People walk by the New York Stock Exchange (NYSE) on February 14, 2023 in New York City.

Spencer Platt|Getty Images

A banking crisis that emerged less than 2 months back now seems less a significant broadside to the U.S. economy than a sluggish bleed that will leak its method through and serve as a possible driver for a much-anticipated economic crisis later on this year.

As banks report the effect that an operate on deposits has actually had on their operations, the photo is a blended one: Larger organizations like JPMorgan Chase and Bank of America continual far less of a hit, while smaller sized equivalents such as First Republic deal with a much harder slog and a defend survival.

That suggests the cash pipeline to Wall Street stays mainly alive and well while the scenario on Main Street is a lot more in flux.

“The small banks are going to be lending less. That’s a credit hit on Middle America, on Main Street,” stated Steven Blitz, primary U.S. economic expert at TSLombard “That’s negative for growth.”

How unfavorable will emerge both in the approaching days and months months as information streams through.

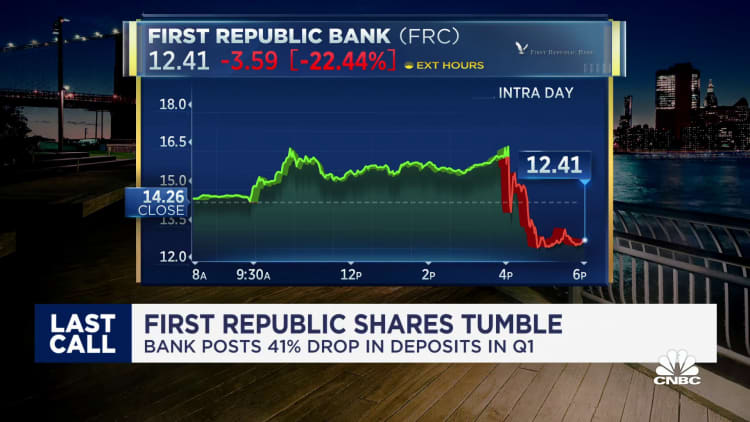

First Republic, a local loan provider viewed as a bellwether for how difficult the deposit crunch will strike the sector, published incomes that beat expectations however showed a having a hard time business otherwise.

Bank incomes mostly have actually been good for the very first quarter, however the sector’s future doubts. Stocks have actually been under pressure, with the SPDR S&P Bank ETF (KBE) off more than 3% in Tuesday afternoon trading.

“Rather than bringing concerning new information, this week’s earnings are confirming that the banking stress stabilized by the end of March and was contained at a limit set of banks,” Citigroup worldwide economic expert Robert Sockin stated in a customer note. “That’s about the best macro outcome that could have been hoped for when stresses emerged last month.”

Watching development ahead

In the instant future, the reading on first-quarter financial development is anticipated to be mostly favorable in spite of the banking issues.

When the Commerce Department launches its preliminary price quote on gdp gains for the very first 3 months of the year, it’s anticipated to reveal a boost of 2%, according to the Dow Jones price quote. The Atlanta Fed’s information tracker is forecasting an even much better gain of 2.5%.

That development, however, isn’t anticipated to last, due mainly to 2 interconnected aspects: the Federal Reserve rate of interest walkings intended intentionally at cooling the economy and reducing inflation, and the restrictions on small-bank financing. First Republic, for one, reported that it suffered a more than 40% decrease in deposits, part of a $563 billion drawdown this year amongst U.S. banks that will make it harder to provide.

Yet Blitz and much of his coworkers still anticipate any economic crisis to be shallow and short-term.

“Everything keeps telling me that. Can you have a recession that is not led by autos and housing? Yes, you can. It’s a recession created by a loss of assets, a loss of income and that eventually flows through to everything,” he stated. “Again, it’s a mild recession. A 2008-2009 recession occurs every 40 years. It’s not a 10-year event.”

In truth, the most current economic crisis was simply 2 years back in the early days of the Covid crisis. The slump was traditionally high and brief, ended by a similarly extraordinary fusillade of financial and financial stimulus that continues to stream through the economy.

Consumer costs has actually appeared to hold up relatively well in the face of the banking crisis, with Citigroup estimating excess cost savings of about $1 trillion still readily available. However, delinquency rates and balances are both increasing: Moody’s reported Tuesday that charge card charge-offs were 2.6% in the very first quarter, increasing by 0.57% from the 4th quarter of 2022, while balances skyrocketed 20.1% on a yearly basis.

Personal cost savings rates likewise have actually toppled, falling from 13.4% in 2021 to 4.6% in February.

But the most thorough report launched up until now that takes into consideration the duration when Silicon Valley Bank and Signature Bank were shuttered showed that the damage has actually been restricted. The Federal Reserve’s routine “Beige Book” report launched, April 19, showed just that financing and need for loans “generally declined” and requirements tightened up “amid increased uncertainty and concerns about liquidity.”

“The fallout from the crisis seems less serious than I had expected just a few weeks ago,” stated Mark Zandi, primary economic expert at Moody’sAnalytics The Fed report “was a lot less hair-on-fire than I had actually anticipated. [The banking situation] is a headwind, however it’s not a gale-force headwind, it’s simply type of an annoyance.”

It’s everything about the customer

Where things go from here depends considerably on the customers who represent more than two-thirds of all U.S. financial activity.

While the need for services is reaching pre-pandemic levels, fractures are forming. Along with the increase in charge card balances and delinquencies is most likely to come the additional barrier of tightening up credit requirements, both by requirement and through an increased probability of harder guideline.

Lower- earnings customers have actually been dealing with pressure for several years as the share of wealth held by the leading 1% of earners has actually continued to climb up, up from 29.7% when Covid struck to 31.9% since mid-2022, according to the most current Fed information readily available.

“Before any of this really started unfolding in early March, you were already starting to see signs of contraction and reining in of credit,” stated Jim Baird, primary financial investment officer at Plante Moran FinancialAdvisors “You’re seeing reduced demand for credit as consumers and businesses start to pull in the deck chairs.”

Baird, however, likewise sees opportunities slim for a high economic crisis.

“When you look at how all the forward-looking data lines up, it’s hard to envision how we sidestep at least a minor recession,” he stated. “The real question is how far can the strength of the labor economy and still-significant cash reserves that many households have propel consumers forward and keep the economy on track.”