Beautiful and vibrant bird’s-eye view of Mumbai horizon throughout golden seen from Currey Road, on February 16, 2022 in Mumbai, India.

Pratik Chorge|Hindustan Times|Getty Images

India’s stock exchange have actually staged record-breaking rallies this year, making the nation a preferred amongst its Asia-Pacific equivalents.

The Nifty 50 index has actually consistently notched fresh all-time highs, reaching yet another peak onTuesday The index is set for a 8th year of gains, up more than 15% year-to-date.

Optimism about India’s development potential customers, increased liquidity and higher domestic involvement have all added to the rise in stock exchange. In reality, India’s stock exchange worth has actually surpassed Hong Kong’s to end up being the seventh biggest on the planet.

As of completion of November, the overall market capitalization of the National Stock Exchange of India was $3.989 trillion versus Hong Kong’s $3.984 trillion, according to information from the World Federation of Exchanges.

Numbers from the WFE likewise revealed that India’s NSE saw more brand-new stock listings than the HKEX. India’s stock exchange had 22 brand-new listings vs. Hong Kong’s 7, since November.

Here are the 5 reasons India’s stock exchange have actually reached brand-new highs this year:

Growth potential customers

India has actually been among South Asia’s fastest growing economies, with expectations just developing for next year.

The world’s most populated nation has actually grown at a regularly strong rate this year, with the most current reading on third-quarter GDP revealing a much higher-than-expected development rate of 7.6%.

Bets on India driving development in Asia have actually likewise been increasing. S&P Global forecasted India’s GDP for the ending March 2024 hit 6.4%, more than its earlier projection of 6%.

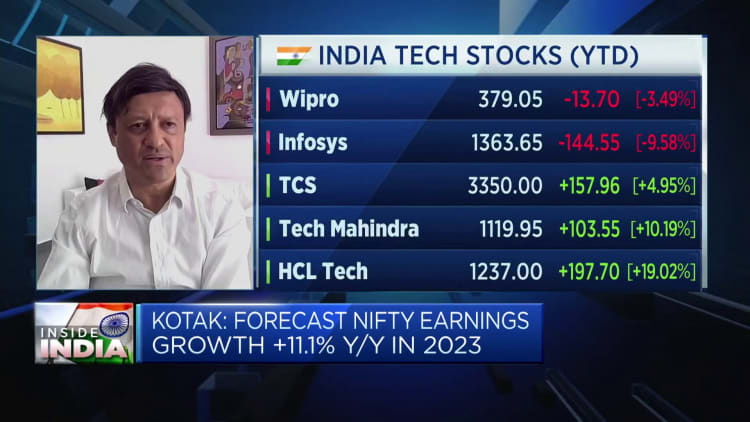

Strong incomes

The Indian stock exchange has actually likewise revealed sound principles and robust incomes, which are anticipated to grow through 2024.

HSBC projections incomes development of 17.8% for India in 2024– amongst the fastest rates inAsia Sectors such as banks, healthcare and energy, which have actually currently succeeded this year are best placed for 2024, according to HSBC.

Sectors such as vehicles, sellers, property and telecoms were likewise fairly well placed for 2024, while fast-moving durable goods, energies and chemicals are amongst those HSBC stated were undesirable.

Domestic involvement

There has actually likewise been an uptick in domestic involvement in Indian stock exchange this year, specifically in high-growth locations, according to research study by HSBC.

“While foreign investors tend to be active in large caps, it is local investors that dominate the small and mid-cap space, which partly explains the outperformance – fund flows into midcap-small schemes of domestic MFs (i.e. mutual funds with a mandate to invest in small/midcaps) have been disproportionately high,” HSBC kept in mind.

It likewise anticipates this pattern to continue into the next year.

Rate cuts are coming

The Reserve Bank of India held its primary financing rate stable at 6.5% last Friday and stated its anticipates the nation to grow at a speed of 7% this year. The reserve bank did alert that inflation, even as it continues to cool, still stays above its target as hidden rate pressures persisted.

That, nevertheless, does not indicate market gamers aren’t anticipating rate cuts next year.

“We expect the policy pause to be extended for now and expect 100bp (basis points) of cumulative rate cuts starting from August 2024,” experts at Nomura composed in a customer note.

Lower financing rates frequently improve liquidity and improve more risk-taking belief in stock exchange.

Policy connection

As India prepares for a huge election year in 2024, markets stay positive on additional policy connection.

Analysts forecast it might be another triumph for the judgment nationalist Bharatiya Janata Party, with current surveys and current state elections revealing the conservative BJP might maintain power.

“The ruling Bharatiya Janata Party (BJP) outdid its national and regional rivals at the recently held state elections. This strong run fed expectations of political stability at the upcoming general elections in April/May24, addressing earlier concerns that a weak showing at the state polls might have stoked a fiscally populist agenda in the coming months,” DBS senior financial expert Radhika Rao stated in a customer note.