Pandora shares up 11% on development upgrade

Pandora share cost.

Jewelry maker and merchant Pandora topped European stock gains Thursday, climbing 10.8% after updating its development targets.

It now targets a like-for-like substance yearly development rate of 4-6% for 2023-2026, up from 3-5%, and in between 16 billion Danish krone ($ 2.256 billion) to 17 billion Danish krone complimentary capital generation from 2024-2026

“Uncertainty is quite high in the macro, but what we’ve experienced so far this year is actually traffic is very healthy into our channels,” CEO Alexander Lacik informed CNBC’s “Squawk Box Europe.”

On the business’s brand-new technique, released in 2021, Lacik stated: “We went back to the roots. Any business that struggles, you have to look yourself in the mirror and say, did we stray? I think Pandora strayed.”

“So this is not magic, we went back to the roots. An affordable and desirable proposition. We went back to the charms business, because that’s the thrust of where Pandora came from.”

Lacik stated the business had strategies to additional drive desirability through marketing, in order to broaden its variety.

The company on Thursday likewise revealed strategies to get in the Indian market and broaden somewhere else in Asia, as it flagged that its development in China would be slower than at first prepared.

— Jenni Reid

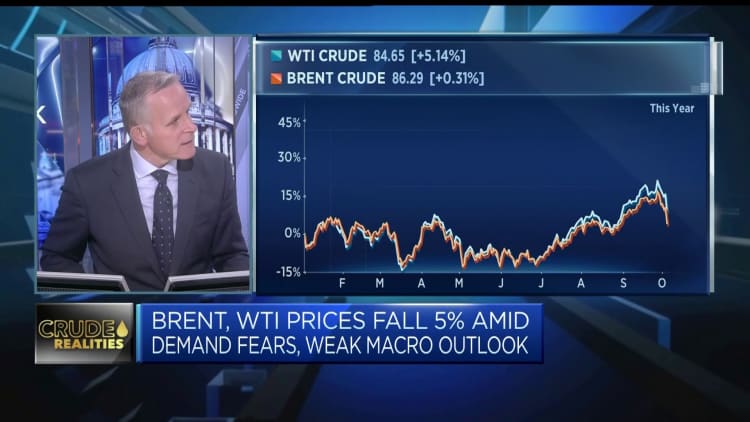

Oil rates continue to slide

Oil rates on Thursday continued to pull back from the 1 year highs they struck recently.

Global standard ICE Brent Crude futures were 1.9% lower at $8419 a barrel at midday London time, as WTI Crude futures fell 1.96% to $8087 a barrel.

It follows a sharp drop of more than $5 on Wednesday as markets absorbed the capacity for lower need, even as the OPEC+ group of oil manufacturers made no modifications to their output policy and Saudi Arabia and Russia declared prepare for output cuts.

ICE Brent crude Dec ’23

OPEC+ ‘very concerned’ about oil need worries, Energy Aspects’ Amrita Sen states

Amrita Sen, creator and director of research study at Energy Aspects, talks about the outlook for oil markets, the OPEC+ output policy and Chinese oil need.

UK’s Metro Bank plunges more than 25%

Shares of Britain’s Metro Bank were quickly suspended from trading two times early Thursday, in an unpredictable start to trade that saw the stock shed more than 29%.

It follows reports that the bank was attempting to raise ₤600 million ($727 million) in financial obligation and equity, according toReuters The opposition bank, which released in 2010, has a market cap of less than ₤100 million.

Read the complete story here.

Metro Bank share cost.

France’s Alstom falls 35% as trading resumes

Shares of French train maker Alstom plunged 35% as they opened after a postponed start to Thursday trade, putting the stock on course for its worst efficiency in a minimum of 20 years, according to LSEG information.

It follows a half-year trading upgrade on Wednesday revealing the business now anticipates unfavorable complimentary capital for the year, below a previous projection of “significantly positive.”

Alstom share cost.

Alstom trading suspended, shares set to plunge after capital upgrade

French train maker Alstom stopped working to open Thursday as trading of its shares was suspended.

Shares were set to decrease around 35%, according to LSEG information mentioned by Reuters.

In an upgrade after the marketplace close on Wednesday, Alstom launched unaudited half-year results revealing its complimentary capital had actually fallen from unfavorable 45 million euros ($47 million) to unfavorable 1.15 billion euros, and is now anticipated to be in a variety of unfavorable 500-750 million euros for the complete year, from a previous projection of “significantly positive.”

It associated the efficiency to a “steep acceleration of the production ramp-up,” a hold-up to a U.K. task, and a fall in downpayments from the previous year.

— Jenni Reid

CNBC Pro: This bearish fund supervisor believes the U.S. is headed for a significant financial obligation crisis. Here’s what he’s purchasing.

The U.S. is headed for a significant financial obligation crisis due to financial deficit being at the “worst structural point since World War Two,” according to worth financier Matthew McLennan.

McLennan, who handles First Eagle’s Global Fund, stated equity and bond markets are revealing indications of “relative complacency” and are yet to absorb the complete impactions of the state’s loaning program.

The fund supervisor likewise called the property and stock to own to hedge versus the threats markets deal with over the next couple of quarters.

CNBC Pro customers can learn more here.

— Ganesh Rao

CNBC Pro: Goldman exposes its brand name brand-new ‘conviction list’ of European stocks– providing one almost 150% benefit

Goldman Sachs has a brand-new list of leading stock choices for Europe, which it called its “most differentiated” concepts for the area.

CNBC Pro has a look at 7 of them.

CNBC Pro customers can learn more here.

— Weizhen Tan

CNBC Pro: Veteran financier states one kind of energy business is ‘exceptionally appealing’– calling a stock he likes

The products market is a “much more constructive place to invest” today– and one kind of business in the energy sector in specific is “extremely attractive,” according to one portfolio supervisor.

We’re “at the beginning of a longer term commodity cycle,” Aaron Dunn, co-head of worth equity and portfolio supervisor at Morgan Stanley Investment Management, informed CNBC’s “Squawk Box Asia” on Wednesday.

He called one stock he likes and others on his radar.

CNBC Pro customers can learn more here.

— Amala Balakrishner

European markets: Here are the opening calls

European markets are anticipated to open greater Thursday.

The U.K.’s FTSE 100 index is anticipated to open 33 points greater at 7,440, Germany’s DAX up 55 points at 15,147, France’s CAC up 24 points at 7,020 and Italy’s FTSE MIB up 80 points at 27,490, according to information from IG.

Data releases consist of German trade information for August and French and Spanish commercial output for August.

— Holly Ellyatt