Job development published a remarkably strong boost in January, showing once again that the U.S. labor market is strong and poised to support more comprehensive financial development.

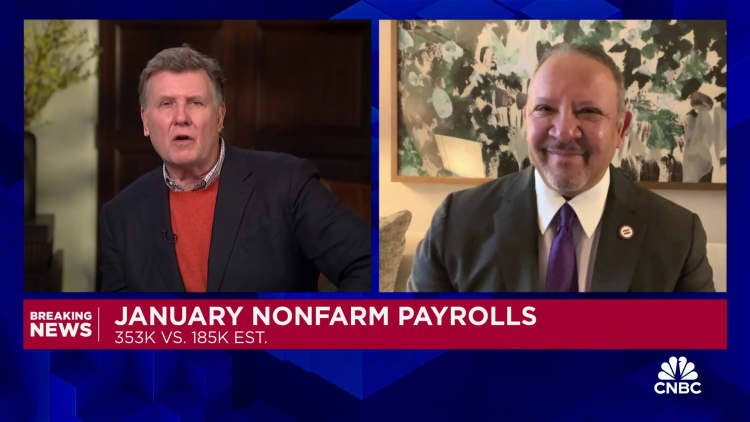

Nonfarm payrolls broadened by 353,000 for the month, far better than the Dow Jones price quote for 185,000, the Labor Department’s Bureau of Labor Statistics reportedFriday The joblessness rate held at 3.7%, versus the price quote for 3.8%.

Wage development likewise revealed strength, as typical per hour incomes increased 0.6%, double the regular monthly price quote. On a year-over-year basis, salaries leapt 4.5%, well above the 4.1% projection. The wage gains came in the middle of a decrease in typical hours worked, down to 34.1, or 0.2 hour lower for the month.

Job development was prevalent on the month, led by expert and company services with 74,000 Other substantial factors consisted of healthcare (70,000), retail trade (45,000), federal government (36,000), social help (30,000) and production (23,000).

“This just reaffirms that the jobs market is entering 2024 on solid ground,” stated Daniel Zhao, lead financial expert atGlassdoor “The fact that job growth was so widespread across industries is a healthy sign. Coming into today’s report, we were concerned about how concentrated jobs were in really just three sectors — health care, education and government. While it is great to see those sectors drive job gains, there was no guarantee that would be enough to support a health labor market.”

The report likewise suggested that December’s task gains were far better than initially reported. The month published a gain of 333,000, which was an upward modification of 117,000 from the preliminary price quote. November likewise was modified up, to 182,000, or 9,000 greater than the last price quote.

DON’T MISS: The supreme guide to acing your interview and landing your dream task

While the report showed the strength of the U.S. economy, it likewise might raise concerns about how quickly the Federal Reserve will have the ability to lower rates of interest.

“Make no mistake, this was a blowout jobs report and will vindicate the recent posturing by the Fed which effectively ruled out an interest rate cut in March,” stated George Mateyo, primary financial investment officer at Key PrivateBank “Moreover, strong job gains combined with faster than expected wage gains may suggest an additional delay in rate cuts for 2024 and should cause some market participants to recalibrate their thinking.”

Futures markets moved after the report, with traders now pricing in a much better than 80% opportunity that the Fed does not cut rates of interest at its March conference, according to the CME Group.

Stocks were blended following the report. The Dow Jones Industrial Average dropped at the open however the S&P 500 and Nasdaq both were favorable. Treasury yields rose.

The January payrolls count includes economic experts and policymakers carefully seeing work figures for instructions on the bigger economy. Some prominent layoffs just recently have actually raised concerns about the resilience of what has actually been an effective pattern in employing.

A more incorporating procedure of joblessness that consists of dissuaded employees and those holding part-time tasks for financial factors edged greater to 7.2%. The home study, which determines the variety of individuals in fact holding tasks, varied dramatically from the facility study, revealing a decrease of 31,000 on the month. The manpower involvement rate was the same at 62.5%.

One possibly essential caution in the report might be the divergence in between typical per hour incomes and hours worked. Retail trade saw a fresh historic low of 29.1 hour in information returning to March 2006.

“This suggests that employers chose to reduce hours rather than resort to layoffs for the moment,” the Conference Board stated in a report analysis.

Broader layoff numbers, such as the Labor Department’s weekly report on preliminary out of work claims, reveal business reluctant to part with employees in such a tight labor market.

Gross domestic item development likewise has actually defied expectations.

The 4th quarter saw GDP increase at a strong 3.3% annualized speed, liquidating a year in which the economy defied prevalent forecasts for an economic crisis. Growth in 2023 came even as the Fed even more raised rates of interest in its mission to reduce inflation.

The Atlanta Fed’s GDPNo w tracker is pointing towards a 4.2% gain in the very first quarter of 2024, albeit with minimal information of where things are heading for the very first 3 months of the year.

The financial, work and inflation characteristics produce a complex image as the Fed looks for to alleviate financial policy. Earlier today, the Fed once again held benchmark short-term loaning expenses consistent and suggested that rate cuts might be ahead however not up until inflation reveals more indications of cooling.

Chair Jerome Powell suggested in his post-meeting press conference that the reserve bank does not have a “growth mandate” and stated main lenders stay worried about the effect that high inflation is having on customers, especially those on the lower end of the earnings scale.

Outside of the wage numbers, current information is revealing that inflation is relocating the ideal instructions.

Core inflation as determined by individual usage expenses rates was simply 2.9% in December on a year-over-year basis, while 6- and three-month assesses both suggested the Fed is at or around its 2% objective.

Still, the Atlanta Fed’s procedure of “sticky” inflation, which concentrates on products such as real estate, treatment services and insurance coverage expenses, was at 4.6% on a 12- month basis in December.

Don’t miss out on these stories from CNBC PRO: