Commercial realty beginning to see the effects of high interest rate, Buffett states

Berkshire Hathaway has actually never ever been extremely active in business realty, however the “hollowing out of the downtowns in the United States and elsewhere in the world is going to be quite significant and quite unpleasant,” Munger stated.

Buffett stated the business realty market price generally depends upon just how much you can obtain non-recourse, and it’s beginning to see the effects of that.

“That’s the attitude of most people that have become big in the real estate business and it does mean the lenders are the ones that get the property,” Buffett stated. “And of course they don’t want the property… the bank tends to extend and pretend.”

“It all has consequences,” he included. “We are starting to see the consequences of people who could borrow at 2.5% and find out it doesn’t work at current rates, and they hand it back to somebody that gave them all the money they needed to build it.”

— Tanaya Macheel

Opportunity in worth investing originates from others doing ‘dumb things,’ Buffett states

Buffett stated financiers particularly concentrated on worth get chances when others make bad choices.

“What gives you opportunities is other people doing dumb things,” he stated.

Still, Munger stated worth financiers need to be comfy earning less due to the fact that there’s more competitors.

— Alex Harring

Charlie Munger anticipates ‘old made intelligence works quite well’ over AI

Billionaire financier Charlie Munger revealed hesitation in action to an investor concern on the future of expert system– though he confesses will quickly change numerous markets.

“We’re going to see a lot more robotics in the world,” Munger stated. “I’m personally skeptical of some of the hype in AI. I think old fashioned intelligence works pretty well.”

Warren Buffett shared his view. While he anticipates AI will “change everything in the world,” he does not believe it will defeat human intelligence.

— Sarah Min

Buffett: Not totally backstopping stopped working Silicon Valley Bank ‘would’ve been disastrous’

Buffett stated the regulators’ choice to backstop all depositors after Silicon Valley Bank stopped working needed to be done, as refraining from doing so might injure the worldwide monetary system.

“It would’ve been catastrophic,” Buffett stated in action to a concern asking what the financial effects would remain in the U.S. if all depositors were not made whole.

While he kept in mind the Federal Deposit Insurance Corporation has a $250,000 limitation on guaranteeing deposits, that’s “not the way the U.S. is going to behave.” He stated no one would wish to be the one describing why the limitation wasn’t broadened thinking about refraining from doing so might trigger a work on more banks and interrupt the worldwide monetary system.

“I think it was inevitable,” he stated.

— Alex Harring

Ajit Jain states Geico is ‘taking the bull by the horns’ to enhance telematics

Ajit Jain, Berkshire’s vice chairman of insurance coverage operations, stated automobile insurance company Geico is “taking the bull by the horns” to enhance using telematics.

Telematics programs enable insurance companies to gather customers’ driving information, including their mileage and speed, to assist rate policies.

Geico has actually been losing market share to Progressive recently as it didn’t accept innovation as rapidly as its rival. Jain formerly stated Geico began integrating telematics 2 to 3 years back, while Progressive has actually been on the bandwagon for near to 20 years.

Jain stated Saturday that Geico is “still a work in progress” although it published a huge underwriting revenue of $700 million in the very first quarter after suffering high underwriting losses for 2022.

— Yun Li

Warren Buffett was a net seller of stocks in Q1

Buffett stated he was a net seller of stocks in the very first quarter. Berkshire offered $132 billion worth of stocks, purchasing just $2.8 billion, according to its incomes report.

— Yun Li

‘We’ve got our own ‘King Charles’ here today,’ Buffett states presenting Charles Munger

As Buffett took the phase Saturday, he referenced the crowning of King Charles III taking place in England hours previously, as he presented his long time partner, Charlie Munger, to the crowd.

“When I woke up this morning, I realized that we had a competitive broadcast going out somewhere in the U.K.,” Buffett stated. “They were celebrating a ‘King Charles,’ and we’ve got our own ‘King Charles’ here today.”

— Alex Harring

Buffett states A.I. most likely will not ‘inform you which stocks to purchase’

Microsoft seen on mobile with ChatGPT 4 on screen, seen in this image illustration. On 15 March 2023 in Brussels,Belgium

Jonathan Raa|Nurphoto|Getty Images

Warren Buffett stated that while AI can assist screen for stocks that fall under specific criteria, it has its constraints beyond that.

“It’s sort of weird,” he stated in an interview with NBC’s regional Omaha affiliate. “I don’t think it’s going to tell you what stocks to buy. It can tell me every stock that meets a certain criteria, or a criteria in three seconds. But it has decided limitations in some ways. You ought to see the jokes it came up with.”

Buffett included that he played with ChatGPT 3 months back when Bill Gates revealed him how it worked.

“It’s very interesting,” he continued. “It can translate the Constitution into Spanish in one second. But the computer could not tell jokes. You could tell it to make a joke about Warren and crypto. It’s read every book and seen all TV, but it couldn’t do that. I told Bill to bring it back when I can ask it, ‘How are you going to get rid of the human race?’ I want to see what it says — and pull the plug out before it does it.”

— Hakyung Kim

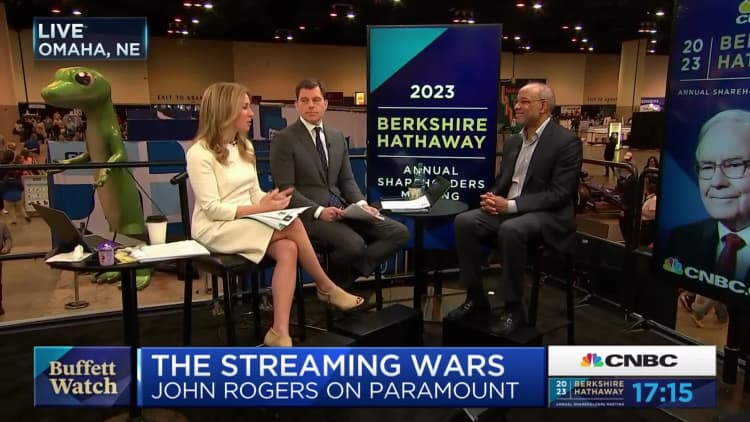

A Buffett offer would bring ‘self-confidence’ to banking sector, states Ariel Investments’ Rogers

Warren Buffett traditionally has actually existed as a source of steady capital for the monetary system when it appeared like it remained in problem. Given the existing chaos in amongst banks, it would be a huge offer if he were to appear for the sector once again, stated John Rogers, chairman and co-CEO chief financial investment officer of Ariel Investments.

“That would bring a lot of confidence to the economy and the financial system,” he stated. “Whenever he steps up – all of us believe in him so much, so I think it would be great if he was able to be helpful during this period and get a great return for Berkshire shareholders.”

“He is so revered around the world and I know that the Biden administration has been talking with him and I know other leaders are,” Rogers included. “You can bet he is the first call of many of the major banking giants on Wall Street to make sure they’re getting his best advice and including him in these conversations.”

— Tanaya Macheel

Berkshire chocolate coins and Buffett- themed clothing in the lead-up to the conference

Warren Buffett visits the premises at the Berkshire Hathaway Annual Shareholders Meeting in OmahaNebraska

David A. Grogan|CNBC

Called “Woodstock for Capitalists,” the multiday occasion began on Friday with an opportunity for investors to go shopping the business’s numerous brand names, which vary from Dairy Queen and See’s Candies to Brooks Sports and PamperedChef One of its most current additions to the portfolio, the luxurious toy brand name Squishmallows, was on vibrant screen for the very first time.

Those going to the significance typically leap at the possibility to scoop up products made particularly for the occasion.

-Christina Cheddar Berk

Buffett asks starlet Jamie Lee Curtis to persuade Munger to grab web stocks

Warren Buffett and Charlie Munger welcomed participants with a welcome video starring an unique visitor– Jamie Lee Curtis.

Buffett asked the starlet to persuade Munger to grab stocks in “this something called the Internet.”

The starlet made flirty remarks while calling both independently from her bed, passionately describing Buffett as “Warren all-you-can-eat buffet,” and Munger as “Charlie hunger.”

— Sarah Min

Buffett’s long-lasting performance history: Why there are smiling faces in Omaha Saturday

Warren Buffett visits the flooring ahead of the Berkshire Hathaway Annual Shareholder’s Meeting in Omaha, NE.

David A. Grogan|CNBC

A take a look at Warren Buffett’s long-lasting performance history describes the smiling faces in Omaha Saturday, a lot of them were made millionaires by the investing expert’s astute relocations and client worth approach throughout the years.

Berkshire Hathaway’s intensified yearly gain was 19.8% from 1965 through completion of in 2015, compared to 9.9% for the S&P500 That’s a general total return of 3,787,464% vs. 24,708% for the standard.

To make certain, more just recently Buffett’s performance history has actually matched the S&P500 Over the last 10 years, Berkshire has actually returned 11% every year, about even with the S&P 500.

Berkshire stock rate long term

Oakmark Funds’ Bill Nygren discovered this significant lesson from Warren Buffett

Everyone can find out something from Warren Buffett– consisting of Oakmark Funds’ Bill Nygren.

One practice that protrudes is the usage of adjusted GAAP accounting for non-tangible properties, the worth financier stated throughout an interview with CNBC Friday.

“I think GAAP accounting was really intended for a tangible world,” he stated. “You can touch and feel it, it goes on the balance sheet. If you can’t touch or feel it, expense it.”

But that setup isn’t “representative of the economics” that exist and the financial investments in business world for things like research study and advancement, and brand name worth.

“Those things are all on the balance sheet at zero,” Nygren stated. “If you aren’t making adjustments for that as a value investor, you’re unnecessarily restricting your universe.”

Although Oakmark Funds does not own shares of Berkshire Hathaway, Nygren called it an appealing financial investment chance for numerous.

“Berkshire rarely exhibits the level of controversy that is required to create a really attractive value stock, but it’s a great business,” he stated. “It’s extremely well run and that’s probably why it isn’t cheap enough to meet our criteria.”

— Samantha Subin

Berkshire’s automobile insurance company Geico manages a huge turn-around

Display proving Gecko character for GEICO Insurance throughout the Berkshire Hathaway Annual Shareholder Meeting in Omaha, Nebraska.

Yun Li|CNBC

Berkshire’s automobile insurance company Geico experienced a huge turn-around in the very first quarter, after gaining from greater typical premiums and a decrease in marketing expenses. Geico published an underwriting revenue of $703 million. The automobile insurance company suffered a $ 1.9 billion pretax underwriting loss in 2015 as it lost market share to rival Progressive.

Ajit Jain, Berkshire’s vice chairman of insurance coverage operations, formerly stated the greatest offender for Geico’s underperformance was not equaling competitors in telematics programs, which enable insurance companies to gather customers’ driving information, including their mileage and speed, to much better rate policies.

— Yun Li

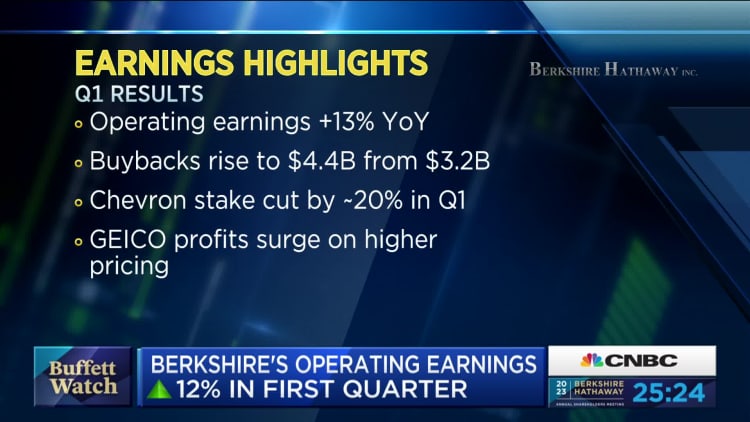

Berkshire operating incomes appear the very first quarter

Warren Buffett’s Berkshire Hathaway reported a 12.6% dive in running incomes for the very first quarter, driven by a rebound in the corporation’s insurance coverage company.

Profit from insurance coverage underwriting was available in at $911 million, up greatly from $167 million a year prior. Insurance financial investment earnings likewise leapt 68% to $1.969 billion from $1.170 billion.

Berkshire’s money stockpile likewise swelled to $130616 billion from $128 billion in the 4th quarter of 2022.

— Fred Imbert

Warren Buffett’s follower Greg Abel is winning over investors

Greg Abel, chairman of Berkshire Hathaway Energy, center, throughout an investors going shopping day ahead of the Berkshire Hathaway yearly conference in Omaha, Nebraska, U.S., on Friday, April 29, 2022.

Dan Brouillette|Bloomberg|Getty Images

Warren Buffett’s follower Greg Abel will be signing up with the Oracle of Omaha and Charlie Munger on phase Saturday, addressing concerns about non-insurance operations.

Abel has actually handled numerous obligations at the huge corporation, while increasing his stake in the business, which has actually provided investors hope that the culture at the business will continue.

“He does all the work, and I take the bows – it’s exactly what I wanted,” Buffett stated in a CNBC interview in Japan on April12 “He knows more about the individuals, the business, he’s seen them all. … They haven’t seen me at the BNSF Railroad for 10, 12 years or something like that.”

— Yun Li

NetJets pilots demonstration beyond arena, stating they’re being underpaid

A line of pilots from NetJets held a demonstration beyond CHI Health Center.

Yun Li

A variety of pilots from Berkshire’s personal jet business NetJets lined up beyond CHI Health Center as investors waited to enter the arena. They held indications that read “overworked” and “underpaid,” stating they were seeking to renegotiate their agreement. NetJets ended up being a Berkshire subsidiary in 1998.

— Yun Li

Shareholders begin lining up in downtown Omaha

Some of individuals lined up at the CHI Health Center in downtown Omaha for the Berkshire Hathaway yearly conference have actually remained in the line because 2 a.m. for the occasion.

— Sarah Min

Berkshire Hathaway has actually exceeded throughout economic downturns and bearishness, Bespoke information states

Berkshire Hathaway has a history of outshining the S&P 500 throughout economic downturns, and carrying out specifically well throughout bearishness, according to information from Bespoke InvestmentGroup Since 1980, Berkshire shares have actually beat the more comprehensive market throughout 6 economic downturns by an average of 4.41 portion points.

Even more remarkable is the stock’s efficiency throughout bearishness. During the very same period, the corporation exceeded the S&P 500 each time it dropped 20%, beating the more comprehensive index by an average of 14.89 portion points.

″[One] stock that has actually gotten a track record for security is Berkshire Hathaway (BRK/A), and based upon the last a number of years, the difference has actually been made,” checked out a Bespoke note from previously today.

— Sarah Min

What to anticipate from Warren Buffett and Charlie Munger

Charlie Munger ahead of the Berkshire Hathaway Annual Shareholders Meeting in Omaha Nebraska.

David A. Grogan|CNBC

On a cloudy Saturday early morning, crowds of Berkshire Hathaway investors are waiting in a light rain to enter the CHI Health Center in Omaha.

The economy and the marketplaces are constantly leading of mind at these occasions, however this year’s conference comes at an especially difficult time. On Monday, First Republic ended up being the 3rd American bank to stop working because March, even more sustaining worries that an economic downturn impends. As ever, financiers will want to the 92- year-old Warren Buffett for homey knowledge in unsure times.

Buffett assured in Berkshire’s investors direct to field more concerns this year. With that in mind, CNBC Pro took a look at what a few of the most important subjects are most likely to be. Questions might vary from a conversation of what kinds of acquisitions the business may make to what is Buffett’s outlook for the banking sector. What’s next for automobile insurance company Geico likewise might be level playing field.

–Yun Li

Here’s the schedule for CNBC’s protection of the Berkshire Hathaway yearly conference

Warren Buffett visits the premises at the Berkshire Hathaway Annual Shareholders Meeting in OmahaNebraska

David A. Grogan|CNBC

CNBC will be livestreaming Berkshire Hathaway’s yearly investor conference on Saturday, start at 9: 45 a.m. ET. Often called “Woodstock for Capitalists,” financiers flock to Omaha, Nebraska, to listen to Warren Buffett’s ideas on the marketplace. He typically states the numerous lessons he has actually discovered throughout his years of investing.

Here is a rundown of the day’s occasions:

9: 45 a.m. – 10: 15 a.m.: Pre- program hosted by Becky Quick and Mike Santoli

10: 15 a.m. – 1 p.m.: Berkshire Hathaway early morning Q&A session with Warren Buffett, Charlie Munger, Greg Abel and Ajit Jain

1 p.m. – 2 p.m.: Halftime program, hosted by Becky Quick and Mike Santoli

2 p.m. – 4: 30 p.m.: Afternoon session of yearly conference

4: 30 p.m. – 5 p.m.: Post- reveal anchored by Becky Quick and Mike Santoli

Note: Schedule shows Eastern Time

–Christina Cheddar Berk