Japan’s Nikkei 225 has actually been the leading entertainer this year, amongst big economy stock indexes in Asia and lots of think that stocks in the area have more space to run in 2024.

Marco Bottigelli|Moment|Getty Images

Asia-Pacific markets increased to brand-new highs in 2023, with Japan’s Nikkei 225 becoming the top-performing equity index. The area is anticipated to continue its great face the next year also.

So, which markets will exceed in 2024?

According to experts that talked to CNBC, Asia-Pacific’s top-performing markets in the very first half of 2024 will be India, Japan and Vietnam– here’s why.

1. India

India’s stock exchange became among the area’s preferred in 2015 and financiers are bullish on the nation’s long-lasting potential customers.

The standard Nifty 50 index acquired 20% in 2023, and struck a string of record-highs.

India’s financial development is anticipated to outmatch other significant Asian economies in 2024, with the International Monetary Fund predicting the nation’s genuine GDP to broaden by 6.3% this year, the exact same rate as is anticipated for 2023.

India’s development potential customers have actually been an effective chauffeur for its stocks at a time when its next-door neighbor and the area’s most significant economy, China, was seen having a hard time to satisfy its target of 5% GDP development for 2023.

Indian stock exchange have actually likewise gained from strong profits, impending rate of interest cuts and higher involvement from domestic financiers. All of which are anticipated to bring the Nifty 50’s record rally into the next year.

The wildcard for 2024 will be the nation’s basic elections. Strategists from J.P. Morgan stated in a note that they see the Nifty 50 striking 25,000 next year, if the judgment nationalist Bharatiya Janata Party maintains power.

The target of 25,000 represents a more than 15% upside from the index’s last close of 21,710

However, JPM cautioned that “if the general election results are unexpected, along with a global recession, geopolitical tensions, higher oil prices, or higher domestic unemployment,” the Nifty might be up to 16,000

2. Japan

Japan’s Nikkei 225 was the leading carrying out stock index in Asia in 2015, and experts think the nation’s equity markets have more space to run in 2024.

The rally in Japan stocks saw the the blue-chip Nikkei 225 getting 28% in 2015 and the wider Topix ending 25% greater.

Japanese stocks were improved by strong profits and growing hopes that the Bank of Japan might lastly end its ultra simple financial policy after years of near-zero rates of interest.

Masashi Akutsu, a strategist at BofA Global Research stated he anticipates the rally in Japan markets to continue well into 2024, likewise keeping in mind an increase in foreign financial investments.

Strategists at BofA see the Nikkei 225 touching 37,500 by the end of2024 The index presently trades at around 33,46417

Akutsu stated innovation and banks were BofA’s leading choices for next year, as the sectors cancel a portfolio with both development and value-focused stocks, at a time when markets anticipate the Bank of Japan to end its ultra-loose financial policy.

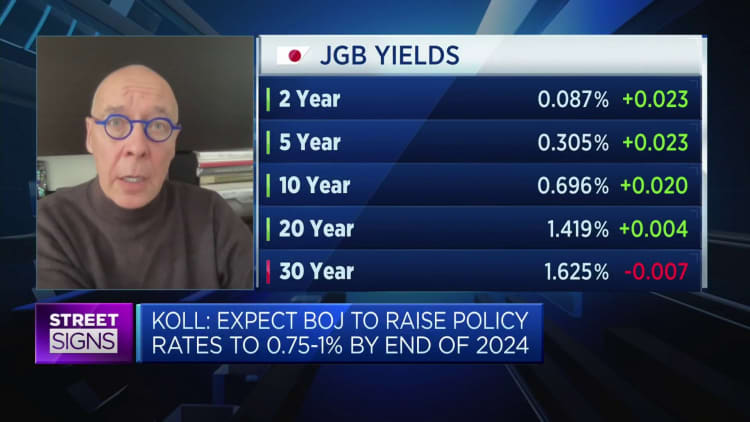

The BOJ’s concluded its last conference of 2023 leaving rates of interest within the unfavorable area at -0.1%, while adhering to its yield curve control policy that keeps the ceiling for 10- year Japanese federal government bond yield at 1% as a referral.

A slowing economy and cooling inflation, nevertheless, might impersonate a possible difficulty for the BOJ when it pertains to relaxing its ultra-easy position. Investors will likewise acutely wait for the yearly spring wage settlements next year to verify a pattern of any significant boosts to salaries.

3. Vietnam

Just like India and Japan, Vietnam has actually taken advantage of the “China plus one” technique with business diversifying financial investments to help in reducing their dependence on China.

The nation anticipates to see a 6% to 6.5% GDP development in 2024 on the back of robust imports and exports, in addition to more powerful production activity.

The optimism in the Vietnamese market has actually likewise resulted in a more than 14% rise in foreign direct financial investments in 2015 compared to 2022.

According to LSEG information, $29 billion in foreign direct financial investments were promised to Vietnam from January to November in 2015.

China represent half of the brand-new FDI inflows into Vietnam this year, showing the beauty of the Southeast Asian country as an increasing production center, Yun Liu, ASEAN economic expert at HSBC stated.

Now is the correct time for financiers to get in Vietnam stocks, Andy Ho, primary financial investment officer of VinaCapital Group stated.

“Over the next 6 to 12 months, Vietnam will be a good market as valuations are inexpensive at about 11 to 12 times earnings for 2023. That’s about a 20% to 25% discount to the regional average,” Ho informed CNBC.

“The average daily trading volume in Vietnam has gone from $500 million a year ago to about a billion dollars daily today,” he stated, elaborating that financial investment chances can be discovered in usage, health care and realty sectors.

“People are beginning to recognize that when they have a lot of liquidity, they don’t want to put it in the bank because the interest rates now becoming uninteresting, and then looking at other options to invest.”

An employee scans and checks a product on the racks of aTiki vn storage facility in Ho Chi Minh City, Vietnam, on May 24, 2021.

Yen Duong|Bloomberg|Getty Images

Investors ought to likewise be bullish on Vietnam’s e-commerce sector, Tyler Nguyen, vice-president and head of institutional equity sales at Maybank Securities Vietnam stated.

“We are seeing 20-30% year-on-year growth every year,” he informed CNBC, mentioning that e-commerce represent just 2-3% of retail sales.

When inquired about Vietnam’s possible entry into MSCI’s list of emerging market economies, Nguyen stated the frontier economy was still “at a very nascent stage” however “we might see good news in 2025.”

Is China still worth a play?

Chinese customer self-confidence has actually not recuperated from the pandemic due to high youth joblessness, financial obligation threats, and a risky residential or commercial property sector, triggering usage routines to end up being more “rational,” Jefferies stated in a note.

Although pessimism in the Chinese market is not likely to dissipate quickly, experts state there are still intense areas.

Jefferies anticipates sales development to stabilize next year and has actually encouraged financiers to take a look at usage sub-sectors such as beer and sportswear. Maybank likewise chooses the customer sector, besides China’s “new economy” section.

Jefferies is likewise bullish on China’s health care sector, advising financiers to “cherry-pick” stocks that are poised to see better-than-expected development and margin growth.