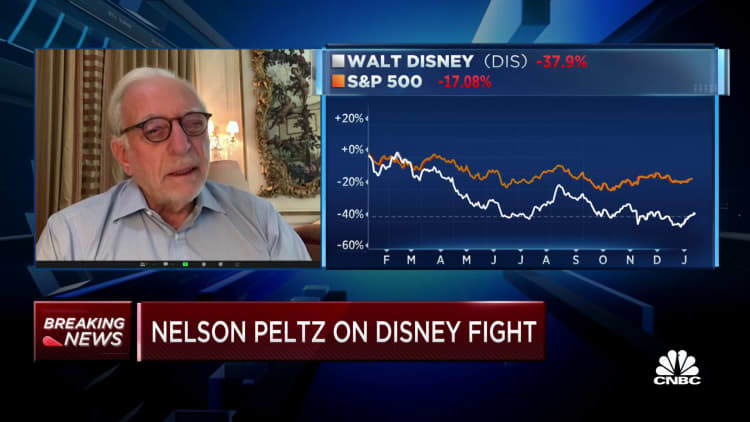

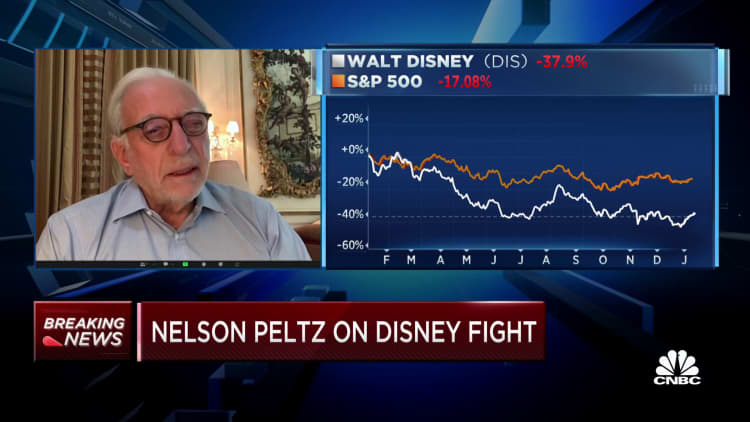

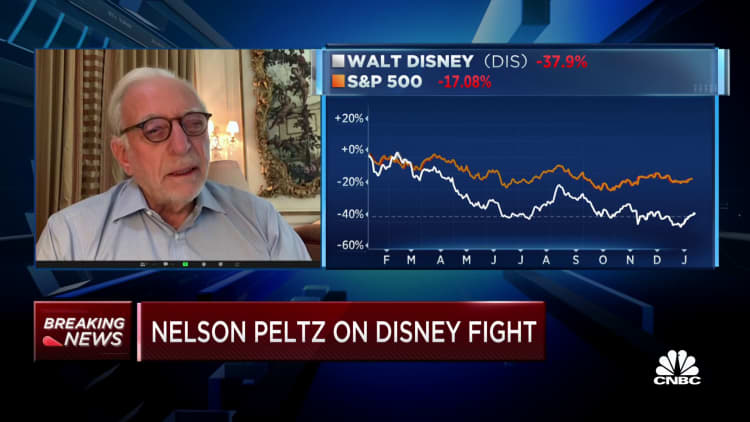

Disney is dealing with a proxy battle as Nelson Peltz’s activist company Trian Fund Management promotes a seat on its board.

Peltz spoke Thursday on CNBC’s “Squawk on the Street,” making his case for the battle his company has actually chosen withDisney He raised concerns with Disney’s $71 billion acquisition of Fox in 2019 and how the business’s investor worth has actually deteriorated over the last few years.

“Fox hurt this company. Fox took the dividend away. Fox turned what was once a pristine balance sheet into a mess,” Peltz stated.

On Thursday, the activist company submitted an initial proxy declaration wanting to put Peltz on Disney’s board.

To preempt what might be an unpleasant proxy fight and opposing Trian, Disney on Wednesday revealed that Mark Parker, the executive chairman of Nike, would end up being the brand-new chairman of the board. Disney’s board will now have 11 members.

The activist company stated it owns about 9.4 million shares valued at roughly $900 million, which it initially built up a couple of months back. Trian stated Wednesday it thinks Disney “lost its way resulting in a rapid deterioration in its financial performance.”

Peltz likewise stated he wishes to be on the board so he can get access to internal numbers and inform other members if they’re losing out on chances.

“I don’t need to overwhelm them,” Peltz informed CNBC. “I don’t need more than one person on the board.”

Shares of Disney were up about 3% on Thursday.

Peltz’s complaints

Trian called out what it considered as bad business governance on Disney’s part, consisting of stopped working succession preparation, “over-the-top” payment practices and Disney’s absence of engagement with Trian in current months.

In public filings Thursday, Trian noted its various conferences with Disney and its board members, starting with then-CEO Bob Chapek, Peltz and their spouses over lunch inJuly Meetings and correspondence in between Trian and Disney increase in frequency in November, according to the filing.

Peltz on Thursday stated he just had a conference with Disney’s board that covered about 45 minutes however he never ever heard a reaction from them. A Disney agent didn’t right away react to comment.

Peltz likewise kept in mind that Disney was open to making him a board observer, permitting him to attend conferences and offer suggestions on operations however without voting benefits.

“I just need to speak reasonably to these people and explain to them where they went wrong or what opportunities they’re missing,” Peltz stated Thursday, keeping in mind other business where he’s rested on the board.

People near to Disney informed CNBC’s David Faber they challenged Peltz’s variation, stating rather the business provided him the chance to participate in an information-sharing pact under a nondisclosure arrangement, in addition to chances to meet management and the board each quarter. Disney did not provide him the capability to attend board conferences, individuals included.

In November, Bob Iger made an unexpected go back to Disney’s helm, ousting Chapek– whom Iger selected as his follower– following a bad profits report. Trian has stated it does not wish to change Iger, however rather deal with him to guarantee an effective CEO shift within the next 2 years.

Parker will take control of as chairman from Susan Arnold and will be entrusted to lead succession preparation, according to Disney’s statement Wednesday.

In Thursday’s filing, Trian likewise called out Disney’s streaming method, stating it is “struggling with profitability, despite reaching similar revenues as Netflix and having a significant IP advantage.” The company likewise slammed what it thinks is Disney’s absence of expense discipline and overearning at its amusement park organization to fund streaming losses.

Disney’s stock had a rough 2022, coming out of the early days of the pandemic, when amusement park and theater were closed down. However, as customer development for streaming slowed and financiers raised concerns about success, while cable cutting increase, a lot of media stocks fell in 2015.

On Thursday, Peltz stated Disney either requires to leave the streaming organization or buyHulu “They must buy Hulu, that unfortunately means the company will have a debt load going forward for several years,” Peltz stated.

While Disney+ is the business’s primary play in streaming, Disney likewise owns two-thirds of Hulu and has a choice to purchase the staying stake from Comcast as early as January 2024.

Last year, Disney likewise revealed it would continue with cost-cutting steps, consisting of a working with freeze that Iger has actually promoted.

— CNBC’s David Faber added to this report.

Disclosure: Comcast is the moms and dad business of NBCUniversal, which owns CNBC.

Watch CNBC’s complete interview with Nelson Peltz on PRO: