The brand-new financial procedures set out by the U.K. federal government “will likely increase inequality”, according to a representative from the International Monetary Fund.

Yuri Gripas|Reuters

LONDON– The brand-new financial procedures set out by the U.K. federal government “will likely increase inequality,” the International Monetary Fund stated in an uncommon declaration.

While the financial bundle– that included significant tax cuts for Britain’s greatest earners– intends to assist households and services deal with the energy shock, the IMF does “not recommend large and untargeted fiscal packages at this juncture,” a representative stated in a declaration late Tuesday.

associated investing news

The so-called “mini-budget” on Friday was not accompanied by a projection from Britain’s independent Office for Budget Responsibility, which normally analyses the effect huge monetary relocations would likely have on the economy.

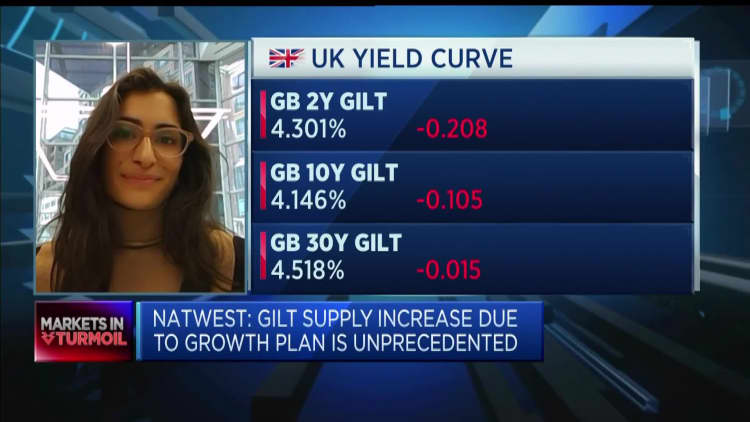

Markets were highly impacted by the brand-new procedures, with U.K. bonds sinking and the British pound dropping to a record low on Monday.

The IMF likewise expected the next complete budget plan statement, set to be set out by Finance Minister Kwasi Kwarteng onNov 23, stating it provides the U.K. federal government “an early opportunity … to consider ways to provide support that is more targeted and re-evaluate the tax measures, especially those that benefit high income earners.”

‘Large unfunded cuts are credit unfavorable’

The “almost unprecedented” financial injections have “put the U.K. economy into a difficult situation,” according to Ian Harnett, co-founder and primary financial investment strategist at research study company Absolute Strategy.

The relocation made the Bank of England’s position “almost impossible,” he stated on CNBC’s “Squawk Box Europe” on Wednesday.

The Bank of England will likely provide a “significant policy response” following Kwarteng’s financial statement, according to its Chief Economist Huw Pill, who spoke at the Barclays- CEPR International Monetary Policy Forum in London on Tuesday.

While no relocations will be made ahead of the bank’s next scheduled conference in November, the current statements “will act as a stimulus,” Pill stated, as reported by Reuters.

Credit scores firm Moody’s, on the other hand, stated “large unfunded cuts are credit negative,” triggering worries of bigger deficit spending and greater rate of interest in the U.K.

“A sustained confidence shock arising from market concerns over the credibility of the government’s fiscal strategy that resulted in structurally higher funding costs could more permanently weaken the UK’s debt affordability,” Moody’s stated, according to Reuters.

The “mini-budget” revealed by the brand-new U.K. federal government on Friday was a “new approach for a new era focused on growth,” according to Kwarteng, and consisted of canceling the organized boost in corporation tax from 19% to 25% and ditching the 45% earnings tax bracket paid on earnings over ₤150,000 ($160,000), bringing the leading rate to 40%.

The pound has actually seen some healing from its record low of $1.0382 at the start of the week, and sat at around $1.0666 on Wednesday early morning.