Bob Iger, chairman and president of The Walt Disney Company, stops briefly while speaking throughout an Economic Club of New York occasion in Midtown Manhattan on October 24, 2019 in New York City.

Drew Angerer|Getty Images

Activist financier Nelson Peltz invested about 30 minutes Thursday early morning speaking with CNBC’s Jim Cramer and David Faber in a comprehensive interview about why he desires a Disney board seat.

But his argument hardly discussed what need to be his greatest point– Disney’s constant failure to prepare for CEO succession.

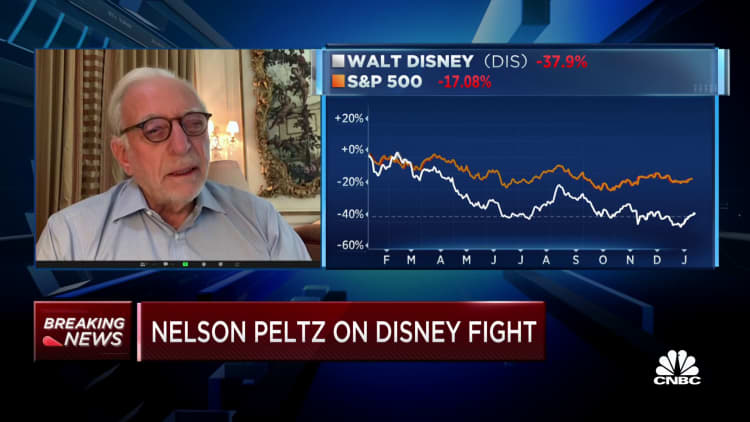

Peltz described his fund’s slide discussion on Disney’s failures under the management of previous CEOs Bob Iger and BobChapek He stated if he needed to boil down the discussion to its core, it would focus on Disney’s bad share efficiency and Trian’s performance history of worth development. Trian kept in mind that Disney’s share rate peaked in 2021 however presently trades near its eight-year-low. The stock was up about 3% Thursday.

But Disney’s underperformance in 2022 mirrored an industry-wide downturn led by Netflix‘s stalled development. Disney’s share rate spike in 2021 was brought on by the exact same phenomenon– financiers charging into streaming services with substantial customer development. Disney and Netflix are both down about 38% in the past 12 months. Other media stocks are down a lot more. Paramount Global shares have actually dropped 45%. WarnerBros Discovery shares are down practically 50% considering that its AT&T combined Warner Media with Discovery on April 8.

Peltz blamed Disney Chief Executive Bob Iger and its board for paying too much for 21 st Century Fox in 2019 for the business’s choice to ditch its dividend throughout the pandemic. But requesting for a board seat based upon Iger’s performance history of acquisition choice making isn’t going to win over lots of financiers. Iger’s string of offers throughout his period as CEO– getting Pixar, LucasFilm and Marvel– prior to Fox were a few of the very best acquisitions in the history of the media market.

Peltz prepares to install a proxy battle and his greatest argument to investors should not have to do with Iger’s efficiency as a CEO. Rather, it need to have to do with the board’s constant failure to prepare for a post-Iger world. Iger established a history throughout his preliminary, 15- year CEO period of repeling prospective followers, consisting of Jay Rasulo, Tom Staggs and KevinMayer When he did quit his CEO task in 2020, he stopped working to leave the business entirely, establishing an 18- month stretch where his handpicked follower, Chapek, felt weakened by his existence.

Now Iger’s back, and the Disney board has actually entrusted him with discovering a follower in the next 2 years. Iger’s performance history recommends succession preparation is the one location where he truly has a hard time.

“Iger has historically dominated the succession process, but it shouldn’t be Iger’s pick, it’s the board’s pick,” stated Charles Elson, founding director of the Weinberg Center for CorporateGovernance “Disney left itself susceptible to activist intervention because it’s had governance issues with succession for almost 25 years.”

Part of Trian’s pitch to financiers is the succession concern, however it does not turn up till slide 27 of a 35- slide discussion. Most of Peltz’s argument is based upon Disney’s underwhelming share efficiency, the choice to ditch the dividend, how the Fox offer hasn’t worked, how a theoretical offer for Sky (an offer that didn’t in fact take place) would not have actually worked, and Trian’s history of improving share worth. He likewise informed CNBC that Disney either required to obtain Comcast’s 33% stake in Hulu or “get out of the streaming business.”

Disney is dealing with the share downturn of the previous year by restoring Iger, an usually well-respected CEO by both staff members and financiers. Disney will likewise quickly have a brand-new board chairman. Peltz’s argument that Iger requirements Trian’s assist with tactical decision-making simply months into going back into the task might be a difficult sell.

It’s a far much easier case to be made that Disney’s board and Iger have actually regularly made a mess of succession preparation. Trian stated in its discussion that Disney’s investor engagement procedure has actually been “among the worst (if not the worst) of all the companies we have interacted with.”

It’s possible Disney does not desire Peltz on the board due to the fact that he’ll require the concern of succession, restricting Iger’s capability to remain as CEO longer than 2 years. As Trian kept in mind in its discussion (on Slide 28), the Disney board extended Iger’s retirement date 5 various times in between October 2011 and December 2017.

Perhaps Peltz requires to improve his message to concentrate on that.

ENJOY: Disney is more than a media business, states Trian’s Nelson Peltz