CNBC’s Jim Cramer stated on Friday that today was the current example of the marketplace gone bananas after a Federal Reserve conference.

But based upon previous market responses to the reserve bank’s previous rate walkings, today’s activity might show not to be that significant in the long run, he stated.

The preliminary response to the Fed’s relocations is “almost always a head fake,” Cramer stated.

The market had a huge response today following the Fed’s newest relocation, Cramer kept in mind– with a tough sell-off on Wednesday, followed by a little resurgence on Thursday and a disorderly sessionFriday While newly found chaos in the European monetary sector dragged down stocks early Friday, they recuperated after those markets closed.

Following the reserve bank’s quarter point rate trek on Wednesday, there have actually been 9 boosts in simply over a year.

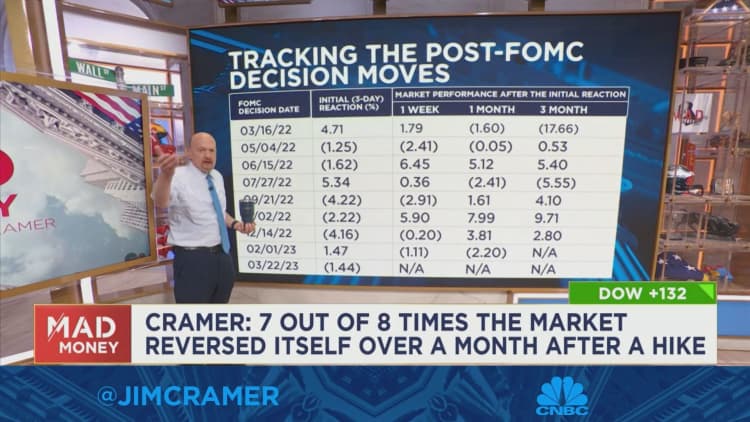

The market has actually tracked a pattern in which– after the very first 3 days following a Fed choice– it will generally enter the opposite instructions the next month, Cramer stated.

When taking a look at the previous 8 rate walkings this cycle, the marketplace reversed instructions over the following month 7 out of 8 times. (There is insufficient information to run an analysis on the February rate walking.)

The just exception was the 2nd one that took place in earlyMay That triggered a tough sell-off that lasted numerous days, and markets were essentially flat in the month that followed.

Generally, when you zoom out 3 months, the preliminary market relocations– whether they are favorable or unfavorable– tend to reverse themselves each time, Cramer stated.

The pattern is too frustrating to overlook, Cramer stated.

To make certain, it stays to be seen whether that exact same pattern will hold this time, or whether the unfavorable preliminary response to the Fed’s move today will reverse itself.

This time, with brand-new emergency situations turning up almost every day, particularly in the banking sector, it “feels dangerous” to anticipate a rally over the next 3 months, Cramer stated.

But the bottom line is, we have actually been here prior to, he worried.

“So, take a deep breath, drink some tea and remember that the initial reaction to the Fed’s rate hikes has been wrong every time over the past year,” Cramer stated.