Singapore innovation ride-sharing and food shipment service business Grab logo design is shown on a smart device screen.

Budrul Chukrut|Sopa Images|Lightrocket|Getty Images

Singapore- based ride-hailing and food shipment giant Grab narrowed losses and recovered cost in its shipments sector for the very first time considering that 2012, throughout the 3rd quarter.

The business published an adjusted incomes prior to interest, taxes, devaluation and amortization loss of $161 million, a 24% enhancement from the changed EBITDA loss of $212 million in the exact same duration a year earlier. EBITDA is a procedure of success that reveals incomes prior to interest, taxes, devaluation and amortization.

Grab uses a series of services consisting of ride-hailing, food shipment, plan shipment, grocery shipment and mobile payments through Grab Pay.

The business stated its shipment organization recovered cost 3 quarters ahead of expectations, “primarily due to optimization of our incentive spend, and contributions from Jaya Grocer.” In January, Grab got a bulk stake in Malaysian mass-premium grocery store chain Jaya Grocer to accelerate its growth into grocery shipment.

Food shipments likewise reported favorable adjusted EBITDA in the 3rd quarter, 2 quarters ahead of its previous assistance.

“We achieved core food deliveries and overall deliveries segment-adjusted EBITDA breakeven ahead of guidance while narrowing our overall loss for the period significantly. We accomplished this by staying laser-focused on our cost structure and incentive,” Anthony Tan, Grab co-founder and group CEO, stated in a declaration.

U.S.-listed shares of Grab increased 0.64% to close at $3.15 a piece in Wednesday trade, surpassing the S&P 500 and Nasdaq Composite which decreased 0.83% and 1.54%, respectively.

Grab went public in December 2021 after closing its SPAC merger. The stock has actually plunged 56% year to date.

Driving towards success

Grab’s regular monthly typical active driver-partners in the quarter hit 80% of pre-Covid levels. The business likewise stated rewards decreased to 9.4% of GMV, compared to 11.4% for the exact same duration in 2015 and 10.4% for the previous quarter.

“This demonstrates our commitment to growing profitably and sustainably,” stated Tan.

Grab raised its full-year projection and now anticipates income in between $1.32 billion and $1.35 billion, up from the previous series of $1.25 billion to $1.30 billion. It likewise modified its adjusted EBITDA outlook for the 2nd half of the year and now anticipates a loss of $315 million, much better than the $380 million it formerly anticipated.

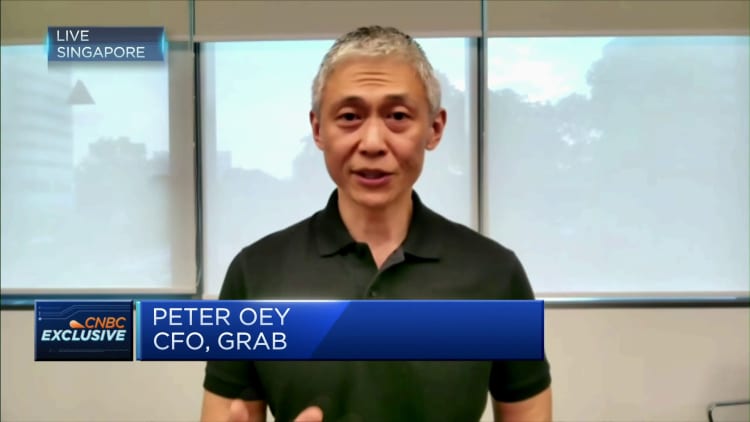

“We will aim to better optimize our cost structure by limiting discretionary spending,” Grab CFO Peter Oey stated throughout the media conference.

“We began pausing or slowing hiring in various corporate departments. We’ve also been disciplined to optimize costs in non-headcount overheads,” he included.