Sergio Ermotti, CEO of Swiss banking huge UBS, throughout the group’s yearly investors conference in Zurich on May 2,2013

Fabrice Coffrini|Afp|Getty Images

Switzerland’s difficult brand-new banking guidelines produce a “lose-lose situation” for UBS and might restrict its possible to difficulty Wall Street giants, according to Beat Wittmann, partner at Zurich- based Porta Advisors.

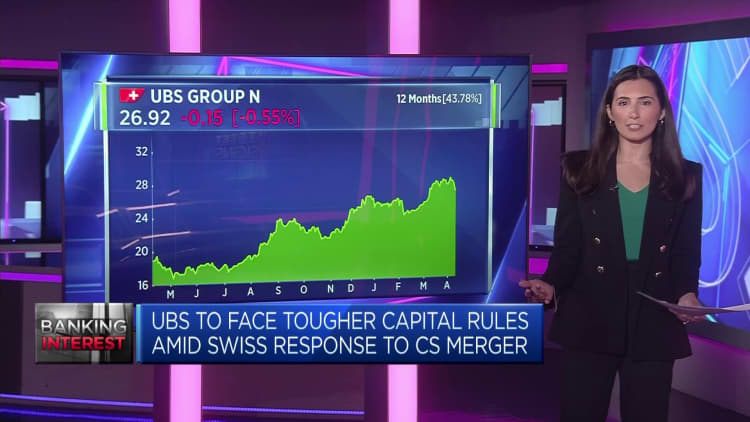

In a 209- page strategy released Wednesday, the Swiss federal government proposed 22 determines targeted at tightening its policing of banks considered “too big to fail,” a year after authorities were required to broker the emergency situation rescue of Credit Suisse by UBS.

The government-backed takeover was the most significant merger of 2 systemically crucial banks because the Global Financial Crisis.

At $1.7 trillion, the UBS balance sheet is now double the nation’s yearly GDP, triggering boosted analysis of the defenses surrounding the Swiss banking sector and the wider economy in the wake of the Credit Suisse collapse.

Speaking to CNBC’s “Squawk Box Europe” on Thursday, Wittmann stated that the fall of Credit Suisse was “a totally self-inflicted and foreseeable failure of federal government policy, reserve bank, regulator, and above all [of the] financing minister.”

“Then naturally Credit Suisse had actually a stopped working, unsustainable company design and an unskilled management, and it was all shown by an ever-falling share cost and by the credit spreads out throughout [20]22, [which was] totally neglected due to the fact that there is no institutionalized knowledge at the policymaker levels, actually, to enjoy capital markets, which is important when it comes to the banking sector,” he included.

The Wednesday report drifted offering extra powers to the Swiss Financial Market Supervisory Authority, using capital additional charges and strengthening the monetary position of subsidiaries– however stopped short of advising a “blanket increase” in capital requirements.

Wittman recommended the report not does anything to relieve issues about the capability of political leaders and regulators to supervise banks while guaranteeing their international competitiveness, stating it “creates a lose-lose situation for Switzerland as a financial center and for UBS not to be able to develop its potential.”

He argued that regulative reform must be focused on over tightening up the screws on the nation’s biggest banks, if UBS is to profit from its newly found scale and lastly challenge the similarity Goldman Sachs, JPMorgan, Citigroup and Morgan Stanley— which have actually likewise sized balance sheets, however trade at s much greater evaluation.

“It comes down to the regulatory level playing field. It’s about competences of course and then about the incentives and the regulatory framework, and the regulatory framework like capital requirements is a global level exercise,” Wittmann stated.

“It cannot be that Switzerland or any other jurisdiction is imposing very, very different rules and levels there — that doesn’t make any sense, then you cannot really compete.”

In order for UBS to enhance its capacity, Wittmann argued that the Swiss regulative program must enter line with that in Frankfurt, London and New York, however stated that the Wednesday report revealed “no will to engage in any relevant reforms” that would secure the Swiss economy and taxpayers, however make it possible for UBS to “catch up to global players and U.S. valuations.”

“The track record of the policymakers in Switzerland is that we had three global systemically relevant banks, and we have now one left, and these cases were the direct result of insufficient regulation and the enforcement of the regulation,” he stated.

“FINMA had all the legal backdrop, the instruments in place to address the situation but they didn’t apply it — that’s the point — and now we talk about fines, and that sounds like pennywise and pound foolish to me.”