Traders deal with the flooring of the New York Stock Exchange throughout early morning trading on February 29, 2024 in New YorkCity

Michael M. Santiago|Getty Images

A brand-new day, a brand-new all-time high. From stocks to bitcoin, possession classes throughout the board have actually been striking uncharted areas.

Why?

There are a couple of factors at play.

Unabating expert system buzz, hopes that international rates of interest might fall, and more particular to the crypto area: bitcoin ETF approvals.

An intense rally in tech stocks powered the Nasdaq 100 to a fresh record and assisted the S&P 500 surface above the 5,000 mark for the very first time ever recently. AI euphoria has actually likewise improved private tech stocks to historical levels, with Nvidia‘s stock exchange worth smashing a $2 trillion assessment for the very first time ever.

Since those peaks nevertheless, Wall Street equities have actually drawn back as interest rate unpredictability weighs on financiers’ minds.

In Asia, Japan’s Nikkei 225 has actually echoed an eye-popping efficiency with the nation’s stock exchange index recently crossing 40,000 points onMonday That’s after the Nikkei zoomed past 1989 highs last month– with the gains mostly driven by robust revenues and business governance reforms.

Over in the alternative possession world, a mix of financiers putting cash into U.S. area exchange-traded crypto items, and bitcoin’s upcoming cutting in half occasion turbo charged the world’s biggest cryptocurrency above $69,000– a rate level not seen in more than 2 years.

Stellar costs for gold have actually likewise taken financier attention, with the rare-earth element scaling a brand-new record of over $2,100 The gains have actually been sustained by U.S. rate cut expectations and China financial concerns, with gold generally rallying in times of financial tension.

The record-breaking numbers for markets, nevertheless, have not stopped some financiers from fretting about 3 crucial concerns.

Inflation renewal

After months of cooling, U.S inflation is showing itself to be more persistent than specialists had actually anticipated.

Nobel laureate Paul Krugman flagged inflationary pressures in the U.S. in a recent post on X, where he constructed on Moody’s financial expert Mark Zandi’s ideas over a boost in core PCE (individual intake expenses) deflator numbers.

“Business surveys keep failing to show an inflation surge. Those January numbers look like a blip ‘juiced by problematic seasonals’, as Mark Zandi puts it,” Krugman stated.

Economist Nouriel Roubini, typically called “Dr. Doom,” likewise chimed in on the subject, stating a Trump reelection might spell problem for the international economy, offered his policies might stir inflation once again and might even set off stagflation.

JPMorgan’s primary market strategist constructed on dangers of stagflation too. Marko Kolanovic alerted a “second inflation wave” might take hold, with the possibilities of the “narrative turning back from goldilocks towards something like 1970s stagflation,” he stated in a current research study note. A goldilocks economy describes a beneficial environment whether information is neither too hot or cold.

Financial instability

A data-obsessed Fed is likewise on the concern cards for monetary financiers.

Top financial expert and Allianz consultant Mohamed El-Erian stated in a Bloomberg op-ed that a Fed “held hostage” by data could trigger financial instability.

“Don’t get me wrong; high-frequency inputs are important in any assessment of economic conditions and policy responses,” El-Erian said.

“In today’s economy, an excessive focus on the numbers tips the balance of risks toward keeping interest rates too restrictive for too long, unduly increasing the probability of output loss, higher unemployment and financial instability,” he added.

El-Erian has long-been critical of the Fed, blaming it for mischaracterizing inflation as a transitory problem as well as being too late in its fight against consumer price pressures.

Speaking to CNBC, El-Erian stated if the Fed does not cut rates this year, then “the market is correct to worry about economic growth and earnings.”

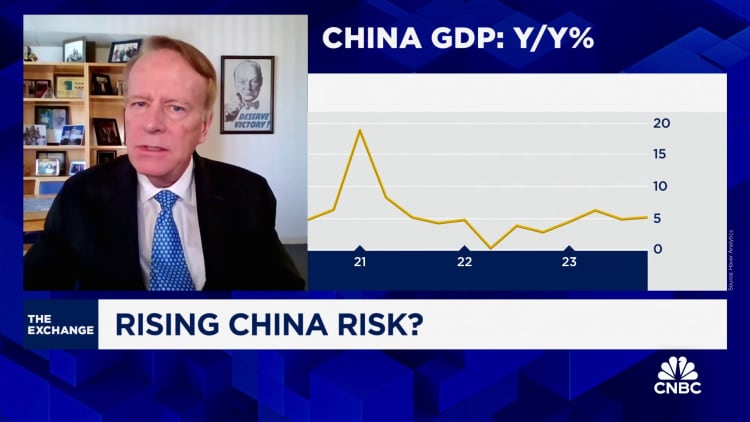

China concerns

Troubles on the planet’s second-largest economy have actually likewise grasped financiers. The nation is blistered with financial concerns, from a residential or commercial property crisis to deflationary pressures– and market watchers are fretted those concerns might overflow to the remainder of the world.

Ariel Investments’ Vice Chair Charlie Bobrinskoy informed CNBC markets are not concentrated on China’s property realty issues. “The market does understand there is a problem, but doesn’t understand the size of the problem,” he stated, talking about the causal sequences of the nation’s home market on the remainder of the world.

The car market has actually currently started seeing the impacts of a China downturn in their revenues outcomes.

Tesla along with Chinese carmaker BYD reported a 19% and almost 40% year-on-year plunge in China sales, respectively, in February.

Record highs or not, it appears market specialists can’t be swayed to the benefit right now.