A building and construction in a multifamily and single household property real estate complex is displayed in the Rancho Penasquitos area, in San Diego, California, September 19, 2023.

Mike Blake|Reuters

In theory, getting inflation closer to the Federal Reserve’s 2% target does not sound awfully tough.

The primary perpetrators relate to services and shelter expenses, with a lot of the other parts revealing obvious indications of alleviating. So targeting simply 2 locations of the economy does not appear like a huge job compared to, state, the summer season of 2022 when generally whatever was increasing.

In practice, however, it might be more difficult than it looks.

Prices in those 2 essential parts have actually shown to be stickier than food and gas or perhaps utilized and brand-new cars and trucks, all of which tend to be cyclical as they fluctuate with the ups and downs of the more comprehensive economy.

Instead, improving control of leas, treatment services and so forth might take … well, you may not wish to know.

“You need a recession,” stated Steven Blitz, primary U.S. financial expert at GlobalData TSLombard “You’re not going to magically get down to 2%.”

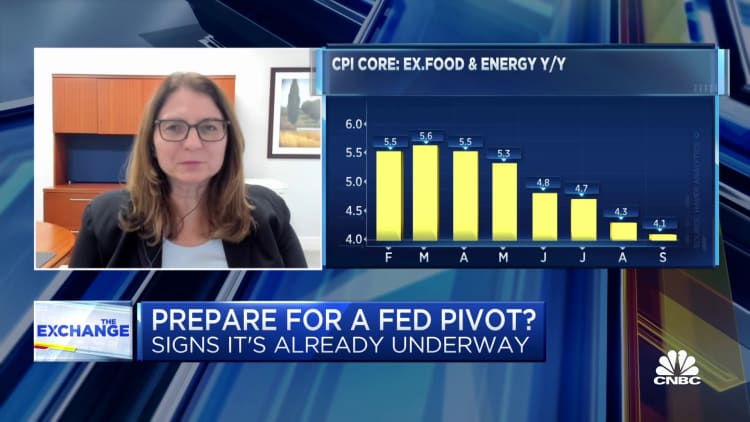

Annual inflation as determined by the customer cost index was up to 3.7% in September, or 4.1% if you toss out unstable food and energy expenses, the latter of which has actually been increasing progressively of late. While both numbers are still well ahead of the Fed’s objective, they represent development from the days when heading inflation was running north of 9%.

The CPI parts, however, informed of unequal development, assisted along by an alleviating in products such as used-vehicle rates and treatment services however obstructed by sharp boosts in shelter (7.2%) and services (5.7% leaving out energy services).

Drilling down even more, lease of shelter likewise increased 7.2%, lease of main home was up 7.4%, and owners’ comparable lease, essential figures in the CPI calculation that shows what house owners believe they might get for their homes, increased 7.1%, consisting of a 0.6% gain in September.

Without development on those fronts, there’s long shot of the Fed accomplishing its objective anytime quickly.

Uncertainty ahead

“The forces that are driving the disinflation among the various bits and micro pieces of the index eventually give way to the broader macro force, which is rising, which is above-trend growth and low unemployment,” Blitz stated. “Eventually that will prevail until a recession comes in, and that’s it, there’s nothing really much more to say than that.”

On the brilliant side, Blitz is amongst those in the agreement view that see any economic downturn being relatively shallow and brief. And on the even brighter side, numerous Wall Street economic experts, Goldman Sachs amongst them, are happening to the view that the much-anticipated economic downturn might not even occur.

In the interim, however, unpredictability rules.

“Sticky-price” inflation, a procedure of things such as leas, numerous services and insurance coverage expenses, performed at a 5.1% speed in September, down a complete portion point from May, according to the ClevelandFed Flexible CPI, consisting of food, energy, car expenses and clothing, performed at simply a 1% rate. Both represent development, however still not an objective attained.

Markets are perplexing over what the reserve bank’s next action will be: Do policymakers slap on another rate trek for great procedure before year-end, or do they merely stay with the fairly brand-new higher-for-longer script as they enjoy the inflation characteristics unfold?

“Inflation that is stuck at 3.7%, coupled with the strong September employment report, could be enough to prompt the Fed to indeed go for one more rate hike this year,” stated Lisa Sturtevant, primary financial expert for Bright MLS, a Maryland- based realty services company. “Housing is the key driver of the elevated inflation numbers.”

Higher rates of interest’ greatest effect has actually been on the real estate market in regards to sales and funding expenses. Yet rates are still raised, with issue that the high rates will hinder building of brand-new houses and keep supply constrained.

Those aspects “will only lead to higher rental prices and worsening affordability conditions in the long run,” composed Christopher Bruen, senior director of research study at the National Multifamily HousingCouncil “Rising rates threaten the strength of the broader job market and economy, which has not yet fully digested the rate hikes already enacted.”

Longer- run issues

The concept that rate boosts amounting to 5.25 portion points have yet to wind their method through the economy is one element that might keep the Fed on hold.

That, nevertheless, returns to the concept that the economy still requires to cool before the reserve bank can finish the last mile of its race to reduce inflation to the 2% target.

One favorable in the Fed’s favor is that pandemic-related aspects mainly have actually rinsed of the economy. But other aspects stick around.

“Pandemic-era effects have a natural gravitational pull and we’ve seen that take place over the course of the year,” stated Marta Norton, primary financial investment officer for the Americas at MorningstarWealth “However, bringing inflation the remainder of the distance to the 2% target requires economic cooling, no easy feat, given fiscal easing, the strength of the consumer and the general financial health in the corporate sector.”

Fed authorities anticipate the economy to slow this year, though they have actually withdrawed an earlier require a moderate economic downturn.

Policymakers have actually been relying on the concept that when existing rental leases end, they will be renegotiated at lower rates, reducing shelter inflation. However, the increasing shelter and owners’ comparable lease numbers are running counter to that believing although so-called asking lease inflation is alleviating, stated Stephen Juneau, U.S. financial expert at Bank of America.

“Therefore, we must wait for more data to see if this is just a blip or if there is something more fundamental driving the increase such as higher rent increases in larger cities offsetting softer increases in smaller cities,” Juneau stated in a note to customersThursday He included that the CPI report “is a reminder that we do not have good historic examples to lean on” for long-lasting patterns in lease inflation.