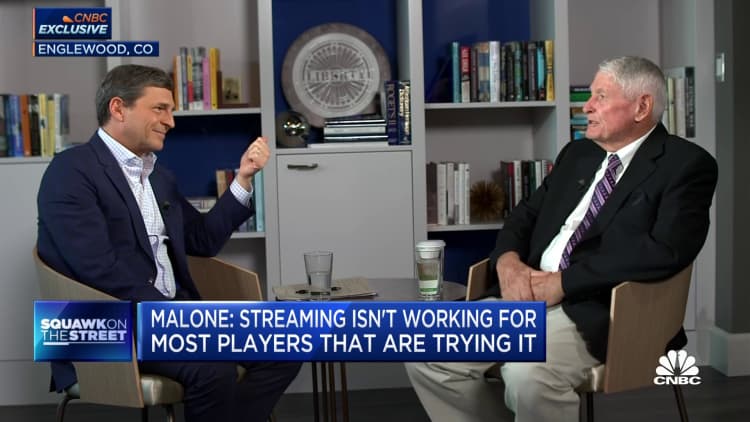

David Zaslav, CEO and president of WarnerBros Discovery (L), and John Malone, chairman of Liberty Media, Liberty Global, and Qurate Retail Group.

CNBC|Reuters

WarnerBros Discovery‘s next action to acquire scale might be taking a look at distressed properties.

Chief Executive David Zaslav and board member John Malone both made remarks today recommending the business is paying for financial obligation and developing totally free capital to establish acquisitions in the next 2 years of media organizations experiencing reduced evaluations.

The targets might be business flirting with or declare insolvency, Malone stated in an unique interview with CNBC onThursday While U.S. regulators might resent big media business coming together due to the fact that of overlaps with studio, cable television or relaying properties, they’ll be a lot more flexible if the business are having a hard time to make it through, Malone informed David Faber.

“I think we’re going to see very serious distress in our industry,” Malone stated. “There is an exemption to the antitrust laws on a failing business. At some point of distress, right, then some of the restrictions, they look the other way.”

Media business evaluations have actually been plunging in the middle of streaming video losses, conventional television customer defections, and a down marketing market. This has actually impacted WarnerBros Discovery as much as its peers. The business’s market assessment just recently fell listed below $23 billion, its floor because WarnerMedia and Discovery combined in 2015. The business ended the 3rd quarter with about $43 billion in net financial obligation.

WarnerBros Discovery is attempting to place itself to be an acquirer, instead of a distressed property, itself, by paying for financial obligation and increasing capital, Zaslav stated throughout his business’s incomes teleconference today. WarnerBros Discovery has actually paid for $12 billion and anticipates to create a minimum of $5 billion in totally free capital this year, the business stated.

“We’re surrounded by a lot of companies that are – don’t have the geographic diversity that we have, aren’t generating real free cash flow, have debt that are presenting issues,” Zaslav statedThursday “We’re de-levering at a time when our peers are levering up, at a time when our peers are unstable, and there is a lot of excess competitive – excess players in the market. So, this will give us a chance not only to fight to grow in the next year, but to have the kind of balance sheet and the kind of stability … that we could be really opportunistic over the next 12 to 24 months.”

Still, WarnerBros Discovery likewise acknowledged it will miss its own year-end take advantage of target of 2.5 to 3 times adjusted incomes as the television advertisement market has a hard time and direct television membership earnings decreases.

Buying from distress

Malone has some experience with benefiting from times of distress.

His Liberty Media obtained a 40% stake in Sirius XM over a number of years more than a years back, waiting from insolvency. Since then, the equity worth of the satellite radio business has actually recovered from almost absolutely no to about $5 per share. Sirius XM presently has a market capitalization of about $18 billion.

“It made us a lot of money with Sirius,” Malone informed Faber.

While Malone didn’t call a particular business as a target for WarnerBros Discovery, he went over Paramount Global as an example of a business whose potential customers appear unstable. Paramount Global’s market assessment has actually dropped listed below $8 billion while bring about $16 billion in financial obligation.

Malone kept in mind that Paramount’s financial obligation was just recently devalued. “I think that they’re running probably negative free cash flow,” he stated.

While Paramount Global shares have actually fallen precipitously because Viacom and CBS combined in 2019, there are indications the business is supporting its balance sheet. CEO Bob Bakish stated previously this month Paramount Global’s streaming losses will be lower in 2023 than 2022, and the business anticipates more enhancement to losses in2024 The business closed a sale for book publisher Simon & &(***************************************************************************************************************************************************** )for $1.6 billion and will utilize the profits to pay for financial obligation.

Paramount Global’s fate

Shari Redstone, chair of Paramount Global, participates in the Allen & &Co Media and Technology Conference in Sun Valley, Idaho, on Tuesday, July 11, 2023.

David A. Grogan|CNBC

Paramount Global is among the couple of properties that rationally fits Malone’s vision of a media property that would have regulative concerns as an acquisition with possible distress issues. Comcast‘s NBCUniversal, another possible merger partner, will lose more than $2 billion this year on its streaming service, Peacock, however the media giant is protected by its moms and dad business, the biggest U.S. broadband supplier.

“WarnerBros [Discovery] now is earning money. Not a lot, however they’re earning money,” Malone stated. “Peacock is losing a great deal of cash. Paramount is losing a lots of cash that they can’t manage. At least [Comcast CEO] Brian [Roberts] can manage to lose the cash.”

Paramount Global’s managing investor Shari Redstone is open to a transformative deal, CNBC reported last month. Puck’s Dylan Byers just recently reported that market experts have actually hypothesized WarnerBros Discovery may pursue an acquisition of Paramount Global after the 2024 U.S. governmental election.

A mix of NBCUniversal and Paramount Global likewise has tactical reasoning, however the mix of 2 nationwide broadcast networks– Comcast’s NBC and Paramount Global’s CBS– would provide a substantial regulative obstacle. WarnerBros Discovery does not own a broadcast network, making an acquisition of CBS simpler.

Spokespeople for Paramount Global and WarnerBros Discovery decreased to comment.

While Malone stated all tradition media business ought to be talking with each other about merger synergies, he acknowledged evaluations might need to fall further to get regulators on board with more combination. Malone forecasted that might take place in the very same timeline Zaslav provided– within the next 2 years.

“Eventually maybe there’ll be regulatory relief,” Malone stated. “Out of distress usually comes the reduction in competition, increased pricing power, and the opportunity to buy assets at a deep discount.”

Disclosure: Comcast owns NBCUniversal, the moms and dad business of CNBC.

Tune in: CNBC’s complete interview with John Malone will air 8 p.m. ET Thursday.