A Brinks armored truck sits parked in front of the shuttered Silicon Valley Bank (SVB) head office on March 10, 2023 in Santa Clara, California.

Justin Sullivan|Getty Images

On Wednesday, Silicon Valley Bank was a well-capitalized organization looking for to raise some funds.

Within 48 hours, a panic caused by the very equity capital neighborhood that SVB had actually served and supported ended the bank’s 40- year-run.

Regulators shuttered SVB Friday and took its deposits in the biggest U.S. banking failure considering that the 2008 monetary crisis and the second-largest ever. The business’s down spiral started late Wednesday, when it shocked financiers with news that it required to raise $2.25 billion to fortify its balance sheet. What followed was the quick collapse of a highly-respected bank that had actually grown along with its innovation customers.

Even now, as the dust starts to decide on the 2nd bank wind-down revealed today, members of the VC neighborhood are regreting the function that other financiers played in SVB’s death.

“This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech financier at Restive Ventures, informed CNBC. “This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face.”

The episode is the current fallout from the Federal Reserve’s actions to stem inflation with its most aggressive rate treking project in 4 years. The implications might be significant, with issues that start-ups might be not able to pay workers in coming days, endeavor financiers might have a hard time to raise funds, and an already-battered sector might deal with a much deeper despair.

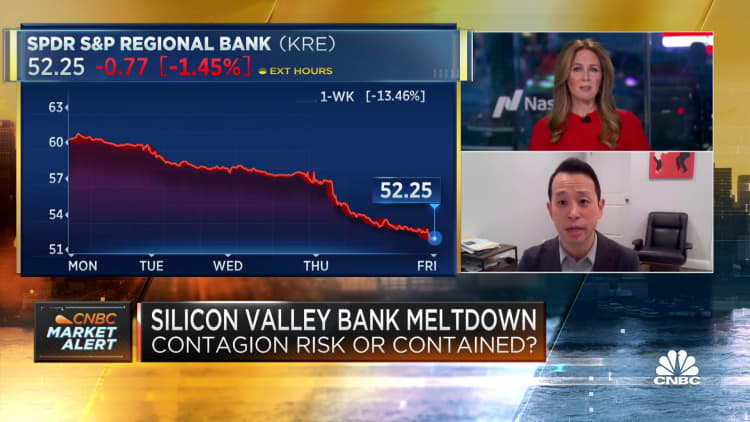

Shares of Silicon Valley Bank collapsed today.

The roots of SVB’s collapse originate from dislocations stimulated by greater rates. As start-up customers withdrew deposits to keep their business afloat in a cold environment for IPOs and personal fundraising, SVB discovered itself brief on capital. It had actually been required to offer all of its available-for-sale bonds at a $1.8 billion loss, the bank stated late Wednesday.

The abrupt requirement for fresh capital, beginning the heels of the collapse of crypto-focused Silvergate bank, triggered another wave of deposit withdrawals Thursday as VCs advised their portfolio business to move funds, according to individuals with understanding of the matter. The issue: a bank perform at SVB might present an existential danger to start-ups who could not tap their deposits.

SVB clients stated CEO Greg Becker didn’t impart self-confidence when he prompted them to “stay calm” throughout a call that started Thursday afternoon. The stock’s collapse continued unabated, reaching 60% by the end of routine trading. Importantly, Becker could not ensure listeners that the capital raise would be the bank’s last, stated an individual on the call.

Death blow

All informed, clients withdrew an incredible $42 billion of deposits by the end of Thursday, according to a California regulative filing.

By the close of service that day, SVB had an unfavorable money balance of $958 million, according to the filing, and stopped working to hunt adequate security from other sources, the regulator stated.

Falvey, a previous SVB staff member who released his own fund in 2018, indicated the extremely interconnected nature of the tech investing neighborhood as an essential factor for the bank’s abrupt death.

Prominent funds consisting of Union Square Ventures and Coatue Management blasted e-mails to their whole lineups of start-ups in current days, advising them to pull funds out of SVB on issues of a bank run. Social media just increased the panic, he kept in mind.

“When you say, `Hey, get your deposits out, this thing is gonna fail,’ that’s like yelling fire in a crowded theater,” Falvey stated. “It’s a self-fulfilling prophecy.”

Another endeavor financier, TSVC partner Spencer Greene, likewise slammed financiers who “were wrong on the facts” about SVB’s position.

“It appears to me that there was no liquidity issue until a couple of VCs called it,” Greene stated. “They were irresponsible, and then it became self-fulfilling.”

‘Business as typical’

Thursday night, some SVB clients got e-mails ensuring them that it was “business as usual” at the bank.

“I’m sure you’ve been hearing some buzz about SVB in the markets today so wanted to reach out to provide some context,” one SVB lender composed to a customer, according to a copy of the message acquired by CNBC.

“It is business as usual at SVB,” the lender composed. “Understandably there may be questions and I want to make myself available if you have any concerns.”

By Friday, as shares of SVB continued to sink, the bank dumped efforts to offer shares, CNBC’s David Faber reported. Instead, it was trying to find a purchaser, he reported. But the flight of deposits made the sale procedure harder, which effort stopped working too, Faber stated.

A consumer stands beyond a shuttered Silicon Valley Bank (SVB) head office on March 10, 2023 in Santa Clara, California.

Justin Sullivan|Getty Images

Falvey, who began his profession at Wells Fargo and sought advice from for a bank that was taken throughout the monetary crisis, stated that his analysis of SVB’s mid-quarter upgrade from Wednesday offered him self-confidence. The bank was well capitalized and might make all depositors entire, he stated. He even counseled his portfolio business to keep their funds at SVB as reports swirled.

Now, thanks to the bank run that ended in SVB’s seizure, those who stayed with SVB deal with an unsure timeline for obtaining their cash. While insured deposits are anticipated to be readily available as early as Monday, the lion’s share of deposits held by SVB were uninsured, and it’s uncertain when they will be maximized.

“The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due,” the California monetary regulator specified. “The bank is now insolvent.”