Japan’s stock exchange have actually outshined Asian peers this year to date, as financiers cheer the possibility of real business governance reforms that would oblige Japan Inc into higher effectiveness and efficiency, while increasing investor returns.

Richard A. Brooks|Afp|Getty Images

For the very first time in years, Japan stocks are back in style.

In the last couple of weeks, the standard Nikkei 225 and Topix indexes touched their greatest levels in more than 30 years as foreign financiers put into Japanese equities with a consistency seldom seen in a minimum of a years.

After what ended up being an incorrect dawn a years earlier, when “Abenomics” very first raised hopes of business governance reform in Japan, lots of appear to believe much better of the most recent steps by the Tokyo exchange.

“The recent Tokyo Stock Exchange initiative is a game-changing moment, because it’s going to challenge a lot of companies that are trading on less than one-time price-to-book to improve profitability and support their share price,” stated Oliver Lee, a Singapore- based customer portfolio supervisor, at Eastspring Investments.

The Tokyo Exchange Group just recently completed its market reorganizing guidelines. Among the most recent steps was one that directed noted business to “comply or explain” if they are trading listed below a price-to-book ratio of one– an indicator a business might not be utilizing its capital effectively.

The exchange alerted such business might deal with the possibility of delisting as quickly as 2026.

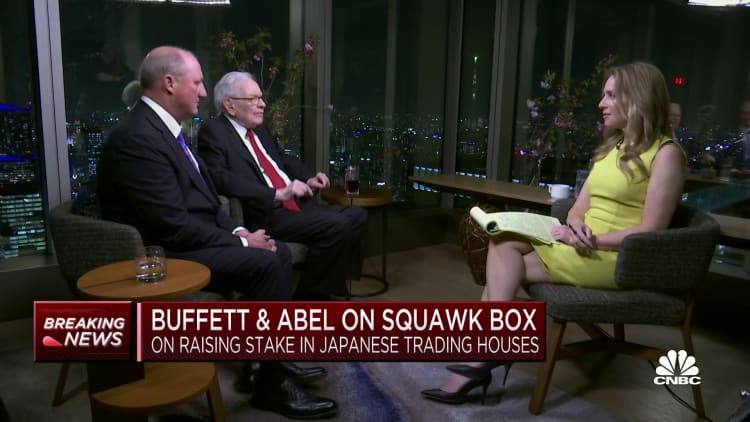

Part of the optimism in Japanese stocks comes from how particular and concrete the Tokyo exchange’s requirements are this time round. Warren Buffett’s bullish contact Japanese equities has actually likewise assisted increase self-confidence amongst foreign financiers.

There is hope this would push Japanese business’ infamously resistant management– which generally see investors as opponents– for higher capital effectiveness and success. It might in turn cause a cause and effect to name a few Japanese business once the huge gamers begin to make modifications.

“Until very recently, the problem was although there has been a rise in healthy corporate activism, companies and managers were still not so proactive listening to shareholder proposals,” Yunosuke Ikeda, Nomura’s primary equity strategist, informed CNBC recently.

The scale for modification– or frustration– is significant.

The exchange stated in March that half the variety of its “prime” listings– the most liquid stocks with the biggest market capitalization– and about 60% of those in the “standard” listings have a return on equity of less than 8% and are trading at price-to-book worth of less than one.

Price- to-book worth is the ratio of the overall market price of a business’s share cost over its book worth — a business’s net possessions. Return on equity is a gauge of a business’s success.

These business should now demonstrate how they prepare to enhance their capital effectiveness, given that the information points recommend they might be trading listed below expense of capital and for that reason not likely to be capital effective. Part of those guidelines need them to show how they have actually engaged financiers and to start releasing public disclosures in English.

If a business does not satisfy boosted noting requirements by the end of the continuous transitional duration and an additional year-long “improvement period,” its securities might be put under guidance and might deal with the possibility of delisting within 6 months.

“Delisting or any punishment or any enforcement is quite unlikely, but the good news in Japan is there is the peer pressure factor,” stated Nomura’sIkeda “If rival companies are doing great improvements in corporate governance, others will tend to follow that move.”

Long tail of Abenomics reform

The goals are clear.

In a file released end-March, the Tokyo bourse operator wishes to guarantee business attain sustainable development and boost business worth over the mid- to long-lasting by concentrating on the expense of capital and success based upon the balance sheet, instead of simply sales and earnings levels on the earnings declaration.

In other words, they wish to see genuine tactical modifications made in tandem with investors.

These reforms belong to a more comprehensive, multi-year structural overhaul that can trace their genesis to Abenomics– an aggressive set of financial policies that the late Shinzo Abe introduced in the early 2010 s, when he was prime minister.

Corporate governance is the “third arrow” of the 3 core tenets of Abenomics– financial relieving and financial stimulus are the other 2. The much-touted financial policy was targeted at restoring financial development and combating the persistent deflation that has actually afflicted the world’s third-largest economy given that the 1990 s.

While the preliminary ecstasy in Japanese stock exchange over Abenomics was brief back in the early 2010 s, financiers now see a capacity for an essential re-rating of Japanese equities need to these most current business governance reforms settle.

Better business governance has actually been drawing in more global financiers consisting of the current ones like Warren Buffett’s Berkshire Hathaway …

Asli M. Colpan

teacher of business technique, Kyoto University

“Investing in Japan equities is not investing in Japan macro, it’s not investing in themes,” stated Shuntaro Takeuchi, a San Francisco- based Japan fund supervisor with Matthews Asia.

“It’s investing in more of a profit growth opportunity coming from margin improvement, return on equity improvement, total return improvement.”

The Buffett result

Known as “sogo shosha,” Japan’s trading homes belong to corporations and do organization in a wide array of items and products, and assisted launch Japan’s economy on to the international phase.

While their varied operations became part of the draw for Buffett, some financiers have actually slammed their complicated operations, and highlighted their growing direct exposure to dangers overseas as they broadened worldwide.

Buffett’s May disclosures assisted stimulate 10 straight weeks of net foreign purchases of Japanese equities. Foreigners purchased a net $578 billion worth of Japanese equities in the last 10 weeks up until June 3, according to Japan Ministry of Finance information.

“There is a pressure from investors, especially foreign ones to comply,” stated Asli M. Colpan, a teacher of business technique at Kyoto University’s Graduate School of Management and Graduate School of Economics.

“Better corporate governance has been attracting more international investors including the recent ones like Warren Buffett’s Berkshire Hathaway; and more international investors are putting more pressure for compliance — forming a virtuous cycle,” she included.

Cash abundant, simple wins

And that’s currently beginning to inform.

“As a result of profit growth, the cashflow generation and accumulation is now at a level that more than 50% of corporates are net cash and might be hoarding too much cash on their balance sheet,” stated Matthews Asia’s Takeuchi.

We’re most likely simply midway through that journey of business reform.

Oliver Lee

Eastspring Investments

“But a bigger factor in the long term is whether they will retain the focus on profitability by cutting underperforming business units and restructuring,” he included.

These are harder choices to carry out, however would eventually be the genuine gauge of business Japan’s cravings for reform, higher effectiveness and efficiency.

Still, the more comprehensive instructions of long-lasting structural modification in Japan is clear.

In a world that is combating stubbornly high inflation and challenging anemic development potential customers, that’s simply including on to the appeal of the Japanese equity markets– with the aid of Japan’s accommodative financial policy, its relatively more moderate inflation after years of persistent deflation, the weak yen, and fairly low-cost assessments.

“We’re probably just halfway through that journey of corporate reform,” Lee stated.