In this image illustration, a graph of the digital Cryptocurrency Ripple is shown on January 30, 2018 in Paris,France

Chesnot|Getty Images

Blockchain start-up Ripple is positive U.S. banks and other banks in the nation will begin revealing interest in embracing XRP in cross-border payments after a landmark judgment identified the token was not, in itself, always a security.

The San Francisco- based company anticipates to begin talks with American monetary companies about utilizing its On-Demand Liquidity (ODL) item, which utilizes XRP for cash transfers, in the 3rd quarter, Stu Alderoty, Ripple’s basic counsel, informed CNBC in an interview recently.

associated investing news

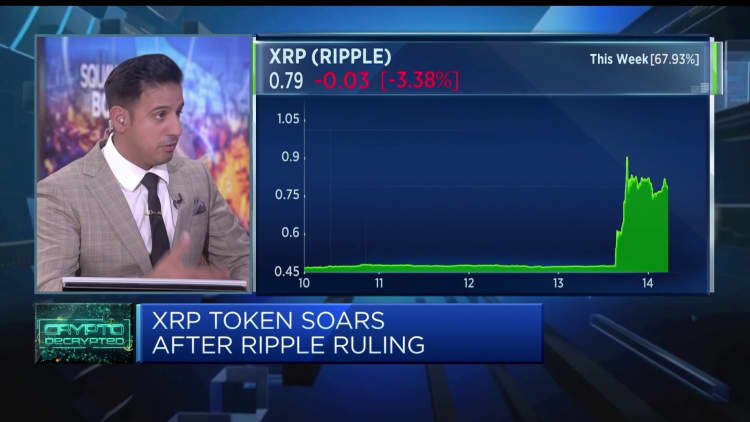

Last week, a New York judge provided a watershed judgment for Ripple identifying that XRP, a cryptocurrency Ripple is carefully related to, in itself was “not necessarily a security on its face,” objecting to, in part, declares from the U.S. Securities and Exchange Commission versus the business.

Ripple has actually been combating the SEC for the previous 3 years over accusations from the company that Ripple and 2 of its executives performed an unlawful offering of $1.3 billion worth by means of sales of XRP. Ripple contested the claims, firmly insisting XRP can not be thought about a security and is more comparable to a product.

Ripple’s company suffered as an outcome, with the business losing a minimum of one consumer and financier. MoneyGram, the U.S. cash transfer giant, dumped its collaboration with Ripple in March 2021.

Meanwhile, Tetragon, a U.K.-based financier that formerly backed Ripple, offered its stake back to Ripple after unsuccessfully attempting to take legal action against the business to redeem its money.

Asked whether the judgment indicated that American banks would go back to Ripple to utilize its ODL item, Alderoty stated: “I think the answer to that is yes.”

Ripple likewise utilizes blockchain in its company to send out messages in between banks, sort of like a blockchain-based option to Swift.

“I think we’re hopeful that this decision would give financial institution customers or potential customers comfort to at least come in and start having the conversation about what problems they are experiencing in their business, real-world problems in terms of moving value across borders without incurring obscene fees,” Alderoty informed CNBC Friday.

“Hopefully this quarter will generate a lot of conversations in the United States with customers, and hopefully some of those conversations will actually turn into real business,” he included.

Ripple now sources the majority of its company from beyond the U.S., with Alderoty formerly informing CNBC that, “[Ripple], its clients and its income are all driven beyond the U.S., despite the fact that we still have a great deal of staff members within the U.S.,” he included.

Ripple has more than 900 staff members worldwide, with approximately half of them based in the U.S.

XRP is a cryptocurrency that Ripple utilizes to move cash throughout borders. It is presently the fifth-largest cryptocurrency in blood circulation, with a market capitalization of $378 billion.

The business utilizes the token as a “bridge” currency in between transfers from one fiat currency to another– for instance, U.S. dollars to Mexican pesos– to fix the problem of requiring pre-funded accounts on the other end of a transfer to wait on the cash to be processed.

Ripple states XRP can make it possible for cash motions in a split second.

Still, the judgment did not represent an overall win forRipple While the judge mentioned XRP was not a security, they likewise stated that some sales of the token did certify as securities deals.

For example, about $7289 countless sales of XRP to organizations the business dealt with did certify as securities, the judge stated, mentioning there was a typical business, an expectation of revenue.

Alderoty yielded it was not an overall win for Ripple, which the business would study the choice in due course to see how it impacts its company.

“She [Judge Analisa Torres] discovered– although we had actually disagreed with her– that our earlier sales straight to institutional purchasers had the characteristics of a security and must have been signed up,” he stated.

He stated Ripple’s company as it stands would be untouched by that part of the judgment as its clients are mostly situated beyond the U.S.

“We’ll study the the judge’s decision, we’ll look at our clients’ needs to look at the market, and see if there’s a situation here that complies with the four corners of what the judge found when it comes to institutions,” he stated.