Stock futures dropped Friday as the marketplace seeks to conclude a roller-coaster week with the S&P 500 headed for its worst month given that March 2020.

Futures on the Dow Jones Industrial Average lost about 340 points, or 1%, after being greater previously in the session. S&P 500 futures lost 0.9%. Nasdaq 100 futures dipped 0.8%.

The significant averages have actually experienced outsized swings every day today– consisting of the Dow comprising a more than 1,000- point intraday deficit to close greater on Monday for the very first time ever.

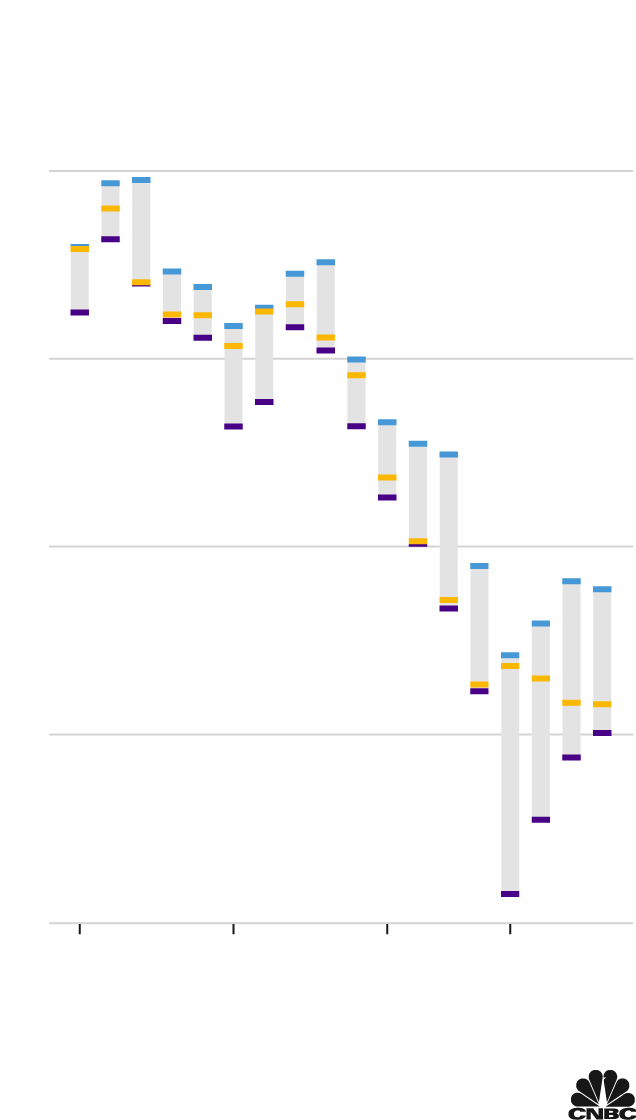

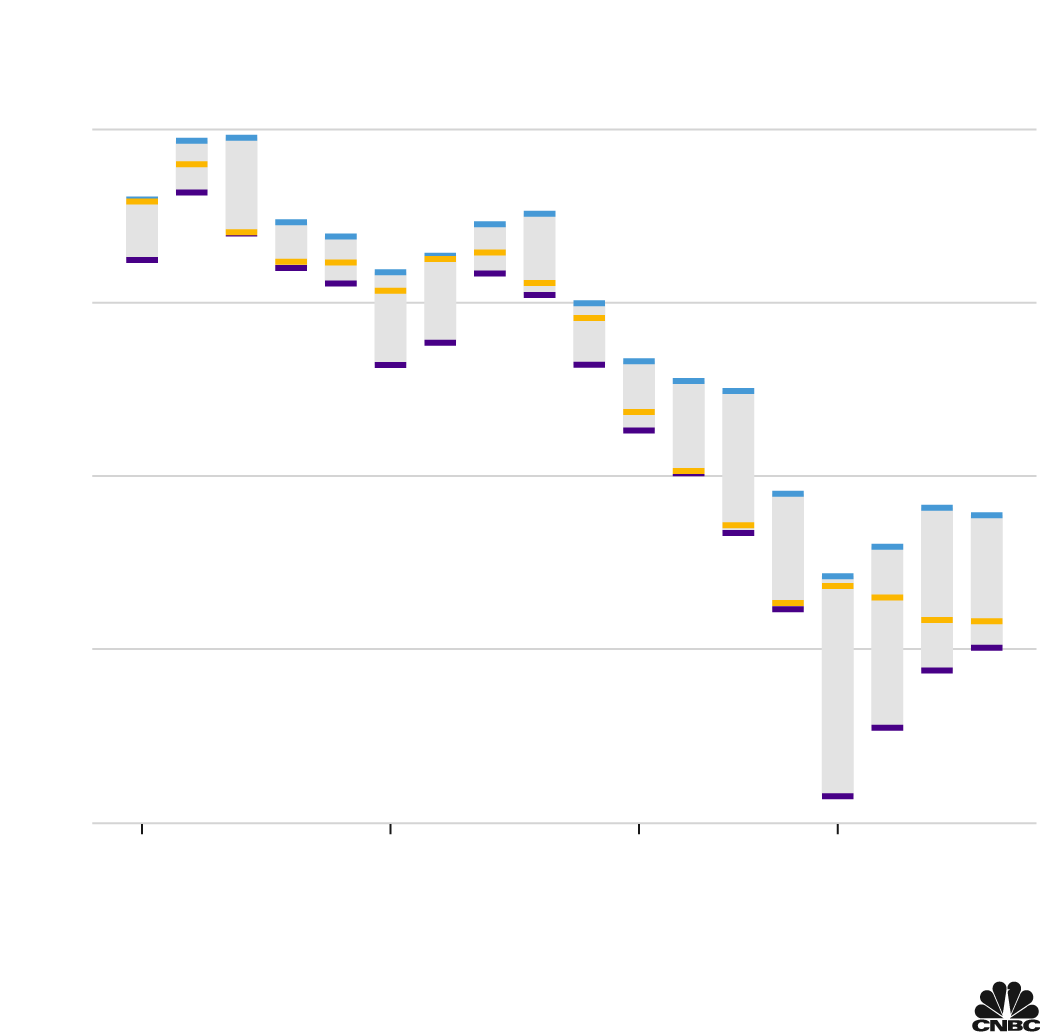

High, low, and closing levels for the Dow Jones Industrial Average

Chart: Nate Rattner/ CNBC

Source: FactSet. As ofJan 27, 2022.

High, low, and closing levels for the Dow

Jones Industrial Average

Chart: Nate Rattner/ CNBC

Source: FactSet. As ofJan 27, 2022.

High, low, and closing levels for the Dow Jones Industrial Average

Chart: Nate Rattner/ CNBC

Source: FactSet. As ofJan 27, 2022.

The Dow is down 0.3% on the week. The S&P 500 is down 1.6% week to date. Both indexes are headed for a 4th successive losing week. The Nasdaq Composite has actually dropped 3% today, on track for its straight 5th unfavorable week.

The S&P 500 completed Thursday off 9.8% from itsJan 3 record close. The Nasdaq is deep in correction area, sitting 17.6% listed below its intraday high.

With January ending Monday, the tech-heavy Nasdaq is headed for its worst month given that October 2008 and worst very first month of the year of perpetuity. The S&P 500 is on rate for its weakest month given that March 2020 and January of perpetuity. The Dow might see its worst month given that March 2020 and worst January given that 2009.

The market’s worry gauge, the Cboe Volatility Index, soared to its greatest level given that October 2020 previously today and has actually traded above 30.

Investors continued to absorb the Federal Reserve’s pivot to tighter policy.

The Fed suggested Wednesday that it likely quickly raise rate of interest for the very first time in more than 3 years as part of a wider tightening up of traditionally simple financial policy. Markets are now pricing in 5 quarter-percentage-point rate of interest walkings in 2022, though the long-range expectation for rates is bit altered.

“The FOMC meeting did not bring any surprises in terms of monetary policy, however, it may be perceived as more hawkish than expectations owing to Chair Powell’s suggestion of a need to enter a ‘steady’ phase of policy normalization,” Chris Hussey, a handling director at Goldman Sachs, stated in a note.

On Thursday, shares of Apple increased about 3% in premarket trading after the business reported its biggest single quarter in regards to earnings ever even in the middle of supply difficulties and the remaining results of the pandemic. Apple beat expert price quotes for sales in every item classification other than iPads.

Chevron shares fell approximately 3% in morning trading after missing out on Wall Street revenues expectations. Dow part Caterpillar dipped 2% in the premarket even after it topped revenue price quotes.

Investors will get a crucial financial photo today as the Commerce Department reports December’s individual usage expenses cost index, which is the Fed’s chosen inflation gauge.

Economists surveyed by Dow Jones anticipate the PCE step to reveal a 4.8% year-over-year gain leaving out food and energy, which would be the greatest reading given that September1983 The report is due out at 8: 30 a.m., the very same time the Labor Department launches the work expense index for the 4th quarter of2021 The Fed likewise sees that gauge carefully for inflation pressure, and it is anticipated to reveal a 1.2% quarterly gain.