provide its first-ever yearly money dividend in2023 Dividends are a method of sharing a part of earnings made by business with their investors.

The business’s board authorized a yearly $0.125 per common share or $1 per American depositary share money dividend for the .

— Shreyashi Sanyal, Ryan Browne

CNBC Pro: Time to purchase Siemens and He lloFresh after huge share cost relocations? Here’s what experts state

Singapore’s non-oil domestic exports depression at slowest speed in a year

The Merlion statue in Singapore, on Tuesday,Jan 3,2023 Photographer: Lionel Ng/Bloomberg through Getty Images

Lionel Ng|Bloomberg|Getty Images

Singapore’s non-oil domestic exports continued to plunge in October however at its slowest speed in one year, federal government information revealed.

Singapore’s NODX fell 3.4% last month, down for the 13 th straight month. It was likewise the tiniest decrease because October 2022.

The decrease in October was generally driven by a downturn in exports of both electronic devices and non-electronics in crucial markets like Taiwan, U.S. and South Korea.

Last month’s reading still revealed an alleviating from the 13.2% contraction seen in September.

— Shreyashi Sanyal

CNBC Pro: Morgan Stanley’s expert simply struck a careful tone onAlphabet Here’s why

Google moms and dad Alphabet has actually been amongst the so-called “Magnificent Seven” stocks that financiers have actually been taking a look at positively this year– however one expert has some appointments.

Morgan Stanley is obese on the stock, however equity expert Brian Nowak struck a careful tone when talking with CNBC, particularly when compared to Meta and Amazon.

It follows the bank cut its cost target on Alphabet from $155 to $150, offering it upside of 11.4% from its close onNov 15.

CNBC Pro customers can learn more here.

— Amala Balakrishner

Dow closes lower

The Dow Jones Industrial Average closed lower on Thursday, although all 3 significant indices notched weekly gains.

The 30- stock index moved 46 points, or 0.13%, to close at 34,94557 The S&P 500 included 0.12% to end up the session at 4,50824, while the Nasdaq Composite climbed up 0.07% to 14,11367

— Lisa Kailai Han

U.S.-China relations will still be specified by ‘competitive fight,’ experts state after Biden-Xi conference

Wednesday’s high-stakes Biden-Xi conference left experts with minor peace of mind that both nations like developing a line of interaction— however likewise kept the belief that U.S.-China relations will stay competitive.

“We think the meeting shows the intention from both sides to restore bilateral relations. This could help reduce near-term risk of escalatory confrontation,” Morgan Stanley expert Robin Xing composed in a Thursday note. “But ‘competitive confrontation’ will likely remain for now, which does not mean a complete decoupling, but instead continued tech competition and de-risking away from China.”

This likewise shows an ongoing decrease in direct foreign financial investment and innovation spillover to China, Xing stated, which might weigh on China’s long-lasting development outlook. Moving forward, the expert thinks that additional stimulus and reforms in China are required to assist support market self-confidence in the nation.

“As China risks tripping into a debt-deflation loop, we think more growth opportunities are needed to retain foreign investors, together with efforts to diversify the supply chain and strengthen its economic relations with other key trading partners,” Xing stated.

According to Piper Sandler expert Andy Laperriere, the financial and geopolitical relationships in between the U.S. and China will stay secured competitors. Both nations remain in a “cold war,” he stated, anticipating the U.S. to preserve its tariffs on Chinese imports and even more tighten up constraints on what China can purchase and how U.S. organizations can buy China.

— Pia Singh

Softer inflation information does not suggest excellent news right now for markets, states BTIG

November’s red-hot stock rally indicates that some financiers think that the Federal Reserve might manage a soft landing. But BTIG expert Jonathan Krinsky isn’t as fast to leap to the conclusion.

“Bulls will cite the inflation data and resilience of cap-weighted indices as signs that a ‘soft-landing’ is here. Bears will cite slowing macro data, company-specific commentary, and persistent weakness of the average stock as signs that a ‘hard landing’ is on the horizon,” the expert composed. “We continue to find ourselves in the latter camp, and today’s data and price action are certainly not doing much to dissuade us from that view.”

Historical performance history likewise reveal a comparable pattern of rallies prior to an economic crisis, Krinsky kept in mind.

“If we look at all recessions ex-Covid over the last 50 years (’07, ’01, ’90, ’80-’82, and ’74), the common trait was there was a period where rates were falling and stocks were rallying. Ultimately as the reality of the recession set in, stocks began to fall,” he stated.

The expert included that the greatest inform for an economic crisis will be any indication of “meaningful weakness” from mega-cap tech stocks, integrated with lower rates.

— Lisa Kailai Han

U.S. petroleum dives as supply increases amidst need concerns

The cost of U.S. petroleum fell 5% on Thursday, as stocks increased while slowing commercial activity raised issues about softening demadn.

The West Texas Intermediate December agreement fell $3.76, or 4.9%, to settle at $7290 a barrel, while the Brent January agreement toppled $3.81, or 4.69%, to $7737 a barrel. U.S. crude and the worldwide criteria were both trading at their most affordable level because early July.

U.S. unrefined stock increased by 3.6 million barrels today, while the Federal Reserve reported that commercial production and production decreased inOctober

— Spencer KImball