Singapore names Lawrence Wong as chairman of reserve bank

The Monetary Authority of Singapore called Deputy Prime Minister Lawrence Wong as Chairman of its Board of Directors efficient July 8.

Wong is likewise the nation’s financing minister, and will change Tharman Shanmugaratnam, who held the function for 12 years given that May2011 Shanmugaratnam will step down on Jul 8, the release stated.

Singapore’s Minister for Trade and Industry Gan Kim Yong will be designated Deputy Chairman of the MAS Board.

— Jihye Lee

HDFC Bank is ‘definitely’ a buy, states wealth management company

Gurmeet Chadha of Complete Circle goes over the merger in between HDFC and HDFC Bank, and states HDFC Bank is clocking in 15% to 16% of credit development.

Factory output in Southeast Asia blended in the middle of worldwide unpredictabilities

Private studies for factory activity in ASEAN nations revealed a blended photo in Southeast Asian markets.

The S&P Global ASEAN Manufacturing buying supervisors’ index saw conditions for the production sector enhance slightly in June, publishing a 51 reading, lower than 51.1 seen a month earlier.

“The region continues to fair well despite the post-COVID boom subsiding,” Maryam Baluch, Economist at S&P Global Market Intelligence stated, including that sticking around worldwide financial unpredictability and rate walkings “worldwide map a challenging road ahead.”

Indonesia’s production PMI broadened to 52.5 in June from 50.3 in May.

Thailand’s production output likewise stayed in growth area, with its PMI reading at 53.2 in June– a slowed development from a reading of 58.2 a month earlier.

Meanwhile in Vietnam, its factory activity stayed in contraction area for the 4th straight month at 46.2, the personal study revealed, a little up from 45.3 in the previous month.

In the Philippines, production companies saw a fractional increase in output in the middle of softer growth in brand-new orders, marking the weakest output development in 10 months.

Its PMI reading can be found in at 50.9 in June, lower than the previous reading of 52.2.

— Jihye Lee

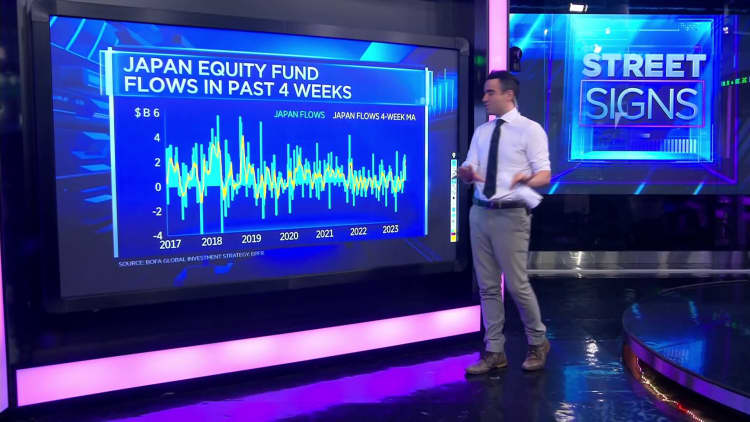

Nikkei can reach record high of about 40,000 in next 12 months, states monetary services company

The Nikkei might strike 40,000 in the next year thanks to principles that “point in the right direction,” rebound in service self-confidence and helpful financial policy, states Jesper Koll of Monex Group.

China’s factory activity grows at slower rate in June: Caixin study

China’s factory activity grew at a slower rate in June, according a personal study by Caixin/ S&P Global.

The nation’s production acquiring supervisors’ index was up to 50.5 in June, below 50.9 in May, however a little greater than the 50.2 anticipated by economic experts surveyed byReuters

China’s National Bureau of Statistics reported recently that the nation’s main production PMI was at 49.0 in June– compared to 48.8 in May.

— Lim Hui Jie, Clement Tan

Japan’s service belief increases in 2nd quarter: Tankan study

Sentiment amongst Japan’s organizations enhanced in the 2nd quarter, according to the Bank of Japan’s quarterly Tankan study.

The heading index, determining huge makers’ state of mind stood at +5 in June, rebounding from a +1 reading in the very first quarter, and likewise greater than the +3 anticipated by economic experts surveyed byReuters

The belief index for big non-manufacturers climbed up a little to +23, up from +22 in March and strike its greatest level given that June2019

A favorable reading on the Tankan suggests enhancing service belief in the sector, while an unfavorable reading suggests the opposite.

— Lim Hui Jie

South Korea’s production activity stays in contraction for 12 th straight month

South Korea’s factory activity stayed in contraction area for the twelfth straight month, according to a personal study by S&P Global.

The nation’s production acquiring supervisors index was up to 47.8 in June, below 48.4 inMay South Korea last tape-recorded a growth in June 2022, with a reading of 51.3.

A PMI reading of above 50 suggests growth, while a reading listed below 50 suggests contraction.

— Lim Hui Jie

Week ahead: Global PMIs, Australia’s rate choice, Fed minutes

Private studies on factory activity will be carefully enjoyed in the Asia-Pacific market today, together with a reserve bank rate choice in Australia.

The S&P Global production acquiring supervisors’ index from Japan, South Korea, Taiwan and India’s production acquiring supervisors index reading will be carefully enjoyed. Releases from ASEAN nations consisting of Thailand, Vietnam and Indonesia will likewise be released.

The U.S. stock exchange will close early on Monday ahead of the Independence Day vacation observed on Tuesday.

The Reserve Bank of Australia’s rates of interest choice is set up for Tuesday, with economic experts surveyed by Reuters anticipating to see a 25 basis point walking.

South Korea’s customer cost index for June will be launched today as the economy continues to see its inflation levels inch closer to the reserve bank’s target of 2%.

On Wednesday, financiers will be carefully browsing minutes from the June Federal Open Market Committee conference for ideas on the Fed’s actions ahead.

May retail sales information for Australia and Singapore will be released together with June inflation prints for Thailand and the Philippines on this day.

Australia’s trade surplus for the month of May for products and services will likely reveal an ongoing decrease for the 2nd straight month onThursday Economists surveyed by Reuters are anticipating a surplus of A$105 billion ($ 7 billion) after being up to A$1116 billion in April.

Malaysia’s reserve bank will provide its rate choice onThursday Economists surveyed by Reuters anticipate the reserve bank to hold its rates after it raised its benchmark rate by 25 basis points in May.

The week will end with South Korea’s bank account reports and Japan’s home costs as subsiding worldwide need stays a leading issue for the area.

— Jihye Lee

CNBC Pro: Goldman strategist states one nation uses the ‘most fertile ground for choosing stocks’ and shares his favorites

It’s time for financiers to think about returning into one essential global market, Koul, who is vice president of Asia Pacific portfolio method at the financial investment bank, informed CNBC’s “Street Signs Asia” on Friday.

“The amount of interest we are seeing, especially from global investors, is off the charts,” he stated.

Koul discusses why it’s time, and shares the stocks to think about.

CNBC Pro customers can learn more here.

— Weizhen Tan

CNBC Pro: Global stocks had a strong start to2023 Here’s where they will go next, according to history

Global stocks increased by more than 12% in the very first half of this year and surpassed historic averages, according to a CNBC Pro analysis.

With financiers bagging excellent returns currently, CNBC Pro analyzes whether there is space for development in the 2nd half of the year.

CNBC Pro customers can learn more here.

— Ganesh Rao

Janet Yellen to consult with Chinese authorities today

U.S. Treasury Secretary Janet Yellen will consult with senior Chinese authorities today in Beijing.

The Treasury stated Yellen will talk about “how the U.S. and China can ” properly handle our relationship, interact straight about locations of issue, and collaborate to deal with worldwide obstacles.”

The department stated it would offer additional information on her journey at a later date.

— Christine Wang

Latest inflation information cools in May

The newest inflation information revealed rates cool in May, according to a Commerce Department report launched Friday.

The individual usage expenses cost index increased 0.3% for the month when omitting food and energy, in line with the Dow Jones price quote. That’s likewise listed below the 0.4% boost see in April.

On a year over year basis, the carefully enjoyed number by the Federal Reserve increased 4.6% from a year earlier, listed below the 4.7% anticipated by economic experts.

When consisting of the unstable food and energy parts, inflation was significantly softer– up simply 0.1% on the month and 3.8% from a year earlier. Those were down respectively from the 0.4% and 4.3% boosts reported for April.

— Jeff Cox, Samantha Subin

Consumer self-confidence enhances, inflation outlook most affordable in 2 years

Consumer self-confidence sped up in June while inflation expectations struck their most affordable in more than 2 years, according to the carefully enjoyed University of Michigan belief study launched Friday.

The heading index increased to 64.4 for the month, up from 59.2 in May and much better than the 63.9 Dow Jones price quote.

At the exact same time, the anticipated outlook for inflation a year from now plunged to 3.3%, below 4.2% and great for the most affordable reading given that March 2021.

— Jeff Cox

Stocks surface greater, for the month, quarter and very first half

Stocks closed greater on Friday, with all the significant typical notching gains for the week, month, quarter and very first half of the year.

The Dow Jones Industrial Average got 285.18 points, or 0.84%, to close at 34,40760 The S&P 500 climbed up 1.23% to end at 4,45038, and the Nasdaq Composite advanced 1.45% to settle at 13,78792

The Nasdaq liquidated its finest start to the year given that1983 The S&P published its finest very first half given that 2019.

— Samantha Subin