A Credit Suisse logo design seen showed on a mobile phone with damaged screen and an illustrative stock chart background in Athens, Greece on March 15,2023 (Photo illustration by Nikolas Kokovlis/ NurPhoto by means of Getty Images)

Nikolas Kokovlis|Nurphoto|Getty Images

Shares of Credit Suisse rose Thursday, rebounding from a fresh all-time low after the beleaguered lending institution revealed it would tap reserve bank assistance to support its financial resources.

Switzerland’s second-largest bank stated it would obtain approximately 50 billion Swiss francs ($5368 billion) from the Swiss National Bank, supplying a minute of relief for financiers after the Zurich- headquartered company led Europe’s banking sector on a wild flight lower throughout the previous session.

The Swiss- noted stock was trading around 17% greater at 1: 35 p.m. London time (9: 35 a.m. ET)– a huge swing from Wednesday’s more than 30% tumble after its most significant backer stated it would not offer more support due to regulative constraints.

The abrupt loss of self-confidence in Credit Suisse, which came as worries about the health of the banking system spread out from the U.S. to Europe, has actually triggered some to question the “true” worth of Credit Suisse’s stock cost.

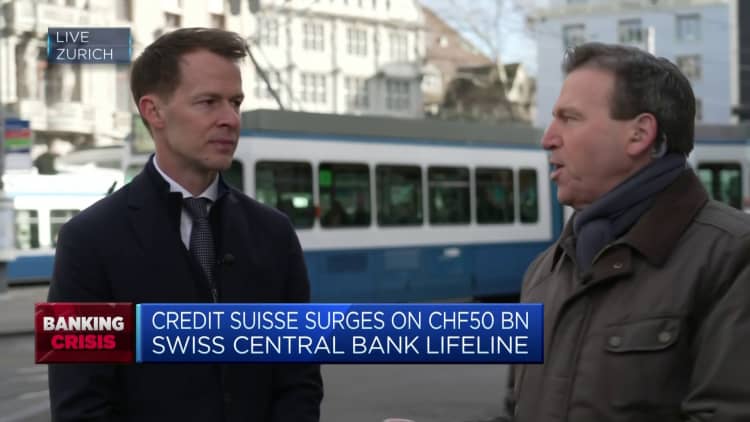

“We need to go back and look obviously at the practicality of business design [and] at the general regulative landscape,” Beat Wittmann, chairman of Switzerland’s Porta Advisors, informed CNBC’s “Squawk Box Europe” on Thursday.

“I think the leadership of the bank has to really use now this lifeline to review their plan because obviously, the capital markets have not bought the plan as we have seen by the performances of the equity price and the credit default swaps very recently.”

Asked for his views on the sharp fall of Credit Suisse’s share cost– which dropped listed below 2 Swiss francs for the very first time on Wednesday– Wittmann stated a “brutal” financial tightening up cycle led by significant reserve banks in current months indicated business susceptible to shocks were now starting to “really suffer.”

“The weakest links are cracking and that’s just happening, and that was entirely predictable — and this will not be the last one. So, now it is really time for policymakers to restore confidence and liquidity in the system, be it in the U.S., be it in Switzerland, or be it somewhere else,” Wittmann stated.

Asked for his suggestions to financiers amidst the marketplace chaos, he stated, “The upside momentum in inflation and interest rates is receding very clearly so I think there is a very healthy underpinning in capital markets.”

“But I would very strongly recommend sticking to high-quality companies — that means strong management, strong balance sheets, strong value proposition. And now you can pick them up at more attractive valuations,” Wittmann included.

‘Material weak points’

Even prior to the shock collapse of 2 U.S. banks recently, Credit Suisse has actually been besieged with issues over the last few years, consisting of cash laundering charges and spying accusations.

The bank’s disclosure previously today of “material weaknesses” in its reporting contributed to financier issues.

Credit Suisse management stated Wednesday, nevertheless, that its newest action to protect a large financing offer revealed “decisive action” to enhance business. It thanked the Swiss National Bank and the Swiss Financial Market Supervisory Authority for their assistance.

Analysts invited the relocation and recommended worries of a fresh banking crisis might be overemphasized.

“A stronger liquidity position and a backstop provided by the Swiss National Bank with the support from Finma are positive,” Anke Reingen, an expert at RBC Capital Markets, stated Thursday in a research study note.

“Regaining trust is key for the CS shares. Measures taken should provide some comfort that a spillover to the sector could be contained, but the situation remains uncertain,” she included.

Analysts at UBS, on the other hand, stated market individuals were “grappling with three interrelated but different issues: bank solvency, bank liquidity, and bank profitability.”

“In short, we think bank solvency fears are overdone, and most banks retain strong liquidity positions,” they included.

‘ A terrific turn-around story’?

For Dan Scott, head of multi-asset management at Swiss property supervisor Vontobel– who utilized to operate at Credit Suisse– it’s not all problem.

“I would say that Credit Suisse specifically is still one of the world’s largest asset managers, it has half a trillion in assets, and certainly this could be a great turnaround story if the execution is good,” he informed “Squawk Box Europe” on Thursday.

Asked by CNBC’s Geoff Cutmore whether this would imply financiers remaining client regardless of market turbulence and the scale of outflows from the bank, Scott responded: “Absolutely. But I think again that the stress that we’re seeing at the moment really should have been predictable.”

“When rates come up so fast, certain business models get challenged and I don’t think it is a wealth management business model that gets challenged. I think much more and why we saw it at Silicon Valley Bank, is private markets are going to be challenged,” Scott included.