Carlos Barquero|Moment|Getty Images

Stock market volatility and discuss a possible economic crisis might have individuals distressed about investing.

However, that should not deter anybody from attempting to construct wealth, whether you are simply starting in your profession, are middle-aged or are nearing retirement.

“We can’t predict the future, but by thoughtful spending and saving throughout your lifespan, you can create financial peace and resiliency for whatever the world and markets throw your way,” stated qualified monetary organizer Carolyn McClanahan, an M.D. and creator and director of monetary preparation at Life Planning Partners in Jacksonville, Florida.

Of course, how you set about constructing wealth depends upon your age. Here is a decade-by-decade guide to growing your cash.

Starting out in your 20 s

The very first thing to do is make certain you have adequate money stored for an emergency situation. If your task is protected, set a cost savings objective of 3 to 6 months’ worth of expenditures. If it is insecure, such as a commission-based sales task, pursue 6 to 12 months, stated McClanahan, a member of CNBC’s Advisor Council.

You ought to likewise begin preparing for retirement. If your company has a 401( k) strategy and provides a match, contribute enough to get that match.

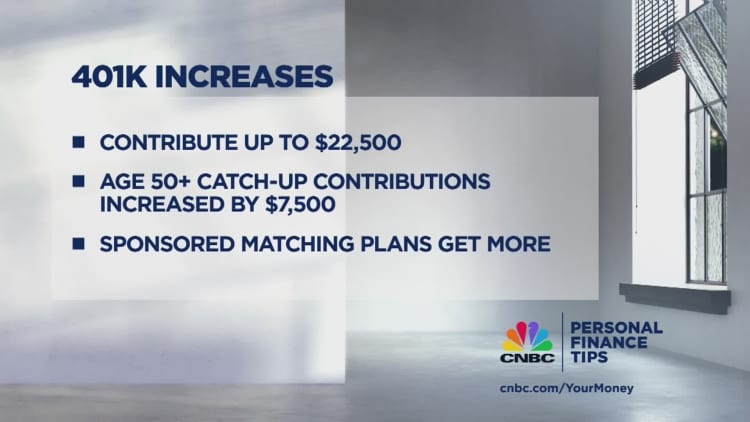

After that, open a Roth specific retirement account, if your earnings certifies, McClanahan stated. You can contribute an optimum of $6,500 in2023 Then, if you still have cash to invest after maxing out your Roth, contribute more to your 401( k) strategy, she stated. In 2023, you can put as much as $22,500 into the account.

When it pertains to the balance of your portfolio, you can have more equities than set earnings considering that you have more time to recuperate from any down markets.

In addition, make certain you are guaranteed properly, specifically with automobile and impairment insurance coverage, considering that one mishap or health problem might eliminate any cost savings you might have.

This is likewise a great time to handle a side hustle, stated Winnie Sun, co-founder and handling director of Sun Group Wealth Partners, based in Irvine, California, and a member of CNBC’s Advisor Council.

“It may not be generating a lot of income, but it is something they can create more income from,” she stated.

In your 30 s

As your profession grows and you start to make a greater wage, do not come down with the “lifestyle creep” and begin investing that newly found cash, alerted CFP Matt Aaron, creator of Washington, D.C.-based Lux Wealth Planning, an affiliate of Northwestern Mutual.

Instead, put that money into your 401( k) strategy.

The general rule is to put aside about 10% of your earnings, if you begin young, however a monetary expert can assist you exercise the numbers, he stated.

After you max out those contributions, begin investing beyond your pension. Your portfolio must be diversified, with a mix of stocks and bonds.

You might likewise be considering purchasing a home, marrying or having kids.

CFP Elaine King highly suggests thinking about a house purchase in your 30 s. It’s OK to begin little, she stated.

“It doesn’t need to be a big house, just something that in your future can be your rental income to diversify your assets,” stated King, creator of Family and Money Matters in North Miami, Florida.

When you begin conserving for those occasions, do not purchase stocks– unless your time horizon is longer than 5 years, McClanahan recommended.

Instead, she suggests a cash market account. These days, cash market fund rates have actually skyrocketed as the U.S. Federal Reserve treked rate of interest. The typical yield on Crane Data’s list of the 100 biggest taxable cash funds is 4.62%. Similarly, certificates of deposits, or CDs, have actually likewise seen their rate of interest increase.

If anybody is depending on your earnings, such as a partner or kid, it’s likewise time to purchase life insurance coverage. For those with kids, you might wish to begin putting cash aside for college.

The hectic 40 s

Maskot|Maskot|Getty Images

You might now remain in your peak making years and might likewise be raising kids.

If possible, attempt to begin a college cost savings account if you have not done so currently. If you can’t manage to, do not divert cost savings from your pension.

“You can borrow for college, but you can’t borrow for retirement,” McClanahan stated.

For those who have not started conserving for retirement yet, reserving 15% to 20% of your earnings is thought about a basic general rule at this age, Aaron stated.

You can obtain for college, however you can’t obtain for retirement.

Carolyn McClanahan

director of monetary preparation at Life Planning Partners

You might likewise have aging moms and dads, so make certain to examine their monetary preparation, McClanahan stated. If they aren’t prepared, it is another monetary commitment that might be unexpectedly tossed on your lap.

Sun stated she’s had numerous customers in their 40 s start to ask about long-lasting care, with Covid pressing care issues to the leading edge. Traditional long-lasting care insurance coverage is costly, however there are other policies that are a hybrid– integrating life insurance coverage and long-lasting care protection.

“It is really figuring out how much you can afford, and if you can’t afford it right now, at least have the discussion so you are prepared,” Sun stated. “You may have to self-insure, or look for it through work.”

Getting major in your 50 s

Retirement is possibly a years away, so it’s time to buckle down about just how much you are really investing, and whether you are on track to conserve enough to support you throughout your life, McClanahan stated.

Once you strike 50, you can likewise set more aside into your 401( k) or individual retirement account with so-called catch-up contributions. In 2023, the limitation is $7,500 for 401( k) strategies and $1,000 for IRAs

If you do not utilize a monetary organizer, a minimum of get a per hour one to identify if you are on track to support your way of life in retirement, McClanahan suggested.

Assess your properties and make certain your portfolio is stabilized to your requirements. As you approach retirement age, specialists generally suggest minimizing dangerous properties, such as stocks, and increasing set earnings, such as bonds.

However, it is very important to keep stock direct exposure considering that it provides you a higher return, Aaron stated.

In your 60 s and beyond

At this point, you require to have a retirement circulation method. That indicates comprehending the various earnings streams you’ll have can be found in.

“We need to build an investment strategy based on a proper asset allocation, taking on only as much risk that is needed for the income you require and your legacy goals,” Aaron stated.